A federal appeals court in Washington on Thursday temporarily reinstated the most sweeping of President Donald Trump’s global tariffs—known as the “Liberation Day” tariffs—after a lower court had struck them down as an unconstitutional overreach of executive power. The decision pauses enforcement of the U.S. Court of International Trade’s May 28 ruling, buying time for the Trump administration to pursue its appeal (Reuters).

A Surprise Rebuke: Trade Court Strikes Down ‘Liberation Day’ Tariffs

On May 28, a three-judge panel of the U.S. Court of International Trade issued a landmark decision in V.O.S. Selections, Inc. v. United States, ruling that President Trump had exceeded the authority granted him by the International Emergency Economic Powers Act (IEEPA) when he imposed across-the-board tariffs of at least 10% on imports from most U.S. trading partners—and additional 25% levies on goods from Canada, Mexico, and China tied to allegations of fentanyl trafficking.

The court held that the U.S. Constitution vests the power to levy taxes and tariffs exclusively with Congress, and that IEEPA—enacted in 1977 to address bona fide emergencies—did not provide an “intelligible principle” for such sweeping economic measures. As a result, the panel vacated and permanently enjoined the tariff orders, prompting jubilation among businesses that had reported more than $34 billion in lost sales and higher costs since the tariffs’ announcement on April 2.

Appeal and Emergency Stay: Tariffs Temporarily Back On

Within 24 hours, the U.S. Court of Appeals for the Federal Circuit granted the government’s request to stay the lower court’s injunction, effectively keeping the tariffs in force while the legal challenges proceed. The appeals court ordered the plaintiffs to file their response by June 5, and the government to reply by June 9, setting the stage for expedited briefing on the central constitutional question: Can the president, under IEEPA, impose broad tariffs without congressional authorization?

A temporary stay is a routine procedural step in high-stakes litigation, but it underscores the Trump administration’s determination to defend the tariffs as a vital tool of U.S. trade policy. Senior White House officials signaled they would “vigorously” pursue all available avenues—both on appeal and by exploring alternative statutory authorities—to preserve America’s leverage in global trade talks

The Legal Crux: IEEPA, Nondelegation, and the Major Questions Doctrine

At the heart of the dispute lies the scope of presidential power under the International Emergency Economic Powers Act, which authorizes the president to regulate commerce “in a national emergency” declared by the executive. While IEEPA has long underpinned targeted sanctions regimes, the trade court found it was never intended to confer carte blanche tariff-setting powers.

- Nondelegation Doctrine: The court applied this constitutional principle to hold that any delegation of congressional power must include clear standards—absent here—to guide the president’s actions.

- Major Questions Doctrine: Under recent Supreme Court precedents, agencies (or the president) need explicit congressional authorization for policies of “vast economic and political significance.” The imposition of tariffs on billions of dollars of trade unquestionably meets that threshold.

Legal analysts predict the Federal Circuit, and potentially the Supreme Court, will grapple with these doctrines, balancing the need for swift executive action in emergencies against the constitutional separation of powers.

Administration’s Playbook: Alternative Statutory Routes

Even if the appeals court ultimately upholds the trade court’s IEEPA ruling, Trump’s broader tariff strategy is unlikely to be derailed. Experts point to several other statutory authorities that could be invoked:

- Section 232 of the Trade Expansion Act of 1962 (national security): Used by Trump to impose steel and aluminum tariffs in 2018.

- Section 301 of the Trade Act of 1974 (unfair trade practices): The basis for the original U.S. action against China’s technology policies.

- Section 338 of the Tariff Act of 1930 and Section 122 of the Trade Act of 1974: Less-common provisions that permit targeted countermeasures.

An analysis by Reuters noted that shifting to these authorities could blunt legal challenges even as it risks further escalating trade tensions—with the potential for retaliatory measures by affected trading partners.

Market Reaction: Caution Amid Ongoing Uncertainty

Financial markets, which have swung wildly on each legal twist, reacted with measured caution to the appeals court stay. On Thursday:

- The S&P 500 slipped 0.4%, weighed by industrial and consumer-discretionary stocks with heavy import exposure.

- The ICE U.S. Dollar Index eased back slightly after a brief rally following the trade court’s initial ruling.

- Treasury yields held near multi-month highs as investors priced in the ongoing risk of U.S.-China trade flare-ups.

Business Impact: Real Costs and Supply-Chain Disruptions

Since the imposition of the Liberation Day tariffs:

- U.S. importers have reported $34 billion in lost sales and higher input costs, per a Reuters analysis of customs-data and corporate disclosures.

- Manufacturers of household appliances, electronics, and auto parts warned of margin compression and delayed product launches.

- Consumer-goods companies such as Nike and Estée Lauder signaled they may pass at least part of the tariffs onto customers, risking inflationary pressures.

Several multinational firms—including General Motors, Ford, Honda, Diageo, Campari, Roche, and Novartis—have publicly weighed relocating supply-chain nodes or expanding U.S. production to mitigate duties. The head of a Midwest auto-parts supplier told Reuters that “planning for 25% tariffs on key components is like building a factory on quicksand; every cost-benefit analysis breaks down”.

International Responses: A Delicate Balancing Act

Foreign governments have largely treated the legal battle as a domestic U.S. matter, but have voiced guarded relief at the trade court’s initial ruling—tempered by recognition that the stay prolongs the tariffs for now:

- Canada: Prime Minister Justin Trudeau welcomed the finding that the tariffs lacked legal basis, calling it “consistent with Canada’s longstanding position,” while noting that the stay ensures no immediate relief for Canadian exporters.

- European Union: The European Commission noted it was “monitoring developments closely” but declined further comment, underscoring the uncertainty facing EU automakers and agri-exporters.

- United Kingdom: A UK government spokesperson stressed that the issue “remains a U.S. legal process,” while downplaying any near-term implications for the recent U.S.–UK trade agreement signed in May.

- China: Foreign Ministry spokespersons have criticized the tariffs as “protectionist” and warned of continued retaliation, though no new measures have been announced amid broader Sino-U.S. diplomatic recalibration.

With major trading partners—Japan included—hesitant to finalize bilateral deals while legal clouds hover over U.S. tariff authority, the lawsuits have already dampened momentum in trade negotiations scheduled this summer.

Political Stakes: The Presidency and the Separation of Powers

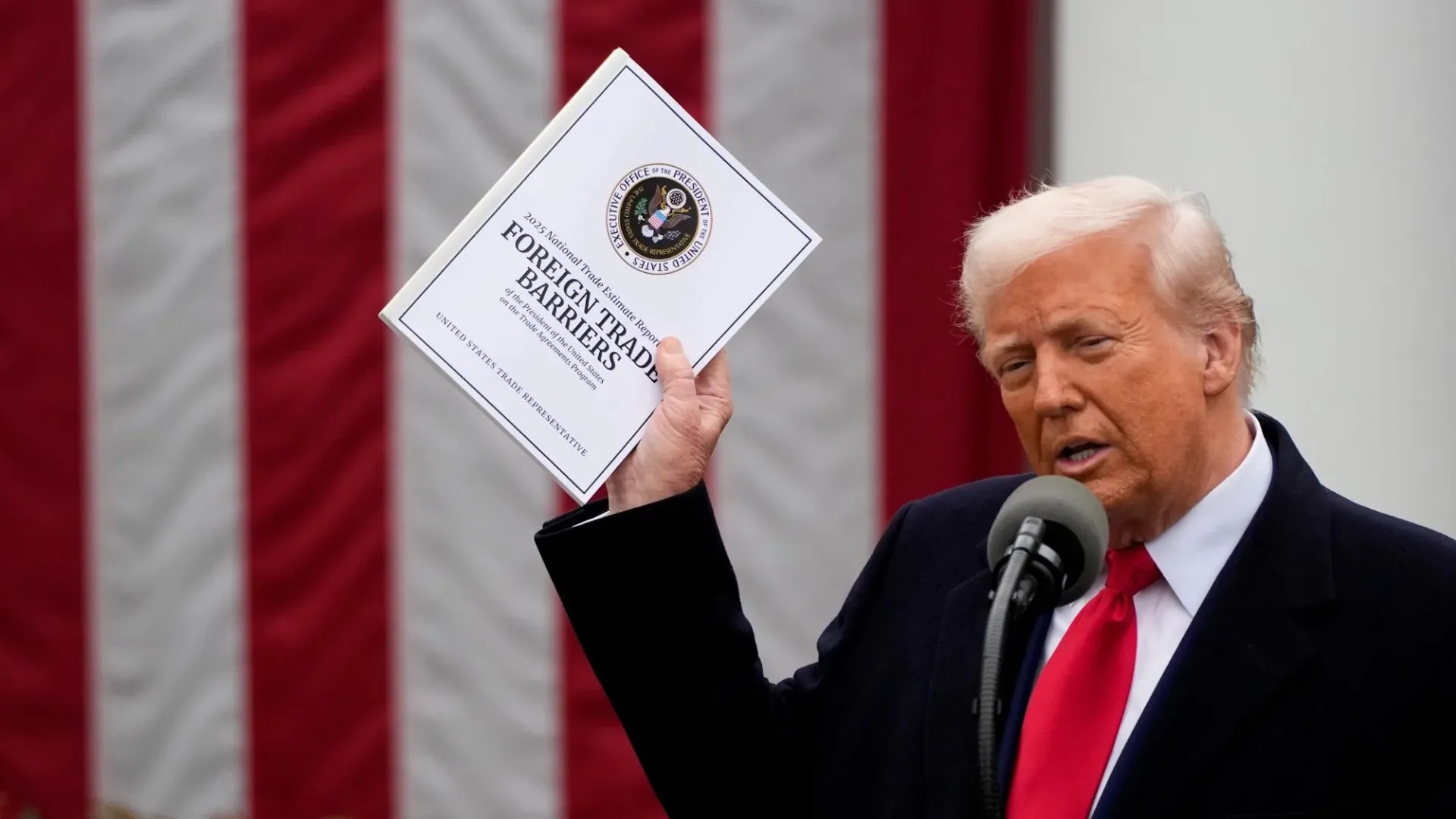

Beyond economics, the litigation has become a symbolic battleground over the Constitution’s separation of powers. In a social-media statement on Thursday, President Trump decried the trade court’s decision as “country-threatening,” warning that upholding it “would completely destroy Presidential Power — The Presidency would never be the same!” He appealed directly to the U.S. Supreme Court to reverse the lower court, pledging to “use every legal remedy” to defend executive authority.

Constitutional scholars note that the case may ultimately force the Supreme Court to clarify the limits of IEEPA and set a precedent for presidential trade actions for decades to come. If the Court of Appeals affirms the trade court’s injunction, and the Supreme Court declines review, future presidents could find themselves stripped of a potent tool for rapid trade retaliation.

Looking Ahead: Scenarios and Timelines

- Early June 2025: Plaintiffs file opening briefs (by June 5), followed by government reply (by June 9).

- Late June 2025: Oral arguments expected before the Federal Circuit, with a decision potentially by late summer.

- Fallback Options: If IEEPA authority is struck down, the administration could swiftly pivot to Section 232 or Section 301 tariffs, preserving much of the existing duty structure.

- Congressional Response: Some legislators have floated standalone bills to clarify or curtail presidential tariff powers—an unlikely outcome in an election year but one to watch in 2026.

Even under the most conservative estimates, broad tariff authority under IEEPA will remain on ice until at least November 2025, when the Federal Circuit rules—and later, if necessary, until the Supreme Court acts.

Conclusion: Tariffs as a Tool in Flux

The swift appellate stay illustrates both the resilience and fragility of Trump-era trade policy. While tariffs remain in effect for now, the ultimate outcome hinges on questions that cut to the core of U.S. constitutional law and the global trade architecture.

For U.S. businesses and international partners alike, the prospect of a protracted legal battle—and the potential for quick pivots to alternative authorities—means tariffs will remain a key variable in supply-chain planning, pricing strategies, and diplomatic engagement for the foreseeable future. As one Chicago-area small-business owner put it, “We’re used to trade wars by now—but this feels different. It’s a legal war, too, and every twist can upend our forecasts.”

In the weeks ahead, all eyes will be on Washington’s courtrooms—and on Capitol Hill—to see whether sweeping tariffs will survive under IEEPA, shift to new legal grounds, or prompt a legislative reckoning over the balance of economic power in U.S. trade policy.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

30th May, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025