.

In a significant development for regional infrastructure cooperation, President William Ruto has confirmed that Uganda will acquire a stake in the Kenya Pipeline Company (KPC) once the privatisation process is completed, marking a new era of joint ownership of strategic energy infrastructure in East Africa. The announcement, made during an investment tour in Uganda on Sunday, signals a deepening of economic ties between the two neighbors and represents a fundamental shift in how regional assets are managed and owned.

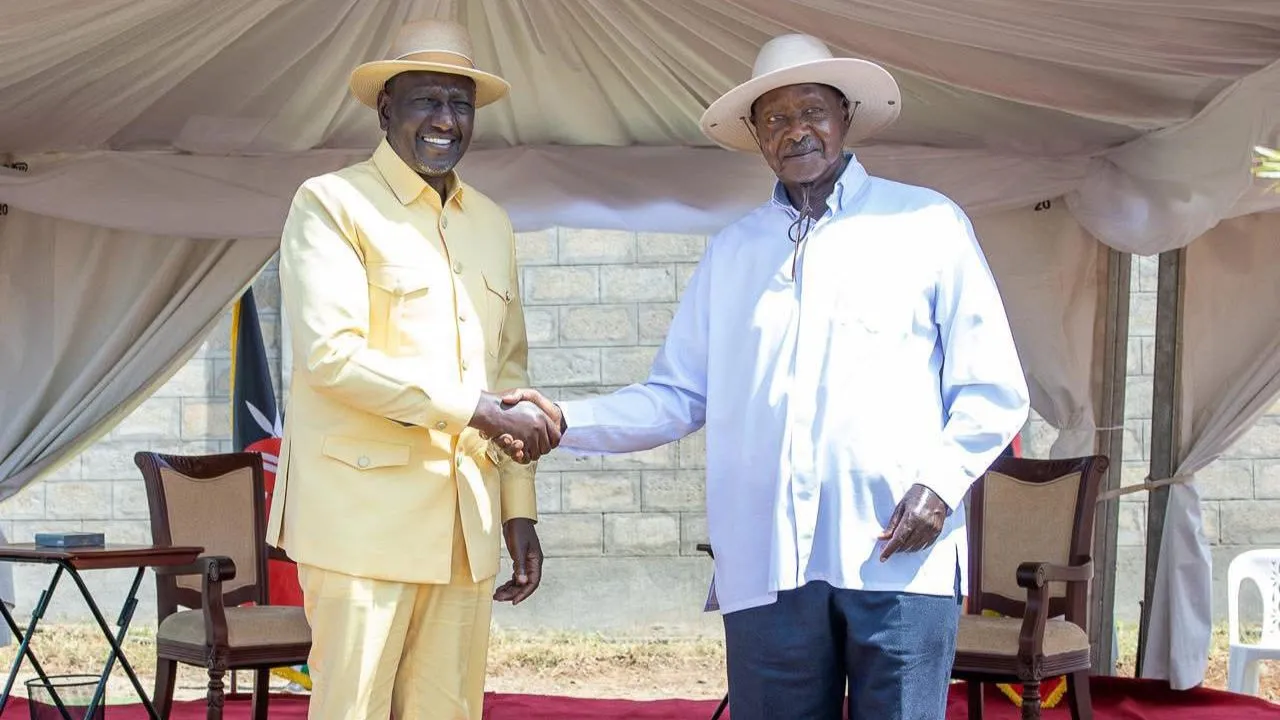

Speaking at the groundbreaking ceremony of the Devki Steel Factory in Osukuru, Tororo District, Uganda, President Ruto revealed that the Kenyan government will publicly list Kenya Pipeline Company shares on the Nairobi Securities Exchange, allowing Uganda to invest in the company as part of a broader regional investment strategy that aims to transform infrastructure ownership patterns across East Africa.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The Kenya Pipeline Company, which operates a sophisticated network of petroleum product pipelines spanning over 1,200 kilometers from Mombasa to various inland destinations including Nairobi, Nakuru, Eldoret, and Kisumu, with extensions serving Uganda and other regional markets, represents one of East Africa’s most critical energy infrastructure assets. The pipeline system handles the bulk of petroleum products consumed not only in Kenya but also in Uganda, Rwanda, Burundi, South Sudan, and eastern Democratic Republic of Congo.

No Cause for Alarm: New Cooperation Frameworks Ratified

President Ruto moved quickly to reassure Kenyans that the joint ownership arrangement should not be a source of concern, noting that both Kenya and Uganda had already ratified new cooperation frameworks during a joint ministerial meeting held in Nairobi last week. According to the President, both governments have agreed to jointly own the key infrastructure that had previously been slated for privatisation under Kenya’s parastatal reform program.

“I want to thank you, Mr President, for agreeing to work with us. The ministers were in Nairobi last week and I have given the necessary guidance on the need for Uganda and Kenya, both public and private, to jointly own the Kenya Pipeline Company (KPC),” President Ruto stated, addressing his Ugandan counterpart President Yoweri Museveni who was present at the event.

The joint ministerial meeting referenced by President Ruto represents months of quiet diplomacy and technical negotiations between the two countries. Sources familiar with the discussions indicate that the framework agreement covers not only KPC ownership but also broader issues of energy security, infrastructure development, and regional economic integration that have been priority areas for both administrations.

This cooperative approach marks a departure from previous privatisation models in Kenya, which typically involved selling state assets to private investors without explicitly reserving stakes for regional partners. The new model reflects a growing recognition that some infrastructure assets have regional rather than purely national significance and that ownership structures should reflect this reality.

Details of the Divestiture: 65% Stake Available for Investment

President Ruto provided specific details about the scale of the divestiture, announcing that the government of Kenya will be divesting 65 percent of its stake in KPC, opening the door for regional investors, private sector participants, and individual shareholders to acquire ownership in the strategic company.

“The government of Kenya will be divesting 65 per cent, and I want to tell you that the government of Uganda is prepared to co-invest with us because KPC is not just a Kenyan facility but also a regional facility,” President Ruto explained, emphasizing the regional nature of the pipeline infrastructure and the rationale for Uganda’s participation in ownership.

The 65 percent divestiture represents one of the largest privatisations undertaken by the Kenyan government in recent years. At current valuations, KPC is estimated to be worth several billion shillings, making this IPO potentially one of the most significant capital markets transactions on the Nairobi Securities Exchange in the past decade.

Under the proposed structure, the Kenyan government will retain a 35 percent stake in KPC, ensuring continued state influence over strategic decisions while allowing private and regional government investors to bring capital, efficiency, and additional expertise to the company’s operations. This balance between public and private ownership is intended to preserve national interests while improving operational performance through market discipline and professional management.

Encouraging Wider Regional Participation

Beyond Uganda’s government participation, President Ruto actively encouraged individual Ugandans and other East Africans to invest once the KPC shares are publicly listed on the securities exchange. This call for broad-based regional participation reflects a vision of shared ownership of strategic infrastructure that goes beyond government-to-government arrangements to include ordinary citizens across the region.

“I want to encourage Ugandans and other East Africans to invest once these shares are publicly listed. This wider participation will diversify earnings and strengthen shared ownership of strategic assets,” the President stated, articulating a philosophy of regional economic integration that emphasizes people-to-people connections alongside institutional relationships.

The emphasis on individual investor participation is significant for several reasons. First, it could help build a constituency of stakeholders across the region who have direct financial interests in the success of cross-border infrastructure, potentially creating political support for deeper integration. Second, it offers ordinary East Africans an opportunity to invest in income-generating assets that have historically been reserved for governments or large corporations. Third, it could help deepen and broaden capital markets in the region by introducing more investors to securities trading.

However, questions remain about how accessible the share offering will be to ordinary citizens, particularly those in Uganda and other regional countries who may not have easy access to the Nairobi Securities Exchange or who may lack the financial literacy to participate confidently in equity investments.

Pipeline Extension to Rwanda and DRC: Another Joint Investment

In addition to the KPC privatisation announcement, President Ruto disclosed that another joint investment initiative involving a pipeline extension from Eldoret through Kampala to the borders of Rwanda and the Democratic Republic of Congo is already at an advanced stage of planning and approval.

According to the President, Kenya has approved a plan that allows both the Kenyan and Ugandan governments to co-invest in extending the pipeline infrastructure to better serve the broader East African region. This pipeline extension would significantly improve access to petroleum products for Rwanda, Burundi, South Sudan, and eastern DRC, all of which currently face logistical challenges and high transportation costs for fuel supplies.

“We have another joint investment in the pipeline from Eldoret through Kampala to the border of Rwanda and the DRC that is already at an advanced stage. Kenya has approved a plan allowing both governments to co-invest in extending the line to better serve the region,” President Ruto announced.

The planned pipeline extension addresses a long-standing infrastructure gap in the region. Currently, petroleum products destined for Rwanda and other inland countries must be transported by road from Eldoret or Kampala, a process that is expensive, time-consuming, environmentally damaging, and prone to accidents and fuel losses. A dedicated pipeline infrastructure would dramatically reduce transportation costs, improve supply reliability, and contribute to lower fuel prices for consumers in these countries.

The project also aligns with broader East African Community objectives of improving regional connectivity and reducing the cost of doing business across member states. Reliable, affordable energy is consistently identified as one of the key prerequisites for industrial development and economic transformation in the region.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Standard Gauge Railway Extension: Naivasha to Kampala

Further demonstrating the deepening infrastructure cooperation between Kenya and Uganda, President Ruto announced that the government will be launching the extension of the Standard Gauge Railway from Naivasha to Kampala in January 2026, with plans for the line to eventually connect to the existing railway from Malaba to Kampala and onward to the Democratic Republic of Congo.

“In January, we will be launching the extension of the SGR from Naivasha to Kampala and onward to join the line from Malaba to Kampala and onward to DRC. The two governments will coordinate this to improve transport and logistics in a bid to enhance regional integration,” President Ruto stated.

The Standard Gauge Railway project has been one of Kenya’s most ambitious and controversial infrastructure initiatives since its launch. The first phase, connecting Mombasa to Nairobi, was completed in 2017, followed by the Nairobi-Naivasha section. However, progress beyond Naivasha has been slower due to financing challenges, concerns about debt sustainability, and questions about the economic viability of extending the line given current cargo volumes.

The announcement that Uganda will co-invest in the extension to Kampala could help address some of these financing concerns while also ensuring that Uganda has a direct stake in the railway’s success. For Uganda, railway access to Mombasa port could reduce transportation costs and transit times for imports and exports, making Ugandan products more competitive in regional and international markets.

The planned connection to the line from Malaba to Kampala and eventually to DRC suggests an even more ambitious vision of a Trans-East African Railway network that would fundamentally transform how goods and people move across the region. However, significant technical, financial, and political challenges will need to be overcome to realize this vision.

Addressing the Territorial Access Controversy

President Ruto’s announcements come just days after controversial comments by Ugandan President Yoweri Museveni regarding territorial and maritime access triggered widespread debate in both Kenya and Uganda. President Museveni, in an interview with Uganda’s state broadcaster that aired earlier in November, had warned of potential conflict with Kenya if landlocked East African nations continued to face barriers to accessing the Indian Ocean.

In the interview, President Museveni highlighted Uganda’s economic and defense needs, questioning how the country could efficiently export goods and maintain its security without guaranteed access to the sea. The comments were interpreted by some observers as a veiled territorial claim or, at minimum, a demand for special transit rights that could impinge on Kenyan sovereignty.

The remarks sparked considerable controversy in Kenya, with politicians, commentators, and citizens expressing concern about what they viewed as an inappropriate statement from a neighboring head of state. Some interpreted Museveni’s comments as a threat, while others saw them as highlighting legitimate frustrations about transit challenges faced by landlocked countries.

President Ruto sought to defuse the controversy during his Uganda visit, maintaining that both governments remain committed to working together and faulting sections of the media for misrepresenting President Museveni’s remarks. According to President Ruto, there was no wrongdoing in the Ugandan leader’s comments, which were aimed at promoting regional connectivity and integration rather than making territorial claims.

“I want to clarify that President Museveni’s remarks were taken out of context by some media outlets. He was simply emphasizing the need for improved connectivity and integration, which we fully support. There is no territorial dispute between Kenya and Uganda,” President Ruto stated, seeking to calm tensions and refocus attention on the positive aspects of bilateral cooperation.

The controversy and its resolution through increased infrastructure cooperation highlight the complex interdependencies between East African nations and the importance of managing these relationships through dialogue, mutual investment, and shared infrastructure development rather than confrontation.

The Privatisation Timeline and Parliamentary Approval

The privatisation of Kenya Pipeline Company is proceeding according to a structured timeline, with an Initial Public Offering expected to be completed by March 31, 2026. This deadline was established following parliamentary approval for the privatisation process, which was secured in October 2025 after extensive debate and scrutiny by the relevant parliamentary committees.

The parliamentary approval process involved detailed examination of KPC’s financial statements, operational performance, strategic importance, and the proposed privatisation structure. Members of Parliament raised questions about valuation methodologies, the rationale for the 65-35 ownership split, protections for employees who might be affected by the privatisation, and mechanisms to ensure that privatisation would improve rather than compromise service delivery.

Ultimately, Parliament approved the privatisation based on assurances that the process would be conducted transparently, that the company would be properly valued to ensure fair returns for taxpayers, that regulatory oversight would prevent abuse of monopoly power, and that strategic national interests would be protected through the government’s retention of a 35 percent stake and through regulatory mechanisms.

The March 2026 deadline gives the government approximately four months to complete all the necessary preparatory steps for the IPO, including final valuation, preparation of the prospectus, regulatory approvals from the Capital Markets Authority, investor roadshows, and coordination with the Nairobi Securities Exchange on listing procedures.

Meeting this timeline will require efficient coordination among multiple government agencies, strong investor interest to ensure the offering is fully subscribed, and favorable market conditions that make equity investments attractive. Any delays could push the privatisation into the next financial year, potentially complicating budget planning and other government priorities dependent on the expected proceeds from the sale.

Strategic Implications for Regional Energy Security

The joint ownership arrangement for KPC has significant strategic implications for energy security across East Africa. By giving Uganda and potentially other regional countries a direct ownership stake in the pipeline infrastructure, the arrangement creates aligned incentives for ensuring the system operates efficiently and reliably.

Historically, tensions have occasionally emerged between Kenya and its neighbors over pipeline access, pricing, and reliability of supply. Uganda has sometimes complained about delays in fuel deliveries or disruptions to pipeline services that affected its energy security. By becoming co-owners rather than merely customers of the pipeline system, Ugandan stakeholders will have direct visibility into operations and a voice in strategic decisions affecting the infrastructure.

This ownership model could also facilitate more rapid expansion of pipeline infrastructure to underserved areas, as regional governments pool resources and coordinate planning rather than Kenya having to finance and develop extensions alone. The shared ownership structure may also help address concerns about national sovereignty over strategic infrastructure, as decisions would be made jointly rather than unilaterally.

However, the model also introduces complexities. Joint ownership requires sophisticated governance mechanisms to manage potential conflicts between shareholders, whether between the two governments or between government and private shareholders. Clear frameworks will be needed to address issues such as pricing policies, investment priorities, dividend distribution, and management selection.

Economic and Financial Considerations

From an economic perspective, the KPC privatisation and Uganda’s participation offer potential benefits for both countries. For Kenya, the privatisation is expected to raise significant capital that can be deployed to other development priorities, reduce the government’s direct financial exposure to KPC’s operations, and potentially improve operational efficiency through private sector participation and market discipline.

For Uganda, the investment represents an opportunity to own a stake in strategic infrastructure that serves its economy, potentially reducing long-term costs and improving supply security. If KPC is well-managed and profitable, the investment could generate returns for the Ugandan government and any individual Ugandan investors who participate in the IPO.

However, questions remain about the valuation of KPC and whether the terms of the privatisation are favorable for Kenyan taxpayers. KPC has historically been a profitable enterprise, raising questions about whether selling a majority stake makes economic sense, particularly if the company’s profitability could generate sustained revenue for the government over time.

Critics of privatisation argue that selling income-generating assets to address short-term fiscal pressures essentially trades long-term revenue streams for one-time capital injections, potentially leaving the government worse off in the long run. Proponents counter that private sector management could improve KPC’s efficiency and profitability sufficiently to offset the loss of full government ownership, while the capital raised can be invested in projects that generate even greater economic returns.

Looking Ahead: Implementation Challenges and Opportunities

As Kenya and Uganda move forward with this ambitious cooperation agenda spanning pipeline infrastructure, railway development, and joint ownership of strategic assets, several implementation challenges will need to be addressed.

First, the technical and legal frameworks for joint ownership will need to be carefully designed to prevent future conflicts and ensure efficient decision-making. This includes establishing clear governance structures, dispute resolution mechanisms, and operational protocols that can accommodate the interests of multiple government and private shareholders.

Second, the governments will need to manage public expectations and address concerns about sovereignty, accountability, and benefits. Kenyans will want assurance that privatisation does not compromise national interests or result in reduced service quality or higher prices. Ugandans will want to see concrete benefits from their government’s investment in Kenyan infrastructure.

Third, the success of the IPO will depend heavily on investor confidence, which requires transparency, credible financial information, and assurance of good governance. Any perception of political interference or insider dealing could undermine the offering and reduce the proceeds realized by the government.

Finally, the broader vision of regional infrastructure integration will require sustained political will, significant financial resources, and effective coordination among multiple stakeholders over many years. While the current momentum is positive, maintaining this trajectory through potential political transitions, economic challenges, and competing priorities will be critical.

If successfully implemented, the Kenya-Uganda infrastructure cooperation model could provide a template for other regional partnerships, demonstrating how neighboring countries can move beyond purely transactional relationships to become genuine partners in development. The coming months will reveal whether this ambitious vision can be translated into operational reality.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

25th November, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025