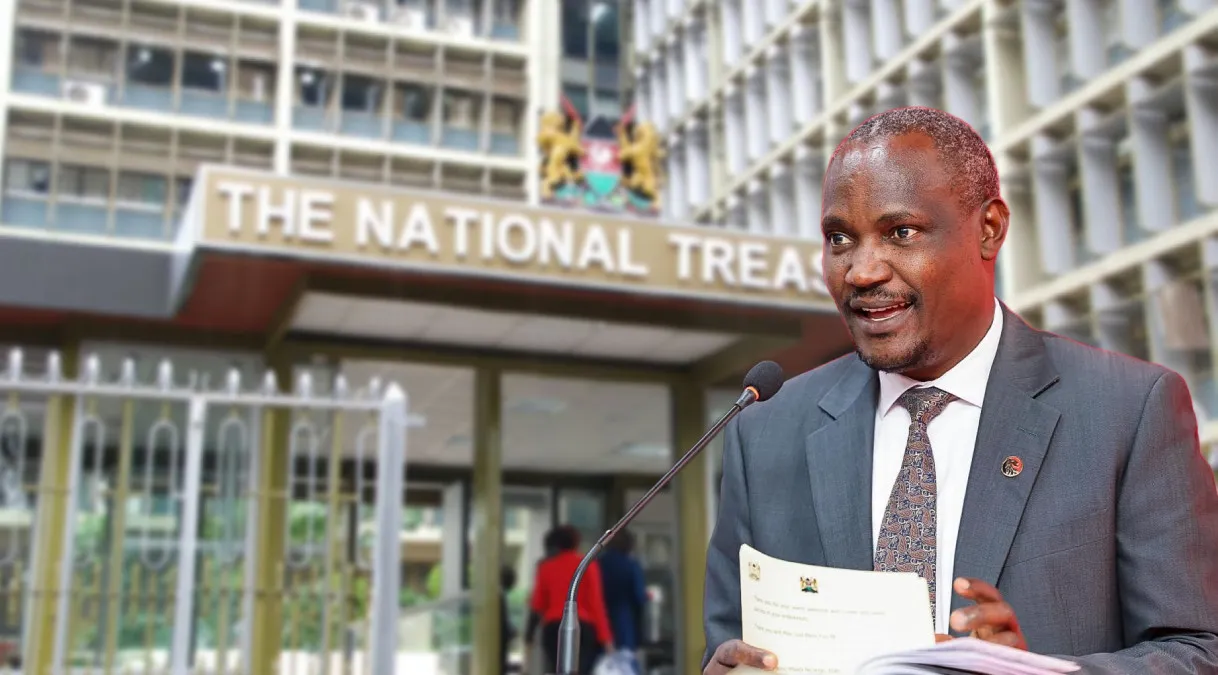

Kenya Moves to Raise KSh 50 Billion Through Long-Dated Treasury Bonds as Domestic Borrowing Intensifies

Kenya’s government has returned to the domestic debt market with a new push to raise KSh 50 billion through the issuance of long-term Treasury bonds, underscoring the growing importance of local financing in funding the national budget. Acting in its role as the state’s fiscal agent, the Central Bank of Kenya (CBK) has announced the […]