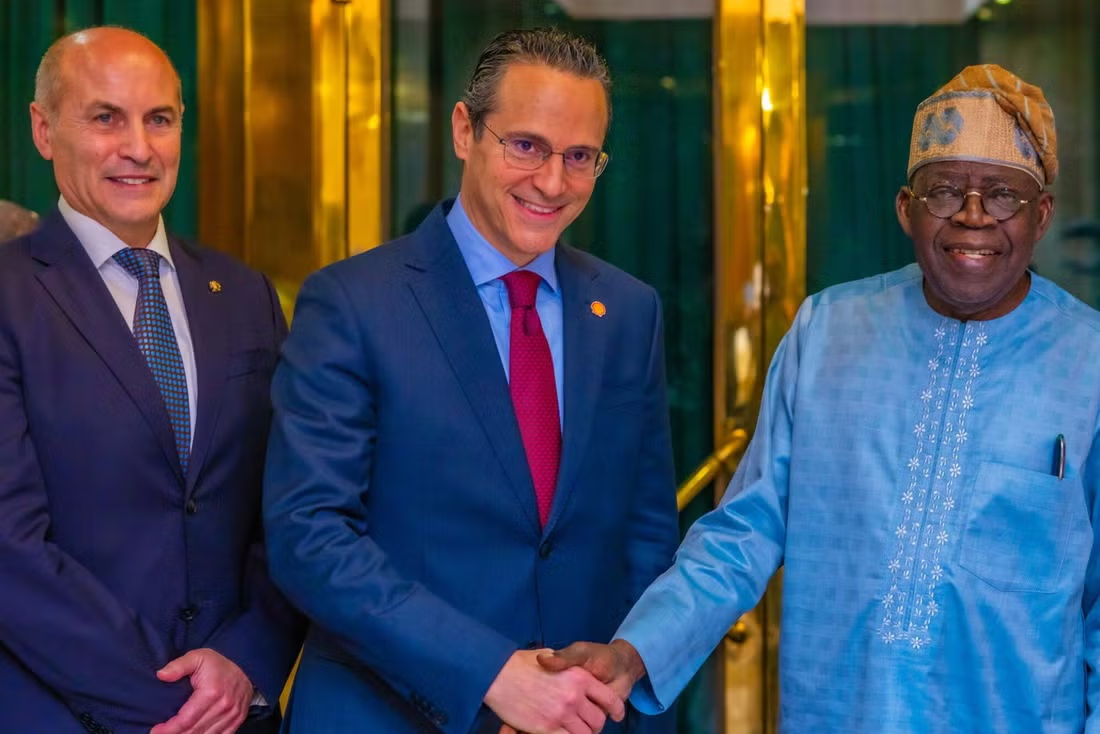

Nigerian President Bola Tinubu has approved targeted, investment-linked incentives to support Shell’s proposed Bonga South West deepwater oil project, following a high-level meeting with Shell’s Global Chief Executive Officer Wael Sawan at the State House in Abuja. The approval marks the latest milestone in Nigeria’s aggressive push to attract foreign investment to its energy sector and boost oil production to 2 million barrels per day by 2027, with longer-term ambitions to reach 3 million barrels per day by 2030.

During the January 22 meeting, Shell’s Special Adviser on Energy Olu Verheijen indicated that the oil major had informed President Tinubu of plans to invest an additional $20 billion in the upcoming Bonga South West project, though Shell has not officially confirmed the exact investment figure. The company’s spokesperson stated that CEO Wael Sawan “discussed various projects with President Tinubu, including Bonga South West, that could see us and partners potentially make future investment decisions.”

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Strategic Importance and Investment Framework

The proposed incentives represent a carefully calibrated approach by the Nigerian government to attract international oil capital while protecting state revenues. President Tinubu emphasized that “these incentives are not blanket concessions,” but are instead “ring-fenced and investment-linked, focused on new capital and incremental production, strong local content delivery, and in-country value addition.”

The president set an ambitious timeline for the project, stating: “My expectation is clear: Bonga South West must reach a Final Investment Decision within the first term of this administration.” With Tinubu’s first term scheduled to end in mid-2027, this creates significant pressure on Shell and its partners to accelerate development planning and secure necessary approvals within approximately 18 months.

The Bonga South West project is projected to produce up to 150,000 barrels of oil per day at peak, alongside significant gas resources. This production capacity would represent a meaningful contribution to Nigeria’s broader production targets and help offset natural decline rates in aging fields across the Niger Delta and offshore basins.

President Tinubu described the Bonga South West project as strategic to Nigeria’s economy, with potential to create thousands of direct and indirect jobs, generate significant foreign-exchange inflows, and deliver sustained government revenues over the project’s lifecycle. He added that the development would deepen Nigerian participation in offshore engineering, fabrication, logistics, and energy services—addressing long-standing calls for greater local content in the country’s petroleum sector.

Shell’s Deepening Commitment to Nigerian Deepwater

Shell’s interest in Bonga South West comes within the context of a broader strategic pivot toward Nigerian deepwater and integrated gas operations. In November 2025, the company completed the acquisition of TotalEnergies’ 12.5 percent stake in Oil Mining License 118, which contains the Bonga field. The $510 million transaction increased Shell’s operated stake in the license to 65 percent, with Eni subsidiary Nigerian Agip Exploration holding 15 percent after exercising pre-emption rights to acquire 2.5 percent, and ExxonMobil affiliate Esso Exploration and Production Nigeria retaining 20 percent.

This acquisition underscores Shell’s continued interest in offshore Nigeria production after the company sold its onshore assets to escape the endemic problems of pipeline theft, vandalism, and community conflicts that have plagued Niger Delta onshore operations for decades. The company completed the $1.3 billion divestment of its Shell Petroleum Development Company of Nigeria Limited (SPDC) joint venture in 2024, transferring a 30 percent operating stake to Renaissance Africa, a consortium of five predominantly Nigerian companies.

The Bonga field itself has been a cornerstone of Shell’s Nigerian operations since production commenced in 2005. Located in water depths exceeding 1,000 meters approximately 120 kilometers offshore the Niger Delta, the field represented Nigeria’s first major deepwater development. The Bonga Floating Production Storage and Offloading (FPSO) vessel has a capacity to produce 225,000 barrels of oil per day and achieved its one-billionth barrel milestone in 2023, demonstrating the field’s prolific nature and operational longevity.

Recent Investment Momentum: Bonga North and HI Projects

Shell’s commitment to Nigerian deepwater has already been demonstrated through substantial recent investments. In December 2024, the company announced a Final Investment Decision on the Bonga North project, a $5 billion subsea tie-back to the existing Bonga FPSO. The Bonga North project holds an estimated recoverable resource of more than 300 million barrels of oil equivalent and is expected to reach peak production of 110,000 barrels of oil per day, with first oil anticipated by the end of the decade around 2030.

The development encompasses the drilling, completion, and startup of 16 wells—eight production wells and eight water injection wells—along with modifications to the Bonga FPSO and installation of subsea infrastructure. In December 2024, Shell Nigeria Exploration and Production selected a consortium comprising Saipem, KOA Oil & Gas, and AVEON Offshore for Engineering, Procurement, Construction, and Installation (EPCI) work valued at approximately $1 billion. Additionally, TechnipFMC won a contract valued between $250 million and $500 million to supply Subsea 2.0 production systems including subsea trees, manifolds, jumpers, controls, and services.

Complementing the Bonga North investment, Shell and its partner Sunlink Energies and Resources Limited took a Final Investment Decision in October 2025 on the HI gas project offshore Nigeria, representing an additional $2 billion investment. The HI field, discovered in 1985 and located 50 kilometers from shore in water depths of 100 meters, holds an estimated 285 million barrels of oil equivalent in gas and condensate resources.

The development consists of a wellhead platform with four wells, a pipeline to transport gas to Bonny Island, and a gas processing plant from which processed gas will be delivered to Nigeria LNG while condensate goes to the Bonny Oil and Gas Export Terminal. Together with the Ubeta Non-Associated Gas project, the HI development can supply up to 15 percent of Nigeria LNG’s total feedgas requirements across Trains 1 through 7.

According to the Nigerian National Petroleum Company Limited (NNPC) Group Chief Executive Officer Bayo Ojulari, Shell and its partners have invested nearly $7 billion in Nigeria over the past 13 months, particularly in the Bonga North and HI projects. Ojulari explained that after Shell’s divestment of onshore assets, the company reached a $5 billion Final Investment Decision on Bonga North, followed by the $2 billion approval for the HI shallow-water gas development, demonstrating how Nigeria’s reforms are translating into tangible investment commitments from international oil companies.

Nigeria’s Broader Regulatory and Fiscal Reforms

The incentives approved for Bonga South West must be understood within the context of Nigeria’s comprehensive energy sector transformation under the Tinubu administration. Since taking office in May 2023, President Tinubu has pursued aggressive reforms designed to restore investor confidence and position Nigeria as a competitive destination for large-scale energy investment after years of policy uncertainty, regulatory delays, and inadequate fiscal terms.

The foundation for these reforms was laid by the Petroleum Industry Act (PIA), which was passed in August 2021 after a two-decade legislative struggle. The PIA overhauled Nigeria’s hydrocarbon industry legal framework, establishing separate upstream and midstream/downstream regulatory commissions, transforming the Nigerian National Petroleum Corporation into a commercially-oriented limited liability company, and creating modernized fiscal and contractual terms aimed at attracting capital while ensuring the state captures a fair share of petroleum rents.

Building on the PIA framework, President Tinubu has issued targeted executive orders and directives coordinated by the Office of the Special Adviser to the President on Energy. In April 2025, the president signed the Upstream Petroleum Operations Cost Efficiency Incentives Order, providing performance-based tax credits to oil and gas companies that achieve cost-reduction targets verified by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC).

Under this scheme, operators across onshore, shallow-water, and deepwater sectors can earn tax credits of up to 20 percent of their annual tax liability by meeting cost-reduction benchmarks that NUPRC sets and reviews annually. The initiative aims to lower operational costs that have made Nigerian petroleum projects less competitive compared to alternatives in Guyana, West Africa, and Southeast Asia, while creating incentives for efficiency improvements without sacrificing government revenues.

The Nigerian Upstream Petroleum Regulatory Commission has also accelerated approval processes and increased regulatory predictability. Commission Chief Executive Oritsemeyiwa Eyesan, appointed in December 2025, unveiled a 90-day fast-track approval programme designed to unlock near-ready production opportunities including Field Development Plans, well interventions, rig mobilization, and other quick-win projects capable of delivering early barrels. The commission approved 46 Field Development Plans in 2025, contributing to increased upstream activity.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Production Recovery and Ambitious Targets

Nigeria’s production has shown signs of recovery after years of decline driven by underinvestment, crude theft, aging infrastructure, and regulatory uncertainty. According to NUPRC data, crude oil production climbed to 1.71 million barrels per day in 2025, with peak levels reaching 1.83 million barrels per day—a substantial improvement from the sub-1.5 million barrel levels that characterized much of 2022 and early 2023.

The country’s active drilling rig count surged from 16 rigs in 2021 when NUPRC was established to more than 60 active rigs by late 2025, reflecting renewed upstream investment and accelerated field development activity. This represents a remarkable turnaround in drilling activity that had collapsed during the years of policy uncertainty preceding the PIA’s passage.

The Nigerian government has set aggressive production targets aligned with its economic development objectives. NNPC is working to increase oil production to 2 million barrels per day over the next two years, with aspirations to reach 3 million barrels per day by 2030. These targets include both crude oil and condensate production, allowing Nigeria to pursue growth while managing its OPEC+ quota obligations, which currently stand at 1.5 million barrels per day for crude oil.

Special Adviser on Energy Olu Verheijen has indicated that the planned production surge will partly come from oil condensate, a lighter, more volatile hydrocarbon that is not counted against OPEC+ crude oil quotas, enabling Nigeria to expand total liquids production while nominally complying with cartel discipline. Improvements in security around oil production and transportation sites represent the main driver behind anticipated production growth, as the government and security forces have intensified efforts to combat pipeline vandalism and crude theft that had previously cost Nigeria billions of dollars in lost revenues annually.

Competitive Context and Investment Alternatives

Nigeria’s push to secure the Bonga South West Final Investment Decision occurs within an intensely competitive global environment for petroleum investment capital. International oil companies are evaluating competing opportunities across multiple continents, with particularly strong competition from developments in Guyana’s offshore basins, Namibia’s emerging deepwater province following major discoveries by TotalEnergies and Shell, Suriname, Brazil’s pre-salt fields, and established deepwater hubs in the Gulf of Mexico and West Africa.

NNPC Group CEO Bayo Ojulari acknowledged this reality, noting that the competition for investment is global, with countries in Africa, Guyana, and the Far East continually adjusting policies to attract capital. While the Petroleum Industry Act provided a critical framework for reform, Ojulari explained that further incentive measures were necessary to sustain Nigeria’s competitiveness in attracting global investment capital against these alternatives.

The targeted nature of the Bonga South West incentives—designed to be ring-fenced to specific projects rather than applied sector-wide—reflects Nigerian policymakers’ attempt to balance multiple objectives: attracting investment in priority strategic projects, maintaining fiscal discipline to avoid unsustainable revenue losses, and creating precedents that can be selectively applied to other high-value developments without creating open-ended commitments.

President Tinubu has emphasized his administration’s commitment to policy stability, regulatory certainty, and speed in approvals, recognizing that investors value predictability and efficient processes as much as fiscal terms. The rapid approval of incentives following Shell CEO Sawan’s visit demonstrates the government’s willingness to move quickly when dealing with major investment decisions, contrasting with the bureaucratic delays that historically plagued Nigerian petroleum sector approvals.

Economic Implications and Development Objectives

Beyond the immediate production and revenue implications, Nigerian officials view the Bonga South West project as a vehicle for broader economic development objectives. The project is expected to generate thousands of direct jobs in engineering, construction, offshore operations, and related services, along with multiplier effects creating indirect employment throughout supply chains and service industries.

Foreign exchange generation represents a critical consideration for Nigeria, which continues to face periodic currency pressures and balance of payments challenges despite being a major oil exporter. Large-scale petroleum developments like Bonga South West generate foreign exchange both through export revenues and through capital expenditures that flow into the domestic economy through local content requirements, supporting the naira and providing hard currency liquidity to the financial system.

The emphasis on “strong local content delivery” in the approved incentive framework reflects Nigeria’s longstanding commitment to maximizing domestic participation in petroleum activities. The Nigerian Oil and Gas Industry Content Development Act of 2010 established targets for Nigerian participation across various petroleum sector activities, from engineering and fabrication to drilling and logistics services. Major projects like Bonga South West provide opportunities to build local capabilities and transfer technology and expertise to Nigerian companies and workers.

President Tinubu has also highlighted the project’s potential to deepen Nigerian participation in offshore engineering, fabrication, logistics, and energy services—sectors where the country has been building capabilities but still relies heavily on imported expertise and equipment. Shell’s track record of engaging Nigerian contractors and service providers on previous Bonga developments provides some foundation for optimism that Bonga South West could deliver meaningful local content outcomes, though the complexity of deepwater projects limits the scope for domestic participation in certain highly specialized technical areas.

Challenges and Risk Factors

Despite the positive momentum around Bonga South West, significant challenges and uncertainties remain. The project has been under consideration for many years without reaching Final Investment Decision, suggesting technical, commercial, or regulatory obstacles that have prevented its advancement. While the newly approved incentives address some commercial and fiscal concerns, fundamental questions about project economics, technical complexity, and execution risks must still be resolved.

Deepwater developments carry inherently higher costs and technical risks compared to shallow-water or onshore projects. Water depths at Bonga South West likely exceed 1,000 meters similar to the main Bonga field, requiring sophisticated subsea engineering, specialized vessels and equipment, and extensive expertise in deepwater operations. Development costs for such projects can easily run into billions of dollars, requiring careful optimization of field development plans, production facility designs, and execution strategies to achieve acceptable returns on investment.

Oil price volatility represents an ongoing concern for large-scale petroleum investments with multi-year development timelines. While current crude prices in the $70-80 per barrel range support project economics for many deepwater developments, companies must model projects across a range of price scenarios including prolonged periods of lower prices that could undermine project returns. Shell’s investment decision will depend on confidence that Bonga South West can generate attractive returns even in less favorable price environments.

Regulatory and approval processes, despite reforms, remain a potential source of delay. Securing all necessary permits, environmental approvals, stakeholder consents, and regulatory clearances for a major offshore development involves navigating multiple government agencies, local communities, and other stakeholders. While the Tinubu administration has demonstrated commitment to streamlining approvals, converting political will into operational reality across the entire bureaucracy requires sustained effort and institutional change.

Nigeria’s broader security and political stability considerations also factor into international oil company decision-making. While offshore deepwater projects are largely insulated from the onshore security challenges that plagued Niger Delta operations, investors must still assess political risk, regulatory stability, currency convertibility, and the overall investment climate when committing billions of dollars to long-term developments.

Global and Regional Context

Shell’s potential $20 billion commitment to Bonga South West would represent one of the largest petroleum investments in Africa in recent years and would reinforce Nigeria’s position as a priority destination for international oil company capital despite competition from newer petroleum provinces. The investment would also strengthen Shell’s global upstream portfolio at a time when the company is balancing traditional oil and gas investments with energy transition initiatives and shareholder returns.

For Nigeria, securing the Bonga South West Final Investment Decision would validate the reform agenda pursued by the Tinubu administration and demonstrate that appropriate policy frameworks can attract major international investment even in a mature petroleum province with historical challenges. Success with Bonga South West could catalyze additional Final Investment Decisions on other stalled or prospective projects from Shell and other international operators including ExxonMobil, TotalEnergies, and Eni.

Other international oil companies have shown renewed interest in Nigerian deepwater opportunities following implementation of the Petroleum Industry Act and subsequent reforms. ExxonMobil is planning to invest $1.5 billion between 2025 and 2027 to revitalize the Usan deepwater oilfield (OML 138), targeting a Final Investment Decision by third quarter 2025. The Usan field, which peaked at 100,000 barrels per day in 2014, features 34 subsea wells tied to a 180,000 barrel per day FPSO with two-million-barrel storage capacity.

The convergence of multiple large deepwater Final Investment Decisions—Bonga North already approved, Bonga South West potentially forthcoming, Usan under development, and other prospects in various stages of evaluation—could mark an inflection point for Nigerian petroleum production after years of decline and stagnation. If realized, these projects would add several hundred thousand barrels per day of new production capacity, helping Nigeria move substantively toward its 2 million barrel per day near-term target and providing a foundation for longer-term growth toward 3 million barrels per day.

Stakeholder Perspectives and Next Steps

The Shell delegation that met with President Tinubu included senior executives from the company’s global and Nigerian leadership teams, signaling the strategic importance Shell attaches to the Nigerian relationship and the Bonga South West opportunity specifically. Shell’s Upstream President Peter Costello has emphasized that investments in Nigerian deepwater contribute to sustained liquids production and growth in Shell’s Upstream portfolio, supporting the company’s target to grow production across Upstream and Integrated Gas businesses by 1 percent per year through 2030.

Shell CEO Wael Sawan stated that Nigeria’s investment climate has improved remarkably under the Tinubu administration, adding that Shell is increasingly confident in the country as a destination for long-term capital deployment. This public endorsement from Shell’s chief executive represents valuable validation for Nigeria’s reform efforts and could influence other international investors’ perceptions of Nigerian investment opportunities.

President Tinubu’s directive to Special Adviser on Energy Olu Verheijen to facilitate the gazette of the incentives in line with Nigeria’s existing legal and fiscal frameworks indicates the government’s intent to move quickly from political commitment to legally binding implementation. The gazetting process will formalize the incentive terms and provide Shell with the regulatory certainty needed to advance detailed engineering, commercial negotiations with partners and contractors, and ultimately the Final Investment Decision itself.

The timeline pressure created by President Tinubu’s expectation for Final Investment Decision within his first term ending mid-2027 will drive urgency in both government and company processes. Shell and its partners—ExxonMobil and Eni—will need to accelerate technical studies, finalize field development plans, complete Front-End Engineering and Design work, negotiate contracts with major service providers, and secure all regulatory approvals on a compressed schedule if they are to meet the president’s deadline.

The outcome of the Bonga South West process will have implications extending far beyond the project itself. Successful progression to Final Investment Decision would demonstrate that Nigeria can compete effectively for major petroleum investments through well-designed fiscal incentives, regulatory reforms, and political commitment to the energy sector. It would provide a template that could be adapted for other strategic projects and potentially catalyze a broader renaissance of international oil company investment in Nigerian deepwater and gas development.

Conversely, failure to reach Final Investment Decision despite the approved incentives would raise questions about the adequacy of Nigeria’s reform measures and could deter other prospective investors from committing capital to similarly large and complex projects. The stakes are high for all parties, making the next 18 months critical for determining whether Nigeria’s reform agenda can translate political commitment into transformative investment outcomes.

For now, the approval of targeted incentives for Bonga South West represents a significant step forward in Nigeria’s efforts to revitalize its petroleum sector and attract the billions of dollars of investment needed to reverse production declines, boost revenues, create jobs, and position the country as a major player in global energy markets for decades to come. Whether this step leads to the $20 billion Final Investment Decision that Nigeria hopes for—and Shell has indicated it is considering—will be determined by technical, commercial, and ultimately corporate strategic factors that will unfold over the coming months as both parties work toward what could become one of Africa’s largest petroleum developments of the decade.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

26th January, 2026

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025