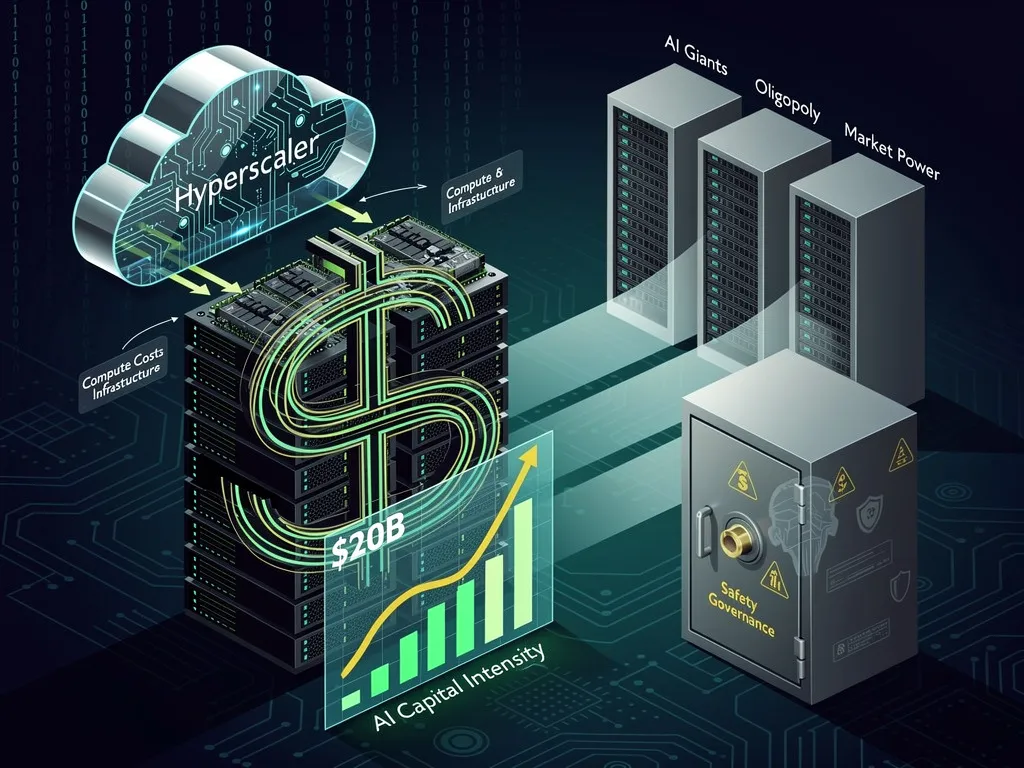

The artificial intelligence arms race has entered a new phase of financial intensity that would have seemed unimaginable just two years ago. Anthropic, the AI safety-focused startup behind the popular Claude chatbot, is closing in on a $20 billion funding round—an extraordinary feat made even more remarkable by its timing. This mega-raise comes just five months after the company closed a $13 billion Series F round in September 2025, representing one of the fastest sequences of massive capital injections in technology history.

The breathtaking fundraising velocity exposes the harsh economic realities of competing at the frontier of artificial intelligence development. If this deal closes at the reported level, Anthropic will have raised an astounding $33 billion in capital in less than six months—a rate of spending that underscores how the cost of building state-of-the-art AI models has spiraled far beyond even the most aggressive projections from industry insiders and investors.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

According to reports from the Financial Times, the new round values Anthropic at approximately $350 billion, representing a 91% increase from its $183 billion valuation achieved just months earlier. The dramatic valuation surge reflects not just investor enthusiasm but also the company’s operational momentum. When Anthropic announced its September funding, the company revealed that its run-rate revenue had surged from approximately $1 billion at the beginning of 2025 to over $5 billion by August—making it one of the fastest-growing technology companies in history.

The capital raise reportedly drew interest totaling five to six times the company’s original $10 billion fundraising target, prompting Anthropic to double the size of the round. Expected backers include Sequoia Capital (which also invests in rival OpenAI), Singapore’s sovereign wealth fund, and investment management firm Coatue. The round structure also includes potential additional investments from Microsoft and Nvidia, who have committed up to $5 billion and $10 billion respectively in separate agreements.

The Compute Cost Crisis Driving Capital Demands

The fundamental driver behind this fundraising frenzy is compute—specifically, access to the massive GPU infrastructure required to train and run cutting-edge AI models. Training large language models demands access to tens of thousands of high-end graphics processing units, primarily Nvidia’s H100 and newer Blackwell architecture chips, which remain in constrained supply despite production increases.

The economics are staggering. Individual H100 GPUs cost approximately $25,000 to $40,000 to purchase per card, with complete 8-GPU server systems reaching $200,000 to $400,000 including infrastructure. Cloud rental prices for H100 instances currently range from $2.10 to $5.00 per GPU per hour depending on provider and commitment level, though some specialized providers offer rates as low as $1.50 per hour.

For frontier AI labs running massive training operations, these costs accumulate at breathtaking speed. Cloud computing bills can easily run into hundreds of millions of dollars per quarter, and that’s before accounting for the research and engineering talent needed to push model capabilities forward. The next generation of Nvidia’s Blackwell GPUs—including the B100 and B200 models—are estimated to cost $35,000 to $40,000 per unit, with full GB200 NVL72 systems exceeding $1 million for complete configurations.

This capital intensity creates a brutal competitive dynamic. OpenAI, for instance, expects to spend approximately $14 billion in losses in 2026 while pursuing its own massive fundraising efforts. The company recently closed a $40 billion funding round led by SoftBank that values it at $300 billion post-money. Meanwhile, Elon Musk’s xAI has raised more than $10 billion in new capital to support its Colossus supercomputing cluster, which currently houses 200,000 H100 and H200 GPUs with plans to expand to one million GPUs.

The Competitive Pressure Cooker

The competitive landscape Anthropic faces is uniquely intense. OpenAI continues to dominate mindshare despite recent challenges, maintaining nearly 900 million weekly active users for ChatGPT. However, the company’s market share in enterprise AI has reportedly fallen from about 50% in 2023 to 27% currently, according to Menlo Ventures, as competitors like Anthropic gain ground.

Google leverages its own infrastructure advantage through its Gemini models, recently releasing Gemini 2.0 Flash, which reportedly matches GPT-4o performance at four times lower cost. The tech giant’s partnership with Apple, integrating Gemini into Apple Intelligence and future Siri upgrades, accelerates this competitive threat. Google’s AI web traffic share grew from 5.7% in January 2025 to 21.5% in January 2026, according to Similarweb’s Global AI Tracker.

Anthropic has positioned itself as the safety-conscious alternative in this race, emphasizing constitutional AI and responsible development practices. But good intentions don’t come cheap. The company’s Claude models compete directly with GPT-4 and other frontier systems, requiring comparable infrastructure investments. CEO Dario Amodei and his team, many of whom are OpenAI alumni who left over directional differences, understand intimately that falling behind on compute means falling behind on capabilities.

The company’s success in enterprise markets has been notable. Anthropic now serves more than 300,000 business customers, with the number of large accounts—customers representing over $100,000 in run-rate revenue—growing nearly seven times in the past year. Claude Code, the company’s developer-focused product launched in May 2025, quickly achieved over $500 million in run-rate revenue with usage growing more than 10x in just three months.

Major enterprise deployments underscore this momentum. In January 2026, financial services provider Allianz announced plans to deploy AI throughout its insurance business worldwide with Anthropic’s help. Microsoft has become one of Anthropic’s top customers, reportedly on track to spend around $500 million annually to use Anthropic’s AI in Microsoft products.

The Bifurcation of AI Capital Markets

The fundraising environment for AI startups has bifurcated sharply. While frontier labs like Anthropic, OpenAI, and a handful of others can command multi-billion dollar rounds, smaller AI companies are finding capital harder to come by. Investors are increasingly betting that scale and compute access will determine winners, creating a concentration of capital in just a few players.

This year alone has seen over $84 billion raised across major AI funding rounds. Beyond the mega-rounds for Anthropic and OpenAI, the pattern extends to newer entrants with strong pedigrees. Former OpenAI CTO Mira Murati’s startup Thinking Machines Lab secured a $2 billion seed round at a $10 billion valuation despite sharing almost no information about its product offering. Safe Superintelligence, co-founded by former OpenAI chief scientist Ilya Sutskever, closed a $2 billion funding round for its own AI safety efforts.

This capital intensity has broader implications for the AI industry. The cost of entry for new frontier labs has become prohibitively high, potentially cementing the current group of leaders. It also raises fundamental questions about sustainability—even with massive revenue growth, these companies are burning through capital at rates that would have been unthinkable in previous technology cycles.

Anthropic’s path illustrates this trajectory. Since its founding in 2021 by former OpenAI employees including siblings Daniela and Dario Amodei, the company has now raised more than $33.7 billion total across multiple rounds. The September Series F round was co-led by Iconiq Capital, Fidelity Management & Research Company, and Lightspeed Venture Partners, with participation from major institutional investors including affiliated funds of BlackRock, Blackstone, the Qatar Investment Authority, and sovereign wealth funds.

The Economics of Model Training and the Scaling Debate

The relationship between compute spending and model performance remains hotly debated within the AI research community. While larger training runs generally produce more capable models, the returns appear to be diminishing in some areas. This reality has pushed companies to invest not just in raw compute but in more efficient architectures, better data quality, and novel training techniques that can extract more value from each GPU-hour.

Training costs for large models are substantial. According to industry benchmarks, training large models with 70 billion or more parameters can cost $10,000 to $50,000 using 8 H100 GPUs for 300 to 1,000 hours, though these figures represent just the direct GPU costs and don’t account for data preparation, experimentation, failed runs, or the full research team. Fine-tuning costs are typically 10-20x cheaper than training from scratch, making parameter-efficient techniques increasingly important.

The energy and infrastructure requirements add another dimension to the cost equation. Power consumption for GPU clusters runs $3,000 to $7,000 monthly per 8-GPU server at typical commercial electricity rates, including cooling overhead. At data center scale with tens of thousands of GPUs, these operational costs become massive ongoing expenses that must be factored into the total cost of ownership.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Revenue Growth and the Path to Profitability

Despite the extraordinary capital requirements, Anthropic’s revenue trajectory has been impressive. The company’s growth from approximately $1 billion in annual run-rate revenue at the beginning of 2025 to over $5 billion by August represents a rare achievement in technology company scaling. According to The Information, Anthropic has hiked its revenue forecasts for the next several years, projecting that sales will quadruple to as much as $18 billion in 2026 and hit $55 billion in 2027.

However, profitability remains elusive. Like its competitors, Anthropic faces the challenge of massive infrastructure costs that scale with usage. The company’s cash burn trajectory reportedly shows approximately $3 billion in cash burn expected for 2025, with internal projections showing the company will stop burning cash in 2027 and reach break-even in 2028, according to industry analysis from Sacra.

The IPO question looms large. Late last year, reports emerged that Anthropic hired lawyers from Wilson Sonsini as a step toward preparing for an IPO that could come sometime in 2026. The company’s reported engagement with this prominent Silicon Valley law firm, which has significant tech IPO experience, signals serious preparation for a potential public offering that could value the company well above its current $350 billion private market valuation.

An Anthropic IPO would be closely watched as a bellwether for the broader AI industry’s path to public markets. The company has structured itself as a Delaware public-benefit corporation, which enables directors to balance stockholders’ financial interests with its public benefit purpose—a structure that reflects its founding mission around AI safety and responsible development.

The Broader Industry Implications

Anthropic’s fundraising sprint crystallizes several trends reshaping the technology industry. First, the sheer scale of capital required to compete at the frontier of AI development has created unprecedented concentration of venture capital and institutional investment in just a handful of companies. The $500 billion Stargate joint venture between SoftBank, OpenAI, and Oracle to build AI infrastructure in the U.S. exemplifies this mega-scale thinking.

Second, the competitive dynamics have intensified to a point where even billion-dollar fundraises no longer provide comfortable runway. The rapid succession of Anthropic’s $13 billion and $20 billion rounds demonstrates that capital needs are accelerating faster than even optimistic revenue projections can support through operations alone.

Third, the talent war compounds the capital intensity. Both Anthropic and OpenAI face significant competition for AI researchers and engineers, with reports indicating that engineers at OpenAI are eight times more likely to leave for Anthropic than the reverse. OpenAI reportedly expects to spend $6 billion on stock-based compensation in 2025—nearly half of projected revenue—to retain talent.

The emergence of Chinese competitors adds another dimension to the competitive pressure. DeepSeek’s V3.2 model, released in December 2025, reportedly matches GPT-5-level performance on elite reasoning benchmarks while running at inference costs 10-30x cheaper than Western alternatives. This development challenges the assumption that massive capital spending is the only path to competitive AI capabilities.

The Infrastructure Build-Out Race

Beyond pure training costs, frontier AI companies are racing to secure long-term compute capacity through ambitious infrastructure projects. Anthropic in October 2025 announced a cloud partnership with Google, giving it access to up to one million of Google’s custom Tensor Processing Units (TPUs). According to the company, the partnership will bring more than one gigawatt of AI compute capacity online by 2026.

The November 2025 partnership deal with Nvidia and Microsoft represents another strategic compute arrangement. Under these agreements, Anthropic said it would buy $30 billion of computing capacity from the partnerships, with the two tech giants investing up to $15 billion total in Anthropic. These arrangements effectively lock in future compute access while providing capital to bridge to profitability.

The strategic importance of these partnerships cannot be overstated. As one investor told the Financial Times, Anthropic has seen “as much as six times the interest” it originally expected for the current fundraising round. This overwhelming demand reflects investor belief that compute access and scaling capabilities will determine the winners in the AI race, making Anthropic’s aggressive infrastructure investments a competitive necessity rather than a choice.

Market Dynamics and Valuation Questions

The AI market’s valuation dynamics have reached levels that strain traditional metrics. Anthropic’s progression from a $61.5 billion valuation in March 2025 to $183 billion in September to $350 billion in early 2026 represents nearly a sixfold increase in less than a year. These valuations are predicated on the belief that frontier AI will capture enormous economic value and that only a handful of companies will succeed at building truly transformative AI systems.

Investor appetite remains robust despite the eye-watering capital requirements and uncertain path to profitability. The $20 billion round, if it closes at the reported level, would rank among the largest private company funding rounds on record. Previous backers who participated in the September round included sophisticated institutional investors like the Ontario Teachers’ Pension Plan, T. Rowe Price Associates, Jane Street, and General Catalyst, alongside corporate strategic investors like Google and Salesforce Ventures.

The concentration of capital reflects a “winner-take-most” thesis in AI development. As compute requirements escalate and the technical bar for frontier capabilities rises, investors are betting that the field will consolidate around a small number of well-capitalized players with access to massive GPU clusters and top-tier research talent. This dynamic creates self-reinforcing advantages for current leaders while raising barriers for new entrants.

The Path Forward: Sustainability Questions

Anthropic hasn’t commented publicly on the reported fundraising, and deal terms could still change before any official announcement. But the company’s apparent urgency to raise capital speaks volumes about how executives view the current competitive landscape. In the race to build transformative AI systems, running out of runway isn’t an option, and the capital required to stay competitive continues to escalate.

The sustainability questions extend beyond individual companies to the broader AI ecosystem. Can the current model of massive capital raising and aggressive spending continue indefinitely? What happens if the expected returns on AI investments take longer to materialize than current valuations assume? How will the industry evolve as the cost of frontier model development potentially exceeds the financial capacity of all but the largest technology companies or sovereign wealth funds?

For now, the market is answering these questions with continued capital inflows at unprecedented scale. Whether $20 billion rounds become routine, as some industry observers predict, will determine the next chapter of the AI revolution. What’s certain is that Anthropic’s fundraising sprint represents more than one company’s capital needs—it’s a signal that the AI arms race has entered a phase where only the most heavily funded players can continue competing at the cutting edge.

The implications ripple across the technology industry and beyond. For investors, the message is that AI represents a potentially transformational investment opportunity worth backing with extraordinary sums. For employees and job seekers, the concentration of talent and resources in a handful of companies shapes career trajectories. For competitors, the barriers to entry keep rising, and the window for new challengers to emerge may be closing faster than anyone expected. And for society, the concentration of advanced AI capabilities in the hands of just a few extraordinarily well-funded companies raises questions about competition, innovation, and the distribution of AI’s benefits.

As Anthropic races to close this latest mega-round and deploy the capital toward compute infrastructure and model development, the broader AI industry watches closely. The outcome will help determine not just Anthropic’s competitive position but the future structure of the entire AI ecosystem—and ultimately, who gets to shape the technology that may define the next era of human progress.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

11th February, 2026

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025