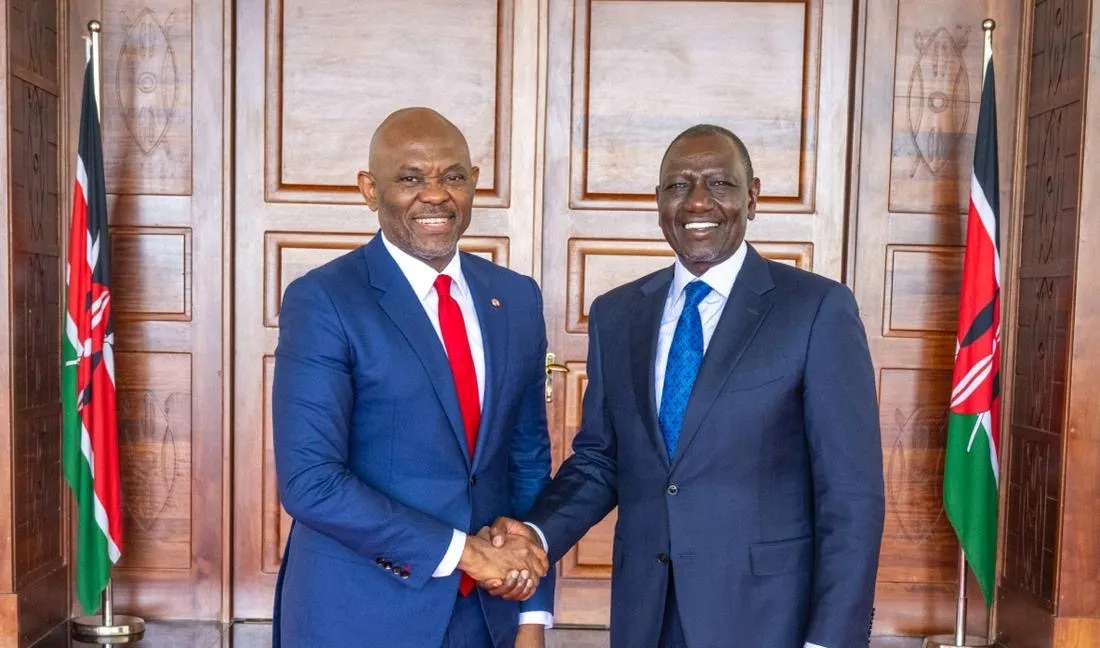

The United Bank for Africa (UBA) Group has made a landmark commitment of Sh19 billion ($150 million) to Kenya’s ambitious Road Infrastructure Securitisation Programme, marking a significant milestone in the nation’s quest to modernize its transport network and strengthen regional trade corridors. This substantial investment, announced during a high-profile meeting between President William Ruto and UBA Group Chairman Tony O. Elumelu, underscores the growing confidence of pan-African financial institutions in Kenya’s economic trajectory and development agenda.

The commitment represents a critical injection of capital into Kenya’s infrastructure sector at a time when the country is actively pursuing multiple large-scale projects aimed at enhancing connectivity, reducing transportation costs, and positioning itself as East Africa’s premier logistics and commercial hub. The Road Infrastructure Securitisation Programme, which has attracted a total of $1 billion in commitments, is designed to transform Kenya’s road network through innovative financing mechanisms that leverage private sector capital alongside government resources.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Strategic Meeting Between President Ruto and Tony Elumelu

The announcement emerged from a high-level bilateral meeting between President William Ruto and Tony O. Elumelu, who serves as both UBA Group Chairman and the founder of the Tony Elumelu Foundation, a leading African philanthropy focused on entrepreneurship development across the continent. The meeting, held in Nairobi, brought together key stakeholders from both the public and private sectors to discuss Kenya’s infrastructure financing needs and UBA’s expanding role in supporting the country’s development priorities.

President Ruto used the occasion to highlight UBA’s instrumental contribution to the $1 billion securitisation programme, characterizing the bank’s participation as a powerful vote of confidence in Kenya’s growth agenda and its strategic importance within the East African Community. The President emphasized that infrastructure development, particularly in the transportation sector, remains central to his administration’s vision of transforming Kenya into a middle-income economy with robust regional connectivity.

“We value institutions like UBA that understand Africa’s development journey and share our vision for sustainable growth,” President Ruto stated during the meeting. “Through collaboration and innovation, we will drive the transformation that powers Kenya’s future.” These remarks reflect the Kenyan government’s broader strategy of partnering with established African financial institutions that possess deep knowledge of the continent’s unique development challenges and opportunities.

Understanding Kenya’s Road Infrastructure Securitisation Programme

The Road Infrastructure Securitisation Programme represents an innovative approach to financing Kenya’s substantial infrastructure needs through capital markets mechanisms. Securitisation involves pooling various types of contractual debt and selling consolidated assets to investors, thereby converting illiquid assets into tradable securities that can be purchased by a broader range of institutional investors.

In the context of road infrastructure, securitisation allows the Kenyan government to leverage future revenue streams from road usage, tolls, or dedicated tax allocations to raise upfront capital for construction and modernization projects. This approach reduces immediate pressure on the national budget while enabling the government to undertake large-scale infrastructure investments that would otherwise require decades of incremental funding.

The $1 billion programme encompasses multiple road projects across Kenya, focusing on critical corridors that connect major urban centers, facilitate agricultural transportation, and link Kenya to its neighboring countries. These projects include highway expansion, road rehabilitation, bridge construction, and the development of modern expressways that meet international standards for safety and efficiency.

Kenya’s road network, which spans over 160,000 kilometers, serves as the backbone of the country’s economy, carrying approximately 80 percent of the nation’s passenger and freight traffic. However, significant portions of this network require substantial upgrading to meet growing demand and support economic expansion. The securitisation programme addresses this challenge by mobilizing private capital on an unprecedented scale.

UBA’s Expanding Footprint in Kenya’s Economy

The Sh19 billion commitment to the road securitisation programme represents just one facet of UBA’s growing engagement with Kenya’s economy. As President Ruto noted during the meeting, his administration has developed a comprehensive partnership with UBA that extends across multiple sectors critical to national development, including railway modernization, airport expansion, food security initiatives, and nationwide water distribution infrastructure.

UBA’s involvement in railway modernization comes at a crucial time for Kenya’s ambitious plans to upgrade its rail network. The country has been working to modernize its railway system to improve freight transportation efficiency and reduce logistics costs for businesses. Modern rail infrastructure is particularly important for Kenya’s position as a gateway to landlocked countries in the region, including Uganda, Rwanda, South Sudan, and parts of the Democratic Republic of Congo.

Airport expansion projects supported by UBA’s investment portfolio align with Kenya’s strategy to strengthen its position as East Africa’s aviation hub. Jomo Kenyatta International Airport in Nairobi handles millions of passengers annually and serves as a critical connection point for travelers across Africa and between Africa and other continents. Capacity expansion at this facility and other airports across Kenya directly supports tourism, business travel, and cargo operations.

The bank’s participation in food security initiatives addresses one of Kenya’s most pressing challenges. Despite being one of East Africa’s most productive agricultural economies, Kenya faces recurring food security challenges related to climate variability, post-harvest losses, and supply chain inefficiencies. UBA’s involvement in financing agricultural infrastructure and distribution networks can help stabilize food supplies and reduce price volatility for essential commodities.

Water distribution infrastructure represents another critical area of collaboration between UBA and the Kenyan government. Access to reliable water supplies remains a significant challenge in many parts of Kenya, affecting both urban and rural populations. Investment in water infrastructure not only improves public health outcomes but also supports agricultural productivity and industrial development.

Kenya’s Energy Transformation and Industrial Growth Plans

During the meeting, President Ruto outlined an ambitious plan to add 10,000 megawatts of electricity generation capacity within seven years through a massive Sh2.3 trillion ($15 billion) investment programme. This transformational energy expansion project aims to achieve two critical objectives: boosting Kenya’s energy independence and catalyzing industrial growth through reliable, affordable power supplies.

Kenya has already established itself as a leader in renewable energy development in Africa, with significant geothermal, wind, and solar installations contributing to the national grid. The country’s geothermal resources, particularly in the Rift Valley, represent some of the most productive in the world. The planned 10,000-megawatt expansion will build on this foundation, incorporating additional renewable capacity alongside conventional generation sources.

Energy independence carries profound implications for Kenya’s economic sovereignty and stability. Reduced reliance on imported petroleum products for power generation lowers vulnerability to global oil price fluctuations and improves the country’s balance of payments position. Furthermore, abundant, affordable electricity is essential for attracting manufacturing investments and supporting the growth of energy-intensive industries.

Industrial growth driven by expanded electricity access can create employment opportunities across multiple sectors, from textile manufacturing and food processing to information technology and advanced manufacturing. Kenya’s Vision 2030 development blueprint explicitly identifies industrialization as a key pillar of economic transformation, and reliable energy supplies represent a foundational requirement for achieving this vision.

Tony Elumelu’s Vision for Africa and UBA’s Development Partnership Model

UBA Chairman Tony Elumelu used the occasion to reaffirm the Group’s long-term commitment to Kenya, pledging to expand investments across energy, real estate, hospitality, and banking sectors. Elumelu, who has become one of Africa’s most prominent advocates for private sector-led development and entrepreneurship, articulated a vision of UBA as more than merely a financial services provider.

“UBA is not just a bank; we are a development partner,” Elumelu stated emphatically. “Kenya’s youth, innovation, and entrepreneurial drive make it one of Africa’s most exciting markets. We see immense opportunity for growth and impact through UBA Kenya.” These remarks reflect Elumelu’s broader philosophy, which he has promoted through the Tony Elumelu Foundation’s entrepreneurship programme that has supported thousands of African entrepreneurs with seed capital, training, and mentorship.

The concept of “development partnership” represents an evolution in how African financial institutions conceptualize their role in economic transformation. Rather than simply providing transactional banking services, institutions like UBA are positioning themselves as active participants in building the infrastructure, supporting the businesses, and developing the human capital necessary for sustainable economic growth.

Kenya’s entrepreneurial ecosystem, which has earned Nairobi the nickname “Silicon Savannah” due to its vibrant technology startup scene, aligns perfectly with Elumelu’s emphasis on innovation and youth engagement. The country has produced numerous successful technology companies, including M-Pesa, the mobile money platform that has revolutionized financial inclusion across Africa and beyond.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

UBA’s Pan-African Presence and Global Reach

UBA’s commitment to Kenya is backed by the institution’s substantial pan-African footprint and global connections. The bank currently operates in 20 African countries, providing it with unparalleled geographic reach across the continent. This extensive network enables UBA to facilitate cross-border trade, support multinational corporations operating in Africa, and leverage insights from diverse markets to inform its investment strategies.

Beyond Africa, UBA maintains strategic offices in major global financial centers, including New York, London, Paris, and Dubai. These international offices serve multiple functions: they facilitate trade finance for African businesses engaged in global commerce, provide banking services to the African diaspora, and connect African opportunities with international investors seeking exposure to the continent’s growth story.

UBA Kenya, the Group’s local subsidiary, provides a comprehensive range of banking services designed to meet the needs of individuals, small businesses, and large corporations. The subsidiary has embraced technology-driven efficiency as a core operating principle, reflecting broader trends in African banking toward digital financial services and mobile banking platforms.

The bank’s focus on sustainable development aligns with growing global emphasis on environmental, social, and governance (ESG) criteria in investment decisions. By prioritizing projects that deliver both financial returns and positive developmental impact, UBA positions itself to attract capital from international investors increasingly focused on sustainable investing principles.

Regional Integration and East African Community Connectivity

The road infrastructure investments supported by UBA’s commitment carry significant implications for regional integration within the East African Community (EAC). Kenya’s geographic position as a coastal nation with strong transport links to its landlocked neighbors makes it a natural hub for regional trade and logistics.

Improved road infrastructure reduces transportation costs, shortens delivery times, and enhances reliability for businesses engaged in cross-border trade. These improvements benefit exporters in countries like Uganda, Rwanda, and Burundi, who rely on Kenya’s ports and transport corridors to access international markets. Lower logistics costs translate directly into improved competitiveness for regional products in global markets.

The Northern Corridor, which connects the port of Mombasa to Uganda, Rwanda, Burundi, and beyond, serves as a critical artery for regional commerce. Investments in road infrastructure along this corridor and other key routes directly support the EAC’s broader integration agenda, which includes the establishment of a common market, customs union, and eventually a monetary union.

Regional integration also supports peace and stability by creating mutual economic dependencies and shared prosperity. When countries are economically interconnected through trade and investment, they have strong incentives to maintain peaceful relations and cooperate on shared challenges.

Implications for Kenya’s Economic Outlook

UBA’s substantial investment commitment arrives at an opportune moment for Kenya’s economic trajectory. The country is working to consolidate its position as East Africa’s leading economy while managing challenges including public debt levels, currency pressures, and the need for continued structural reforms.

Infrastructure investment, particularly in transportation networks, generates multiple economic benefits. Beyond the immediate employment created during construction phases, improved infrastructure reduces operating costs for businesses, expands market access for producers, and enables the development of previously isolated regions. These impacts compound over time, generating sustained economic returns that far exceed the initial capital invested.

For international investors and development partners, UBA’s commitment signals confidence in Kenya’s policy environment and growth prospects. When a respected pan-African institution commits substantial capital to long-term infrastructure projects, it provides reassurance to other potential investors about the viability and security of Kenya-focused investments.

The government’s ability to attract private sector capital through innovative financing mechanisms like securitisation also demonstrates fiscal sophistication and reduces pressure on public finances. Rather than relying exclusively on traditional government borrowing or taxation to fund infrastructure, securitisation mobilizes private capital while transferring some project risks to investors willing to assume them in exchange for appropriate returns.

Future Prospects and Ongoing Collaboration

Looking ahead, the partnership between Kenya and UBA appears poised for continued expansion across multiple sectors. Both parties have expressed commitment to deepening their collaboration, with particular emphasis on projects that deliver transformative developmental impact while generating sustainable financial returns.

The real estate sector represents one area of potential expanded engagement. Kenya’s rapid urbanization creates substantial demand for residential, commercial, and industrial properties. UBA’s expertise in real estate financing, combined with Kenya’s growing middle class and expanding business sector, creates opportunities for mutually beneficial partnerships.

The hospitality sector also offers significant potential, particularly as Kenya seeks to recover and expand its important tourism industry. International arrivals to Kenya, which generate substantial foreign exchange earnings, depend on the availability of quality accommodation and tourism infrastructure. Strategic investments in this sector can support employment creation while enhancing Kenya’s attractiveness as a destination.

Banking sector investments by UBA support financial inclusion and access to credit for underserved populations and businesses. Despite significant progress in recent years, many Kenyans and Kenyan businesses still lack access to formal financial services. UBA Kenya’s expansion can help address this gap while building a profitable customer base.

Conclusion

UBA’s Sh19 billion commitment to Kenya’s Road Infrastructure Securitisation Programme represents far more than a single transaction or investment decision. It symbolizes the growing capacity of African institutions to finance the continent’s development, the increasing sophistication of infrastructure financing mechanisms in emerging markets, and the potential for transformative partnerships between governments and private sector actors.

For Kenya, this investment accelerates critical infrastructure development that will enhance competitiveness, support economic growth, and improve quality of life for millions of citizens. For UBA, the commitment demonstrates the institution’s role as a genuine development partner and positions it for sustained growth in one of Africa’s most dynamic markets.

As President Ruto and Tony Elumelu concluded their meeting, both leaders emphasized that this investment represents just the beginning of a long-term partnership focused on shared prosperity and sustainable development. In an era when Africa increasingly seeks to chart its own development path with reduced dependency on external actors, partnerships like this one between Kenya and UBA offer a compelling model for how African institutions can drive the continent’s transformation.

The road infrastructure that will be built with this investment will carry not just vehicles and goods, but the hopes and aspirations of millions of Kenyans working to build a more prosperous future. Through innovative financing, strategic partnerships, and unwavering commitment to development, Kenya and UBA are paving the way—quite literally—for that future to become reality.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

13th November, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025