On September 30, 2024, the African Development Bank (AfDB) made a significant move in the infrastructure financing landscape by acquiring a $10 million equity stake in Kenya’s Dhamana Guarantee Company. This strategic investment follows an anchor investment by the UK-Government-backed Private Infrastructure Development Group (PIDG) through its subsidiary, InfraCo Africa. The signing ceremony took place in Nairobi, marking a significant step toward improving access to sustainable financing in East Africa.

Dhamana Guarantee Company: Enhancing Access to Financing for Key Sectors

Dhamana Guarantee Company is a Nairobi-based entity focused on providing guarantees that facilitate access to finance for businesses in crucial sectors like transport, water, renewable energy, and waste management. Its mission is to drive sustainable growth by offering credit guarantees, which will, in turn, attract private institutional investment into these vital sectors. The company also aims to play a key role in promoting green and sustainable financing across East Africa, making it a catalyst for regional development.

The AfDB’s investment is poised to significantly enhance Dhamana’s capacity to reduce the capital needed for projects, enabling businesses to gain access to affordable finance. This, in turn, will help achieve several of the Sustainable Development Goals (SDGs), including clean energy, sustainable cities, and infrastructure development.

The Role of the African Development Bank in Catalyzing Growth

Solomon Quaynor, the Vice President of Private Sector, Infrastructure & Industrialization at the African Development Bank, highlighted the importance of Dhamana in infrastructure financing. During the signing ceremony, Quaynor noted that the AfDB’s equity investment in Dhamana exemplifies the bank’s strategy to mobilize local currency financing through innovative credit enhancement models. “We intend to replicate this business model in other African markets in collaboration with partners such as PIDG,” Quaynor emphasized.

Quaynor also referenced the success of similar initiatives, such as Nigeria’s InfraCredit, which has shown the potential for credit enhancement companies to unlock local capital for infrastructure projects. This type of credit enhancement reduces the risks for investors by providing guarantees that facilitate access to long-term local currency funding. This is especially important in Africa, where access to affordable financing is often limited by high-interest rates and currency fluctuations.

Private Infrastructure Development Group: A Key Partner

The Private Infrastructure Development Group (PIDG), through its subsidiary InfraCo Africa, is a major player in the infrastructure investment landscape, focusing on unlocking private investment in sustainable projects across sub-Saharan Africa and Southeast Asia. PIDG’s CEO, Gilles Vaes, lauded Dhamana’s potential, noting that it builds upon the success of other credit enhancement facilities that PIDG has supported, particularly in Nigeria and Pakistan. These facilities have successfully mobilized private investment into infrastructure projects that address the climate crisis while promoting social and economic development.

Vaes noted, “Dhamana will engage new partners and investors to address the climate crisis and accelerate progress toward the UN Sustainable Development Goals.” The inclusion of climate-focused projects in Dhamana’s portfolio is a strategic move that aligns with global efforts to combat climate change and build resilient economies.

Building Local Capacity and Promoting Sustainable Growth

Dhamana CEO Christopher Olobo underscored the company’s mission to connect local institutional capital with East Africa’s real economy, particularly in the areas of green infrastructure and credit provision to businesses. With support from investors like AfDB, InfraCo Africa, CPF Financial Services, and Cardano Development, Dhamana aims to become a critical player in the region’s sustainable finance landscape.

Olobo highlighted that Dhamana’s guarantees will offer local investors opportunities to invest in projects that align with global climate goals, particularly those related to the Paris Agreement. “Dhamana’s local currency guarantees will make a tangible difference in people’s lives by reducing financial barriers for businesses that are delivering critical services like affordable housing, transportation, water, and energy infrastructure,” Olobo remarked.

Importance of Local Currency Guarantees in Infrastructure Financing

One of the standout features of Dhamana’s business model is its provision of local currency guarantees. This is crucial in a region like East Africa, where currency volatility can present significant risks to investors. By offering guarantees in local currency, Dhamana mitigates exchange rate risks, making it more attractive for both local and international investors to participate in infrastructure projects.

This model has already shown success in other markets, particularly Nigeria’s InfraCredit, which has mobilized domestic capital for infrastructure projects by providing local currency guarantees. The aim is to replicate this success in East Africa, starting with Kenya, and eventually expand to other countries in the region. By doing so, Dhamana will help unlock pools of untapped capital from institutional investors, such as pension funds and insurance companies, which have traditionally been hesitant to invest in infrastructure due to perceived risks.

Addressing the Infrastructure Gap in East Africa

The infrastructure gap in Africa remains one of the continent’s most pressing challenges. According to estimates by the African Development Bank, the continent needs between $130 billion and $170 billion annually to meet its infrastructure needs, with a current financing gap of $68 billion to $108 billion per year. This shortfall affects critical sectors such as transportation, energy, water, and sanitation, which are essential for economic growth and improving the quality of life for African citizens.

Dhamana’s focus on providing credit guarantees for projects in these key sectors is an important step toward addressing this gap. By reducing the financial risks associated with infrastructure investments, Dhamana will encourage more private sector participation, which is critical for closing the financing gap.

The Role of Institutional Investors in Infrastructure Development

One of the key objectives of Dhamana is to attract institutional investors, such as pension funds and sovereign wealth funds, into infrastructure projects. These investors often have large pools of capital that are well-suited for long-term investments like infrastructure, but they have traditionally been cautious due to the risks associated with such projects in emerging markets.

Dhamana’s credit guarantees will help de-risk these projects, making them more attractive to institutional investors. This aligns with the African Development Bank’s broader strategy of mobilizing financing from African institutional funds for infrastructure development. By doing so, Dhamana will not only help close the infrastructure financing gap but also create new investment opportunities for local institutions.

Conclusion

The African Development Bank’s $10 million equity investment in Dhamana Guarantee Company marks a significant milestone in the effort to unlock sustainable financing for infrastructure development in East Africa. By providing local currency guarantees, Dhamana will reduce the risks associated with infrastructure investments, making it easier for businesses to access the financing they need to deliver critical services. This, in turn, will contribute to the region’s economic growth and help achieve the Sustainable Development Goals.

With support from key partners like the Private Infrastructure Development Group, InfraCo Africa, and FSD Africa, Dhamana is well-positioned to become a leader in the East African sustainable finance space. Its innovative business model will not only enhance access to finance for businesses but also create new opportunities for local investors to participate in infrastructure projects that have a positive impact on the region’s economy and environment.

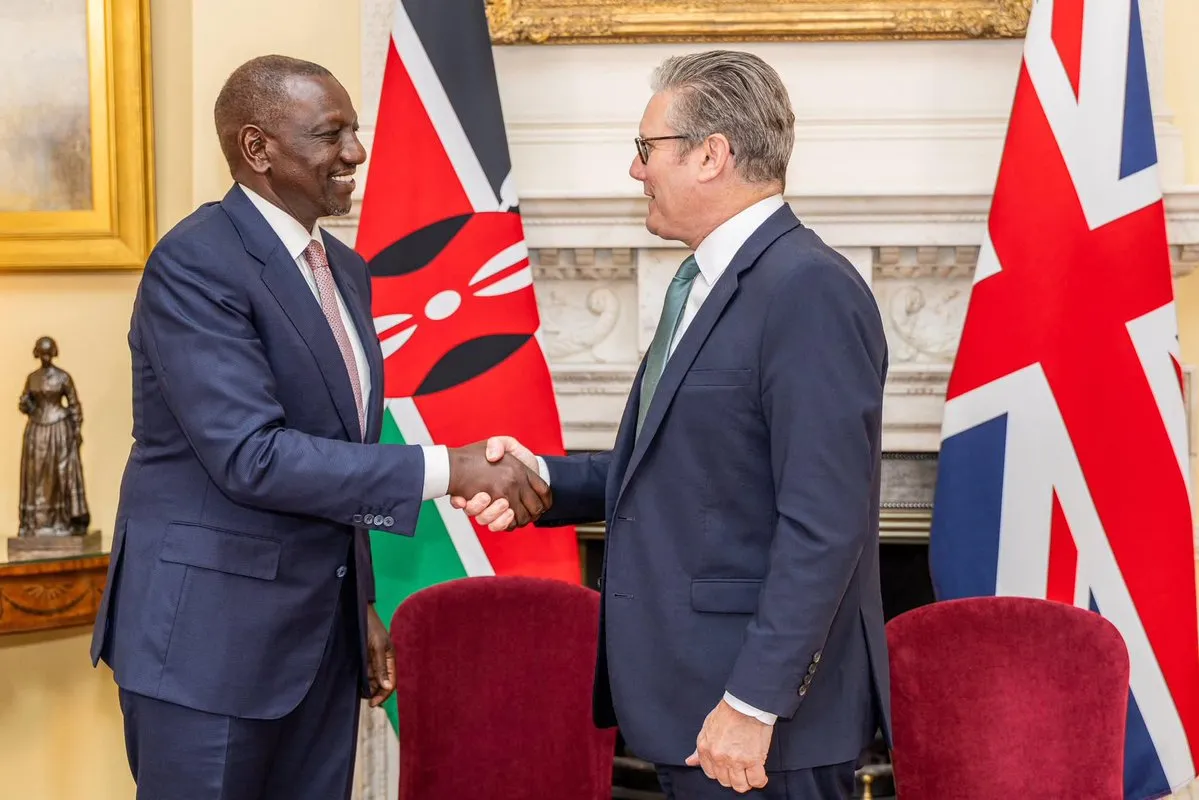

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

1st October, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025