Succession management for businesses is vital for long-term stability and security. It involves identifying key positions, training qualified candidates, and addressing tax and estate planning. There are two main categories to consider: death/accident plans for worst-case scenarios and retirement plans for gradual transitions. It is crucial to create an enforceable and binding plan to protect intended successors and mitigate potential legal issues.

Board Succession Planning

Board succession planning is a strategic process that organizations undertake to ensure the smooth transition of board members and leadership positions within the board of directors. It involves identifying, developing, and preparing potential candidates to fill key roles on the board, including the position of chairman or chairwoman.

Board succession planning is crucial for maintaining continuity, stability, and effectiveness in corporate governance. It allows organizations to proactively address potential leadership gaps and ensure a seamless transition when board members retire, resign, or reach the end of their terms. By having a well-defined succession plan in place, organizations can mitigate risks associated with sudden departures or unexpected vacancies on the board.

Process of Board Succession Planning

- Assessing current board composition: The first step is to evaluate the current composition of the board, including the skills, expertise, and diversity of its members. This assessment helps identify any gaps or areas where additional expertise may be needed.

- Identifying future needs: Once the current board composition is assessed, the next step is to determine the future needs of the organization. This involves considering factors such as strategic direction, industry trends, and emerging challenges that may require specific skills or experience on the board.

- Developing a succession plan: Based on the assessment of current board composition and future needs, a succession plan is developed. This plan outlines the desired characteristics and qualifications for future board members and identifies potential candidates who possess these attributes.

- Recruiting new board members: The recruitment process involves actively seeking out potential candidates who align with the identified criteria. This can be done through networking, referrals, or engaging executive search firms to identify suitable candidates.

- Evaluating candidates: Once potential candidates are identified, they go through a rigorous evaluation process to assess their qualifications, experience, and fit with the organization’s culture and values. This may involve interviews, reference checks, and background screenings.

- Developing and onboarding new members: Once selected, new board members undergo an orientation process to familiarize themselves with the organization’s operations, governance structure, and strategic priorities. They may also receive training or mentoring to enhance their effectiveness in their roles.

- Transitioning outgoing members: As new members join the board, there is a need to manage the transition of outgoing members. This may involve providing support and guidance to ensure a smooth handover of responsibilities and knowledge transfer.

- Ongoing board development: Board succession planning is not a one-time event but an ongoing process. It is important to regularly review and update the succession plan to reflect changing needs and circumstances. Additionally, providing opportunities for board members to enhance their skills and knowledge through training and development programs helps ensure a high-performing board.

Leadership Succession Planning

Leadership succession planning refers to the process of identifying and developing potential leaders within an organization to ensure a smooth transition of leadership positions. It involves creating a strategic plan to identify, groom, and prepare individuals who have the potential to take on key leadership roles in the future.

Succession management is crucial for organizations as it helps them maintain continuity, stability, and effectiveness in leadership positions. By identifying and developing potential leaders in advance, organizations can minimize disruptions that may occur due to unexpected departures or retirements of key leaders. It also ensures that there is a pool of qualified individuals ready to step into leadership roles when needed.

Process of Leadership Succession Planning

- Identifying key leadership positions: The first step is to identify the critical leadership positions within the organization that require succession planning. These positions are usually those that have a significant impact on the organization’s strategic direction and overall performance.

- Assessing current leaders: Once the key positions are identified, the next step is to assess the current leaders holding those positions. This assessment helps in understanding their strengths, weaknesses, and potential for growth. It also provides insights into their readiness for future leadership roles.

- Identifying potential successors: Based on the assessment of current leaders, potential successors are identified. These individuals possess the necessary skills, knowledge, and attributes required for successful leadership. They may be existing employees or external candidates who show promise and align with the organization’s values and goals.

- Developing leadership skills: Once potential successors are identified, organizations invest in their development through various means such as training programs, mentoring, coaching, job rotations, and exposure to different areas of the business. This helps them acquire the necessary skills and experiences needed for future leadership roles.

- Creating development plans: Individualized business plans are created for each potential successor based on their specific needs and aspirations. These plans outline the steps, resources, and timelines required to develop their leadership capabilities.

- Monitoring progress: Regular monitoring and evaluation of potential successors’ progress is essential to ensure that they are on track with their development plans. This allows organizations to make any necessary adjustments and provide additional support if required.

- Succession implementation: When a leadership position becomes vacant, the organization can seamlessly transition by selecting a successor from the pool of developed candidates. This ensures a smooth transfer of responsibilities and minimizes disruptions to the organization’s operations.

- Continual review and refinement: Leadership succession planning is an ongoing process that requires regular review and refinement. As organizational needs and dynamics change, it is important to reassess the effectiveness of the succession plan and make necessary adjustments to ensure its continued relevance.

Difference Between Leadership Succession Planning and Board Succession Planning

Board succession planning and leadership succession planning are two distinct but interconnected processes within an organization. While both aim to ensure the continuity and effectiveness of leadership, they focus on different aspects and involve different stakeholders

| Board Succession Planning | Leadership Succession Planning | |

| Focus | Focuses on ensuring a competent and diverse board of directors that can effectively govern the organization | Focuses on identifying potential successors for key leadership positions |

| Time Frame | Board succession planning is a long-term process that aims to ensure a continuous pipeline of potential board candidates over time | Leadership succession planning, on the other hand, is often triggered by specific events such as retirement, resignation, or unexpected departures of key leaders. |

| Stakeholders | Board succession planning involves various stakeholders, including current board members, executives, shareholders, and external experts | Leadership succession planning, on the other hand, primarily involves senior leaders and HR professionals responsible for talent management and development. |

Estate Planning

Estate planning is a crucial component of succession planning that involves the process of arranging and organizing an individual’s assets, properties, and financial affairs to ensure their smooth transfer to intended beneficiaries upon their death. It encompasses various legal and financial strategies aimed at minimizing taxes, protecting assets, and ensuring that the individual’s wishes are carried out effectively.

The primary objective of estate planning is to provide a clear roadmap for the distribution of assets and properties after an individual’s demise. This process involves creating legal documents such as wills, trusts, powers of attorney, and healthcare directives to outline how the individual’s estate should be managed and distributed. Estate planning also involves considering factors such as guardianship for minor children, charitable donations, and minimizing potential conflicts among beneficiaries.

Steps In Estate Planning

- Define goals and objectives: The first step is to determine your objectives and priorities for your estate. This includes deciding how you want your assets to be distributed, who will be the beneficiaries, and if there are any specific bequests or charitable donations you want to make.

- Take stock of assets and liabilities: Make a comprehensive list of all your assets, such as real estate, bank accounts, investments, retirement accounts, insurance policies, personal belongings, and any outstanding debts or liabilities.

- Create a will: A will is a legal document that outlines how you want your assets distributed and who will be responsible for carrying out your wishes (the executor). It also allows you to appoint guardians for any minor children.

- Establish trusts: Trusts are legal arrangements that hold and manage assets for the benefit of beneficiaries. They can help avoid probate, provide privacy, and offer more control over asset distribution. There are various types of trusts, such as revocable living trusts, irrevocable trusts, and special needs trusts.

- Designate beneficiaries: Ensure that you have named beneficiaries for all your financial accounts, retirement plans, and life insurance policies. These assets typically pass directly to the designated beneficiaries, bypassing probate.

- Consider tax implications: Work with a tax advisor or estate planning attorney to understand and minimize potential estate and inheritance taxes. Strategies like gifting, charitable giving, and utilizing tax-exempt trusts can help reduce tax burdens.

- Plan for incapacity: Establish documents like a durable power of attorney and an advance healthcare directive. These documents designate someone to make financial and medical decisions on your behalf if you become incapacitated.

- Review and update regularly: Life events such as marriage, divorce, the birth of a child, or significant changes in assets can impact your estate plan. Regularly review and update your plan to ensure it reflects your current wishes and circumstances.

- Communicate with loved ones: It’s essential to discuss your estate plan with your family members and loved ones to avoid confusion or disputes later on. Clear communication can also provide peace of mind and ensure everyone understands your intentions.

- Work with professionals: Estate planning can be complex, so it’s wise to seek guidance from an experienced estate planning attorney, financial advisor, and tax professional to create a comprehensive and legally sound plan.

What are the risks of operating a business without estate and succession plans in place?

Lack of adequate guidance in estate planning exposes your family and business to significant financial and personal risks. These risks encompass:

- Unanticipated probate court expenses

- Unexpected estate tax obligations

- Delays in asset distribution

- Possible litigation costs arising from discontented family members

Furthermore, settling your estate and continuing business operations is a challenging task for grieving family members. Proceeding without clear instructions only adds further complexity to these matters.

Conclusion

Succession management is a crucial strategic process that ensures the continuity and effectiveness of leadership within organizations. Board succession planning focuses on identifying, developing, and preparing potential candidates for board positions, including the chairperson role, to maintain stability and governance effectiveness. By assessing the current board composition, identifying future needs, recruiting suitable candidates, and providing continuous development, organizations can proactively address leadership gaps and minimize risks associated with sudden vacancies or departures. On the other hand, leadership succession planning concentrates on grooming potential leaders within the organization to fill critical leadership positions.

By creating personalized development plans, monitoring progress, and implementing seamless transitions, organizations can ensure a steady supply of qualified leaders, minimizing disruptions and maintaining leadership continuity for long-term success. Both board and leadership succession planning requires ongoing review and refinement to adapt to changing circumstances and ensure that the organization’s leadership pipeline remains robust and well-prepared.

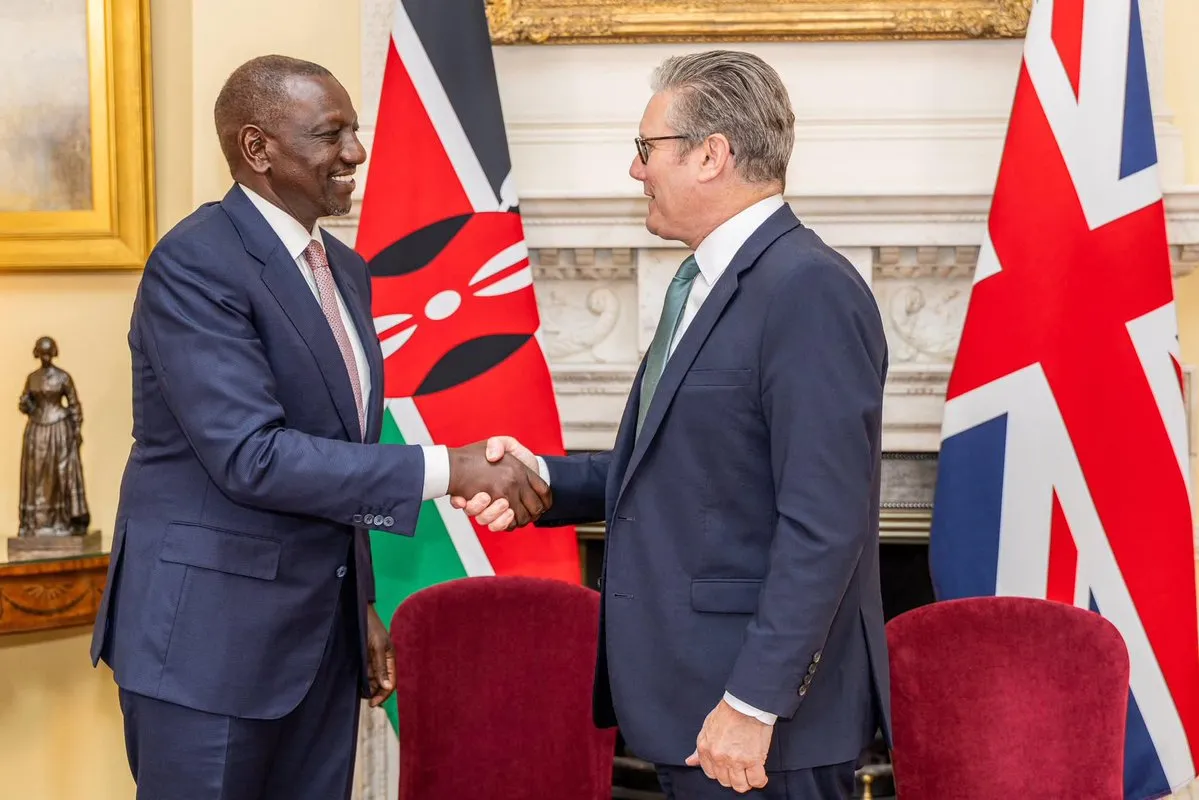

photo source: freepik

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025