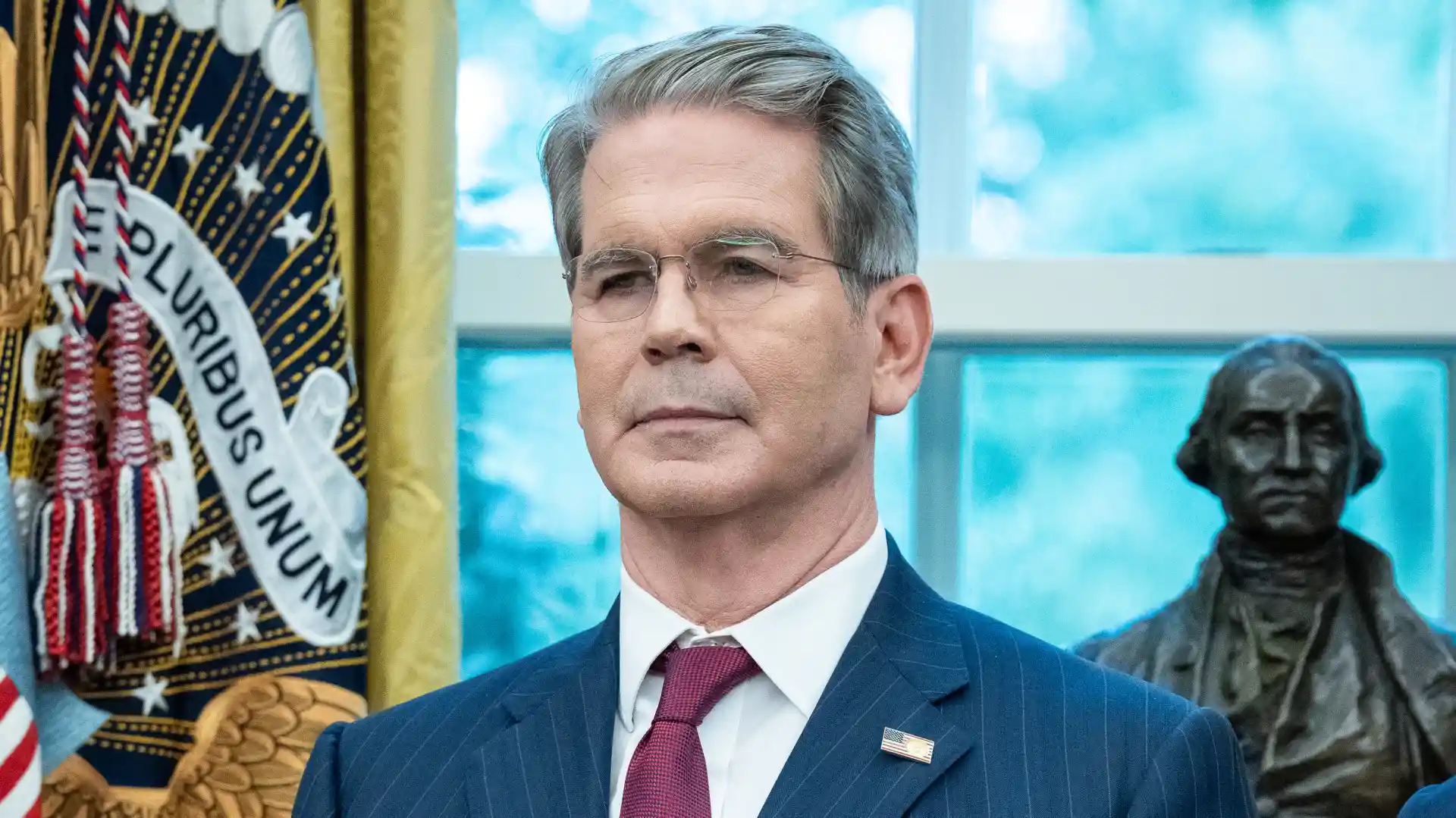

Buenos Aires – In a revelation that ended days of speculation among economists and financial analysts, United States Treasury Secretary Scott Bessent confirmed on Tuesday that Argentina has activated the controversial US$20 billion currency swap line established by the Trump administration to stabilize the South American nation’s volatile peso. The announcement, made during an interview with U.S. news channel MSNBC, comes despite the conspicuous silence from Argentine President Javier Milei’s administration, which has yet to publicly acknowledge or comment on the activation of this substantial financial lifeline.

The confirmation by Secretary Bessent not only validated the analytical conclusions of Argentine economists who had been meticulously examining Central Bank balance sheets for evidence of the swap’s activation but also provided rare transparency into what has become one of the most politically sensitive financial arrangements in recent Latin American economic history. The lack of official confirmation from Buenos Aires has fueled criticism regarding the operation’s transparency, with opposition politicians and economic analysts demanding detailed disclosure about the terms, amounts, and conditions under which Argentina accessed this emergency credit facility.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Treasury Secretary’s Surprising Profitability Claims

Perhaps the most striking aspect of Bessent’s disclosure was his assertion that the United States has already generated profits from the swap arrangement—a claim that sharply contradicts conventional expectations surrounding emergency financial assistance to economically distressed nations.

“We already had a profit on that swap line,” Bessent stated emphatically during the Tuesday morning interview. “We made a line of credit available, and a small amount of it was drawn on, and we have made a profit on that.”

This characterization represents a significant departure from typical bailout narratives, where lender nations or international financial institutions often face substantial risks of non-repayment or must accept concessional terms that prioritize economic stabilization over financial returns. The Treasury Secretary’s explicit framing of the arrangement as profit-generating suggests that the swap line carries interest rates or fee structures substantially above the U.S. government’s own borrowing costs, effectively making Argentina pay a premium for access to dollar liquidity during its moment of acute currency stress.

Bessent was particularly insistent on distinguishing this arrangement from traditional bailouts, noting pointedly that “in most bailouts you don’t make money.” His remarks indicate that the Trump administration structured the facility with terms that protect U.S. financial interests while providing Argentina with the foreign exchange support necessary to prevent a full-scale currency collapse—a delicate balance between emergency assistance and commercially viable lending.

Timeline of the Swap Activation: Electoral Politics and Currency Defense

The timing of the swap line’s activation is inextricably linked to Argentina’s October 26 midterm elections, a politically consequential vote that posed significant risks to President Milei’s radical economic reform agenda. In the weeks preceding the election, the Argentine peso came under severe pressure as markets questioned the government’s ability to maintain currency stability amid aggressive fiscal austerity measures, rapid inflation that had exceeded 200 percent annually at various points during Milei’s presidency, and mounting concerns about the Central Bank’s depleted foreign currency reserves.

According to Secretary Bessent’s account, the U.S. Treasury intervened directly in foreign exchange markets ahead of the October elections, purchasing pesos to “quell a run on the currency.” While the precise dollar amount deployed in this intervention has not been officially disclosed by either government—contributing to the opacity surrounding the entire operation—financial analysts and economists consulted by the Buenos Aires Herald estimate that the United States committed well over US$2 billion to stabilizing the peso during this critical period.

This intervention represented an extraordinary act of financial diplomacy, with the world’s largest economy directly supporting the currency of a middle-income nation to ensure electoral stability and prevent the potential collapse of a politically aligned government. The strategic calculation was unmistakable: allowing the peso to collapse immediately before voting could have triggered an electoral backlash against Milei’s pro-market, pro-American government, potentially returning Argentina to the leftist, anti-U.S. political orientation that had characterized much of the previous two decades.

“The president there won in a landslide,” Bessent noted with evident satisfaction, referring to Milei’s coalition’s strong performance in the midterm elections. “The government is going to make money.” This latter comment, while grammatically ambiguous, appears to suggest either that the Argentine government will economically benefit from continued political stability or that the U.S. government expects Argentina’s improved economic trajectory to ensure full repayment with interest.

Forensic Economics: How Analysts Detected the Swap’s Activation

Even without official confirmation from Argentine authorities, astute economists had concluded days before Bessent’s announcement that the swap line had been activated. Their detective work centered on careful analysis of the Argentine Central Bank’s weekly balance sheet publications, which showed telltale signs of external dollar financing.

Specifically, analysts identified that the “other liabilities” category on the Central Bank’s balance sheet had expanded by approximately 2.9 trillion pesos—equivalent to roughly US$2 billion at prevailing exchange rates—in a timeframe coinciding with the pre-electoral peso defense operations. This sudden balance sheet expansion, occurring without corresponding explanations in standard reserve categories or conventional credit lines, strongly suggested that Argentina had accessed the U.S. swap facility.

The methodology employed by these economists exemplifies the challenges of maintaining financial transparency in Argentina, where official data is often incomplete, delayed, or presented in ways that obscure politically sensitive information. By cross-referencing multiple data series, tracking daily exchange rate interventions, and analyzing anomalous balance sheet movements, independent analysts have developed sophisticated techniques for uncovering financial operations that governments prefer to keep opaque.

This detective work proved prescient when Bessent’s confirmation validated their conclusions. However, the fact that such forensic analysis was necessary underscores the troubling lack of official transparency surrounding an operation that creates significant financial obligations for Argentine taxpayers and represents a notable departure in U.S.-Argentine financial relations.

The Debt Argentina Now Owes Washington

Secretary Bessent’s confirmation establishes definitively that Buenos Aires now carries debt obligations to Washington under terms that remain largely undisclosed to the Argentine public and international observers. This opacity has generated substantial criticism from opposition politicians, economic analysts, and transparency advocates who argue that Argentine citizens have a right to understand the conditions under which their government has mortgaged future resources.

Critical information that remains unavailable includes:

Interest Rates: What rate is Argentina paying on drawn amounts? Given Bessent’s emphasis on U.S. profitability, analysts speculate the rate significantly exceeds standard intergovernmental lending rates and likely includes substantial risk premiums reflecting Argentina’s troubled debt history.

Drawn Amounts: While Bessent characterized the utilization as “a small amount” relative to the US$20 billion total facility, no precise figures have been disclosed. The US$2 billion estimate based on balance sheet analysis remains unconfirmed, and the lack of clarity prevents assessment of how much additional capacity Argentina retains for future currency defense operations.

Maturity Dates: When must Argentina repay these obligations? Short-term debt creates immediate rollover risks, while longer-term arrangements provide breathing room but commit future administrations to repayment schedules they did not negotiate.

Conditionality: Does the swap include policy conditions similar to International Monetary Fund programs, such as requirements for fiscal discipline, monetary policy targets, or structural reforms? Such conditions would represent significant constraints on Argentine policy sovereignty.

Collateral or Guarantees: Has Argentina pledged specific assets, future export revenues, or other guarantees to secure this obligation? Given the country’s history of debt defaults, including the massive 2001 default that remains the largest sovereign default in history, lenders typically demand substantial security.

The absence of this fundamental information has led opposition legislators to demand full disclosure and parliamentary oversight of the swap arrangement. Some critics have suggested that the Milei administration’s silence reflects political calculation—acknowledging dependence on U.S. financial support might undermine the president’s image as an economic reformer restoring Argentina to self-sufficiency.

Broader Geopolitical Context: U.S. Strategy in Latin America

Secretary Bessent’s comments extended well beyond the technical details of the Argentine swap, revealing a broader U.S. strategic approach to Latin America that employs financial diplomacy as a tool for maintaining political influence and countering rival powers, particularly China, which has become a major lender and investor throughout the region.

“The Trump administration used its financial balance sheet to stabilize the [Argentine] government,” Bessent explained, characterizing Argentina as “one of our great allies in Latin America.” This explicit linkage between financial assistance and political alliance represents a frank acknowledgment of what critics characterize as financial imperialism—using economic leverage to shape political outcomes in foreign nations.

The Treasury Secretary positioned this approach as both strategically prudent and economically sound, arguing that relatively modest financial interventions can prevent government collapses that would necessitate far more expensive security operations. “I would rather use peace through economic strength than have to be shooting at narco boats coming offshore [after] a government collapse,” Bessent stated, referencing recent U.S. military actions against Venezuelan vessels.

This doctrine of “peace through economic strength” represents a sophisticated evolution of U.S. foreign policy in Latin America, moving beyond the Cold War era’s military interventions and covert operations toward financial mechanisms that achieve similar ends—maintaining friendly governments and preventing the rise of anti-American regimes—through less overtly coercive means.

Bessent indicated that the United States intends to expand this approach, citing recent electoral developments in Bolivia and upcoming presidential votes in Chile and Colombia as opportunities for similar engagement. This suggests that Argentina’s swap line may represent a template for future U.S. financial interventions designed to support allied candidates or governments facing economic crises that could trigger electoral defeats.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Argentina’s Economic Crisis and Milei’s Radical Experiment

Understanding the swap line’s significance requires context regarding Argentina’s profound economic challenges and President Milei’s controversial policy responses. When the libertarian economist and political outsider assumed the presidency, Argentina was experiencing one of the world’s highest inflation rates, with annual price increases exceeding 200 percent. The Central Bank’s foreign reserves were depleted or encumbered by previous debt obligations, limiting the government’s ability to defend the peso or meet import financing needs.

Milei implemented shock therapy economic policies including massive government spending cuts, elimination of numerous subsidies, and efforts to rapidly reduce the fiscal deficit that had been financed through money printing—the root cause of hyperinflationary pressures. These measures, while arguably necessary to restore fiscal sustainability, imposed severe economic pain on Argentine citizens, particularly lower-income households dependent on government support programs.

The resulting economic contraction and social hardship created significant political vulnerabilities as the October midterm elections approached. Opposition parties, representing both traditional Peronist factions and other political forces, campaigned aggressively against Milei’s austerity program, arguing that it sacrificed Argentine workers to satisfy international creditors and implement ideological libertarian experiments.

The peso’s stability heading into these elections became paramount. A currency collapse would have vindicated opposition criticisms, potentially triggered capital flight, accelerated inflation further, and likely resulted in devastating electoral losses that could have crippled Milei’s ability to continue his reform program. The U.S. intervention, providing the dollar liquidity necessary to maintain peso stability during this critical period, arguably proved decisive in enabling Milei’s coalition to secure the “landslide” victory Bessent referenced.

The Exchange Stabilization Fund: A Powerful Tool of U.S. Financial Diplomacy

The Exchange Stabilization Fund (ESF) through which the swap line was established represents one of the U.S. Treasury’s most powerful and least constrained tools for international financial intervention. Created during the 1930s to stabilize the dollar during the Great Depression, the ESF has evolved into a flexible mechanism that allows the Treasury Secretary to engage in foreign exchange operations, provide emergency lending to foreign governments, and generally promote international monetary stability—all without requiring Congressional approval for individual operations.

This lack of Congressional oversight gives the Executive Branch extraordinary latitude to provide financial support aligned with foreign policy objectives, but also generates criticism from those who argue that such significant financial commitments should require legislative authorization and oversight. The Argentine swap, structured through the ESF, exemplifies both the fund’s utility as a responsive crisis management tool and concerns about democratic accountability when substantial taxpayer-backed resources are committed to politically motivated international operations.

The ESF’s role in supporting Argentina also raises questions about appropriate use of this emergency facility. While the fund has historical precedents for supporting friendly governments during currency crises—including notable interventions supporting Mexico in 1994 and South Korea during the Asian Financial Crisis—the explicitly political framing of the Argentine operation, timed specifically to influence electoral outcomes, arguably represents a more aggressive deployment of this financial tool for geopolitical purposes.

Transparency Deficit and Democratic Accountability

The most troubling aspect of this entire episode may be the extreme opacity surrounding an operation with potentially significant implications for both U.S. and Argentine taxpayers. Despite repeated requests from journalists, including the Buenos Aires Herald, spokespeople for Argentina’s Economy Ministry and Central Bank have declined to comment or provide information about the swap activation, its terms, or the amounts drawn.

This information vacuum prevents meaningful democratic accountability. Argentine legislators cannot effectively oversee government actions they know nothing about. Opposition parties cannot evaluate whether the terms secured were reasonable or unnecessarily burdensome. Independent economists cannot assess the sustainability of Argentina’s debt trajectory without knowing the full extent and terms of obligations. And Argentine citizens cannot make informed judgments about their government’s economic management when critical financial decisions remain concealed.

The lack of transparency is particularly problematic given Argentina’s troubled history with external debt. The country has defaulted on sovereign obligations multiple times, most catastrophically in 2001 when it defaulted on approximately US$93 billion—then the largest sovereign default in history. Subsequent debt restructurings were contentious and protracted, with some creditors holding out for more than a decade seeking full repayment.

Against this historical backdrop, Argentine citizens have justifiable concerns about their government accumulating new external obligations, particularly under non-transparent terms that may prove unsustainable. The political sensitivity surrounding the swap likely reflects the Milei administration’s awareness that acknowledging dependence on U.S. financial support could undermine its nationalist-tinged rhetoric about restoring Argentine sovereignty and ending subservience to international creditors.

Market Reactions and Economic Implications

Financial markets’ response to the swap activation—or more precisely, to the confirmed suspicions of its activation—has been relatively muted, suggesting that sophisticated investors had already priced in the U.S. support when analyzing Argentine assets. The peso has maintained relative stability since the October elections, though it continues to depreciate gradually as part of the government’s managed float regime designed to prevent overvaluation while avoiding disruptive devaluations.

Argentine sovereign bonds, which had rallied in the months following Milei’s initial election on hopes that his fiscal discipline would restore debt sustainability, have shown mixed performance as investors weigh the positive signal of U.S. support against concerns about accumulating new obligations and the opacity surrounding their terms.

The economic implications extend beyond immediate debt service obligations. Access to the U.S. swap line provides Argentina with a financial backstop that could prove critical if economic conditions deteriorate or external shocks materialize. With US$20 billion potentially available (minus whatever has already been drawn), the Central Bank possesses firepower for currency defense operations substantially greater than its own depleted reserves could provide.

However, this financial cushion comes with strings attached—both the literal terms of the swap agreement and the implicit policy constraints associated with maintaining U.S. support. Argentina’s foreign policy has already shifted markedly toward Washington under Milei, including strengthening security cooperation, aligning with U.S. positions in international forums, and distancing from China despite the Asian giant’s status as a major trading partner and creditor.

Comparisons to Historical Financial Interventions

The Argentine swap invites comparisons to various historical episodes of U.S. financial intervention in Latin America and beyond. The 1994 Mexican peso crisis saw the Clinton administration, also working through the ESF after Congress declined to approve a bailout package, provide US$20 billion in loan guarantees that stabilized Mexico’s financial system and prevented default. That intervention, like the current Argentine operation, generated controversy regarding its political motivations and lack of Congressional approval, but ultimately proved financially successful as Mexico repaid obligations ahead of schedule.

More recently, the Trump administration’s first-term willingness to support Venezuela’s opposition leader Juan Guaidó through various mechanisms, and its subsequent aggressive sanctions regime against the Maduro government, demonstrated the administration’s readiness to deploy financial tools as weapons in geopolitical contests throughout Latin America.

The Argentine intervention differs in scale and character from these precedents. Unlike the Mexican crisis, which threatened broader emerging market contagion and U.S. financial institutions with significant Mexican exposure, Argentina’s troubles posed minimal direct risks to U.S. economic interests. The intervention was thus motivated almost purely by geopolitical considerations—supporting an ideologically aligned government—rather than defensive financial crisis management.

Future Trajectory and Outstanding Questions

As Argentina moves beyond the October elections that prompted the swap’s activation, numerous questions remain about the facility’s future utilization and ultimate impact. Will Argentina draw additional amounts as it continues navigating economic stabilization? The full US$20 billion facility presumably remains available, providing continued support as needed, though each additional draw increases the debt burden that must eventually be serviced.

Can Milei’s economic program succeed in restoring sustainable growth and rebuilding Central Bank reserves sufficiently to repay swap obligations without requiring debt restructuring? Argentina’s economic trajectory remains highly uncertain, with the country teetering between potential recovery under continued reforms and possible renewed crisis if political support for austerity collapses.

Will the lack of transparency surrounding the swap eventually generate political backlash against the Milei administration? Opposition parties are already demanding disclosure and questioning whether the government has mortgaged Argentina’s sovereignty in exchange for U.S. support.

More broadly, does this operation represent a template for future U.S. financial diplomacy in Latin America and beyond? Secretary Bessent’s comments suggest an affirmative answer, with potential similar interventions in Chile, Colombia, and other countries where the United States perceives strategic interests in supporting particular political outcomes.

Conclusion: Financial Diplomacy’s Expanding Role

The confirmation of Argentina’s swap line activation, combined with Secretary Bessent’s remarkably frank discussion of its political motivations and financial terms, illuminates the increasingly central role of financial diplomacy in contemporary geopolitical competition. As military interventions become more costly and controversial, and as rising powers like China deploy massive lending through initiatives like the Belt and Road, the United States is refining its own financial tools for maintaining influence in contested regions.

The Argentine operation demonstrates both the potential and the problems of this approach. On one hand, relatively modest financial interventions—even US$2 billion represents a minuscule fraction of U.S. government resources—can achieve significant geopolitical objectives, stabilizing friendly governments and countering rival influence without the human costs and political backlash associated with military operations.

On the other hand, the lack of transparency and democratic accountability surrounding such operations raises troubling questions about whose interests are being served and whether financial diplomacy merely represents imperialism by other means. For Argentina, the immediate crisis may have been deferred, but the long-term implications of enhanced dependence on U.S. support, and the debt obligations incurred, remain unclear.

As this story continues to unfold, with more information potentially emerging about the swap’s precise terms and Argentina’s ongoing economic trajectory, it will provide crucial insights into the future of financial statecraft and the complex interplay between economics and geopolitics in an era of renewed great power competition. For now, what remains certain is that Argentina has activated the swap, the United States claims to be profiting from the arrangement, and the lack of transparency surrounding the entire operation ensures that controversy will continue long after the October elections that prompted this extraordinary financial intervention.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

12th November, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025