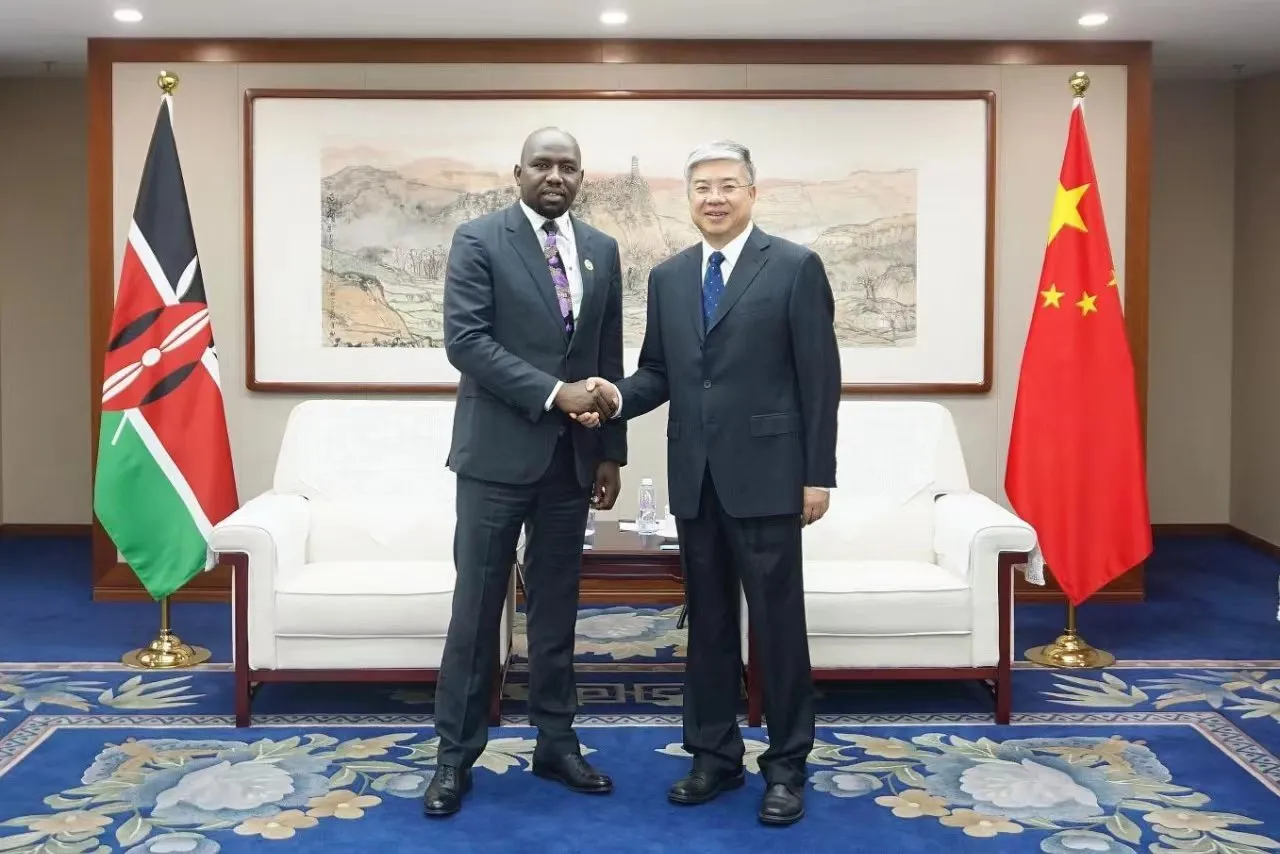

Kenya has officially launched a transformative $1.5 billion highway expansion project with two Chinese state-owned firms, marking a significant realignment in the country’s infrastructure financing strategy following the collapse of U.S.-backed development initiatives. The groundbreaking ceremony held on Friday represents Beijing’s return to major infrastructure development in East Africa after years of cautious lending, while simultaneously exposing the widening gap in American development assistance under the Trump administration’s foreign aid review.

The ambitious project, structured through a debt-equity financing model, comes at a critical juncture as Kenya navigates mounting debt pressures while seeking to modernize its crucial transport corridors. “We don’t have any room to borrow any more money,” Kefa Seda, director general of the Public-Private Partnerships directorate at Kenya’s finance ministry, told Reuters, underscoring the country’s fiscal constraints that have necessitated innovative financing approaches.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The Collapse of American Transit Support

The highway initiative follows the unexpected termination of the Nairobi Bus Rapid Transit (BRT) agreement, originally valued at $60 million and backed by the United States through the Millennium Challenge Corporation (MCC). The deal, signed during President William Ruto’s visit to New York in September 2023 and activated in May 2024 following a White House meeting with former President Joe Biden, was designed to revolutionize urban mobility in Kenya’s congested capital city.

However, the project was placed in jeopardy after the Trump administration cancelled the MCC Threshold Program as part of a comprehensive foreign-aid review. Treasury disclosures confirmed that Kenya received a formal termination notice from Washington, leaving the legally binding project in limbo despite Kenya’s designation as a Major Non-NATO Ally (MNNA) just months earlier in June 2024.

The cancellation of the MCC program has thrown one of Kenya’s flagship urban mobility projects into fresh uncertainty. The $60 million programme was expected to deliver $45.8 million in American support alongside a Kenyan contribution of $12 million, targeting improvements in urban planning, land use, pedestrian and cycling infrastructure, gender-inclusive public transport, and climate-friendly bus acquisition for Nairobi’s emerging BRT network.

The termination reflects a broader pattern of U.S. aid cuts under the Trump administration. According to Treasury Cabinet Secretary John Mbadi, up to 85 U.S.-funded programmes operating in Kenya have been halted, with more than $850 million in USAID contracts already cut or suspended. This withdrawal comes despite Kenya’s strategic importance to Washington and its recent elevation to MNNA status, which was supposed to deepen defense and economic cooperation between the two nations.

China’s Strategic Return to African Infrastructure

The new highway project marks a significant U-turn in China’s engagement with African infrastructure after a period of retrenchment. Beijing had scaled back lending to Africa around 2019 amid rising debt sustainability concerns, which stalled several flagship projects across the continent. Most notably, the railway linking Mombasa to Uganda and South Sudan under the Belt and Road Initiative was halted in 2019 in the Rift Valley, roughly 468 kilometres (290 miles) short of the Ugandan border, after Chinese support was withdrawn.

However, China’s approach has evolved significantly. At a 2024 summit with African leaders, Beijing pledged $50 billion in credit and investment over three years, signaling renewed engagement with a recalibrated strategy for the continent. This commitment represents a shift from traditional lending models that raised concerns about debt burdens to more diversified financing structures incorporating equity partnerships and public-private arrangements.

The renewed Chinese engagement comes as developing countries face what analysts describe as a “tidal wave” of debt repayments. According to a Lowy Institute report, developing countries owe a record $35 billion in debt repayments to China in 2025, with $22 billion owed by 75 of the world’s poorest countries. For Kenya specifically, debt servicing on Chinese loans remains substantial, though it has shown some decline due to currency stabilization and falling global interest rates.

Project Structure and Financing Model

Under the first phase of the project, China Road and Bridge Corporation (CRBC) will partner with Kenya’s state pension fund, the National Social Security Fund (NSSF), to expand two stretches of a 139-kilometre single-lane highway into four- and six-lane dual carriageways at a cost of $863 million, according to the Kenya National Highways Authority (KeNHA).

In the second phase, Shandong Hi-Speed Road and Bridge International, a subsidiary of China’s Shandong Hi-Speed Group, will upgrade a 94-kilometre single-lane section into a six-lane carriageway for $678.56 million. Both cost estimates include financing costs, representing a comprehensive approach to project budgeting that accounts for the full financial burden over the project lifecycle.

Each phase will be funded with 75% debt and 25% equity, with NSSF contributing 45% of the equity in its phase. The borrowing is expected to come from Chinese commercial lenders and state-backed institutions such as the Export-Import Bank of China. This debt-equity structure is gaining favour across Africa as governments face growing pressure to rein in public borrowing while still addressing critical infrastructure gaps.

Construction is expected to be completed by the end of 2027, after which the operators will run the highway under a 28-year toll concession to recover their investment and earn returns. This Build-Operate-Transfer model shifts immediate financial pressure away from the Kenyan government while ensuring long-term maintenance and operational standards through private sector involvement.

The French Contract Controversy

The current Chinese-led project emerges from the ashes of a controversial deal with French contractors. Kenya terminated a $1.3 billion highway expansion deal with a consortium led by France’s Vinci SA earlier in 2025, citing concerns over high toll fees and unfavorable risk distribution.

The consortium, comprising Vinci Highways SAS, Meridian Infrastructure Africa Fund, and Vinci Concessions SAS, had been primed to build the Rironi-Mau Summit highway and recoup investments over 30 years through toll collections. However, KeNHA raised concerns about demand and revenue risks, noting that the State would have to cover revenue shortfalls if there were fewer users than expected.

Treasury disclosures revealed that the French contractors had demanded multi-billion-shilling service fees over 13 years, which would have been financed by additional government borrowing. This was deemed untenable given Kenya’s tight public finances and growing debt burden. The government subsequently agreed to pay the French consortium $48 million in termination compensation.

The new agreement with Chinese contractors was announced during President Ruto’s state visit to Beijing in April 2025, where he secured multiple infrastructure deals worth approximately $1 billion. The pivot to Chinese financing threatened to spark diplomatic tensions with France, which had brokered the original Vinci deal in Paris in 2020 during a visit by then-President Uhuru Kenyatta.

Kenya’s Mounting Debt Challenge

Kenya’s turn to China for infrastructure financing occurs against a backdrop of significant debt challenges. The country currently owes China approximately $6 billion to $8 billion, making Beijing its largest bilateral creditor. The bulk of this debt stems from the $5.3 billion Standard Gauge Railway (SGR) connecting Mombasa with Nairobi, which has consistently failed to generate projected revenues despite government intervention.

According to recent data, Kenya’s total debt has risen to over $80 billion, equivalent to approximately two-thirds of its GDP. The World Bank recently ranked Kenya as the fourth most debt-burdened country in the world, raising concerns about fiscal sustainability and the country’s ability to service mounting obligations.

China accounts for a significant portion of Kenya’s external debt servicing costs. For the fiscal year 2024-2025, Kenya was projected to pay Chinese lenders approximately $1 billion in principal and interest payments, though this figure has declined somewhat due to currency stabilization and falling global interest rates. Treasury data shows that in July alone, SGR payments to China accounted for more than 81% of Kenya’s total foreign debt service.

The debt burden has forced the Ruto administration to pursue multiple strategies, including converting some Chinese loans from U.S. dollars to renminbi to reduce interest costs. This currency conversion, covering $3.5 billion in outstanding principal, shifts the loans onto China’s lower interest rate of 3%, potentially saving Kenya hundreds of millions in interest payments over the loan lifetime.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Strategic Corridor Development

The highway project will improve a key transport corridor that links Kenya’s port of Mombasa with its western region and neighboring landlocked states including Uganda, Rwanda, South Sudan, and the Democratic Republic of Congo. The Northern Corridor, as it is known, serves as the primary trade artery for much of East and Central Africa, making its efficiency critical to regional economic integration.

The Nairobi-Mau Summit highway serves as a transportation link for approximately six million Kenyans. A study by KeNHA indicated that vehicular traffic on the highway averaged 14,450 vehicles per day in 2017, or 5.3 million per year. Traffic is projected to increase by seven percent annually from 2017 to 2025, then by six percent until 2035, and by five percent until 2045, reaching an average of 60,000 vehicles per day by mid-century.

The upgrade is expected to significantly reduce travel times and transportation costs for cargo moving between the coast and the interior, potentially improving Kenya’s competitiveness as a regional logistics hub. However, the toll road model has raised concerns among civil society groups and regional stakeholders about equitable access, particularly for residents of the Rift Valley, Western, and Nyanza regions who rely on the corridor for connectivity to their rural homes.

Geopolitical Implications and U.S. Relations

Kenya’s deepening infrastructure ties with China come at a delicate moment in its relationship with the United States. The country was designated a Major Non-NATO Ally by President Biden in June 2024, becoming the first sub-Saharan African nation to receive this status. The designation provides Kenya with certain military and economic benefits, including eligibility for advanced defense equipment and participation in cooperative research projects.

However, the rapprochement between Nairobi and Beijing has reportedly angered President Donald Trump, prompting Ruto to issue a public defense of the strategy. The Kenyan president has argued that the country needs to boost exports into markets like China and cannot afford to limit its economic partnerships based on geopolitical considerations. “We are ready to work with any partner who is willing to support our development agenda,” Ruto stated during meetings with Chinese officials.

The U.S. Senate has since ordered a sweeping review of Kenya’s MNNA status, citing concerns over Nairobi’s alleged ties with adversarial states including China, Russia, and Iran. The review, mandated through an amendment to the National Defense Authorization Act for Fiscal Year 2026, requires a comprehensive classified assessment within 180 days of Kenya’s military, political, and financial engagements with these countries.

Despite these tensions, Kenya maintains that its approach is pragmatic rather than ideological. The country continues to pursue diverse partnerships, including significant infrastructure financing from the European Union, the African Development Bank, and Gulf states. In December 2024, Nairobi County Governor Johnson Sakaja announced that the city had secured approximately $250 million in financing from the European Investment Bank, the French Development Agency, and the European Union for BRT Line 3 construction.

China’s Evolving Belt and Road Strategy

The Kenya highway project reflects broader changes in China’s Belt and Road Initiative strategy. After a decade of aggressive lending that saw Chinese loans to Africa peak at over $28 billion in 2016, Beijing has significantly scaled back new commitments while focusing on strategic relationships and resource-critical partnerships.

According to research from Boston University’s Global Development Policy Center, new Chinese loan commitments to African governments plummeted from $28.4 billion in 2016 to less than $2 billion in 2020 and have continued to decline. This retrenchment was driven by concerns about debt sustainability, diplomatic pressure to restructure unsustainable loans, and mounting domestic pressure within China to recover outstanding debts.

However, China continues to finance strategic partners and countries with critical minerals essential for electric vehicle battery production and renewable energy technologies. Recent lending has favored immediate neighbors like Pakistan, Kazakhstan, and Mongolia, as well as resource-rich nations such as Indonesia, Brazil, and the Democratic Republic of Congo.

The new financing model employed in Kenya—combining Chinese state enterprise participation with local pension fund equity and structured toll concessions—represents an evolution from pure government-to-government lending. This approach aims to address criticism of China’s traditional lending practices while maintaining Beijing’s infrastructure development footprint in strategically important regions.

Regional Context and Competition

Kenya’s infrastructure choices are being closely watched across East Africa as countries navigate competing offers from China, Western nations, and multilateral development banks. The collapse of MCC programs in multiple countries, including Kenya, Zambia, Indonesia, and Gambia, has created a vacuum that China appears positioned to fill.

The Trump administration’s decision to effectively shutter the Millennium Challenge Corporation—which accounted for $1.7 billion in U.S. foreign assistance obligations in 2024—has particular significance for infrastructure financing. The MCC was the only part of the U.S. government that backed funding for public-sector infrastructure in developing countries, putting it in direct competition with China’s Belt and Road Initiative.

For countries like Kenya, where MCC agreements involved funding worth more than 1% of GNI, the loss of this financing source creates immediate pressure to seek alternative partners. China’s willingness to finance large-scale infrastructure projects with fewer governance conditions makes it an attractive option, despite concerns about debt sustainability and long-term financial implications.

Implementation Timeline and Challenges

The highway project faces several implementation challenges despite the signing ceremony and financing commitments. Kenya’s Public-Private Partnerships Act requires specific procedural steps, including detailed project development plans, environmental impact assessments, and regulatory approvals before construction can commence.

KeNHA has indicated that although users will be required to pay toll fees determined through an approved tariff framework, the authority will map out available alternative roads from Rironi to Mau Summit for use by the public who may not wish to pay tolls. This dual-road strategy aims to address equity concerns while ensuring the toll road generates sufficient revenue to service the debt and provide returns to investors.

The project’s success will depend heavily on traffic volumes and the government’s ability to maintain the free alternative routes in adequate condition. International experience with toll roads suggests that without properly maintained free alternatives, public opposition can undermine project viability and create political challenges for governments.

Environmental and social safeguards will also be critical. CRBC’s previous projects in Kenya, including the Standard Gauge Railway, faced criticism from environmental groups over routing through wildlife areas and inadequate consultation with affected communities. The company has since established public engagement channels and invested in corporate social responsibility programs, though local NGOs have questioned whether these measures represent genuine consultation or tokenistic engagement.

Economic Impact and Expectations

Proponents of the highway project argue that improved transport infrastructure is essential for Kenya’s economic competitiveness and regional integration. The current single-lane highway experiences severe congestion, particularly on weekends and during national holidays, when travel times between Nairobi and Nakuru can extend to several hours.

The expanded highway is expected to reduce travel time by nearly half, potentially cutting the Nairobi-to-Nakuru journey from over three hours to approximately 90 minutes. This improvement could yield significant economic benefits through reduced transportation costs, improved logistics efficiency, and enhanced connectivity for agricultural products moving from Kenya’s breadbasket regions to urban markets and export points.

However, skeptics point to the SGR experience as a cautionary tale. The Chinese-built railway was supposed to transform cargo transportation and pay for itself through freight revenues, but it has consistently fallen short of projections. The project’s inflated construction costs and failure to generate anticipated revenue have left taxpayers bearing the burden of debt repayment, raising questions about feasibility studies and the political motivations behind major infrastructure decisions.

The toll road model transfers some revenue risk to private operators but ultimately places traffic demand risk on the public if government guarantees are involved. Critics argue that Kenya’s history of optimistic traffic projections and revenue estimates suggests caution is warranted before committing to another multi-billion-dollar infrastructure project with Chinese financing.

Looking Ahead

The $1.5 billion highway project represents a critical test of Kenya’s ability to balance infrastructure development needs with fiscal sustainability while navigating complex geopolitical relationships. The project’s success or failure will have implications not only for Kenya but for Chinese infrastructure engagement across Africa and the future of Western development assistance on the continent.

As construction progresses toward the targeted 2027 completion date, several key questions will require answers: Can the debt-equity model successfully reduce fiscal pressure while delivering quality infrastructure? Will traffic volumes justify the investment and generate sufficient toll revenue? How will Kenya manage its relationship with both China and the United States as strategic competition intensifies?

For President Ruto’s administration, the highway project offers an opportunity to demonstrate competence in infrastructure delivery and economic management. However, it also carries significant political risks if debt burdens increase, toll charges prove unpopular, or the project fails to deliver promised benefits to ordinary Kenyans already struggling with high living costs and economic uncertainty.

The broader question facing Kenya and other African nations is whether infrastructure-led development financed through external borrowing can generate the economic growth needed to service debt without compromising sovereignty or creating unsustainable fiscal burdens. As the global development finance landscape shifts, with traditional Western donors scaling back and China recalibrating its approach, countries like Kenya must navigate increasingly complex choices about their economic futures.

The highway project launching this month will serve as a real-world laboratory for testing new models of infrastructure financing, Chinese engagement in Africa, and the viability of public-private partnerships in developing countries facing significant fiscal constraints. The outcomes will be closely watched by policymakers, investors, and development experts across the continent and beyond.

Catch Up With Our Other Headlines

28th November, 2025

Meta reportedly negotiating multi-billion dollar deal for Google chips,The Information reports

European Commission Plans Financial Relief for Baltic States Hit by Russia Sanctions

DR Congo Commits $500,000 to UN Partnership for Economic Transformation and Capacity Building

Ghana Central Bank Cuts Interest Rate to 18 Percent as Inflation Falls to Four-Year Low

Mars Wrigley Commits Sh4.3 Billion to Kenya Manufacturing Expansion, Shifts Production from Poland

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

28th November, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025