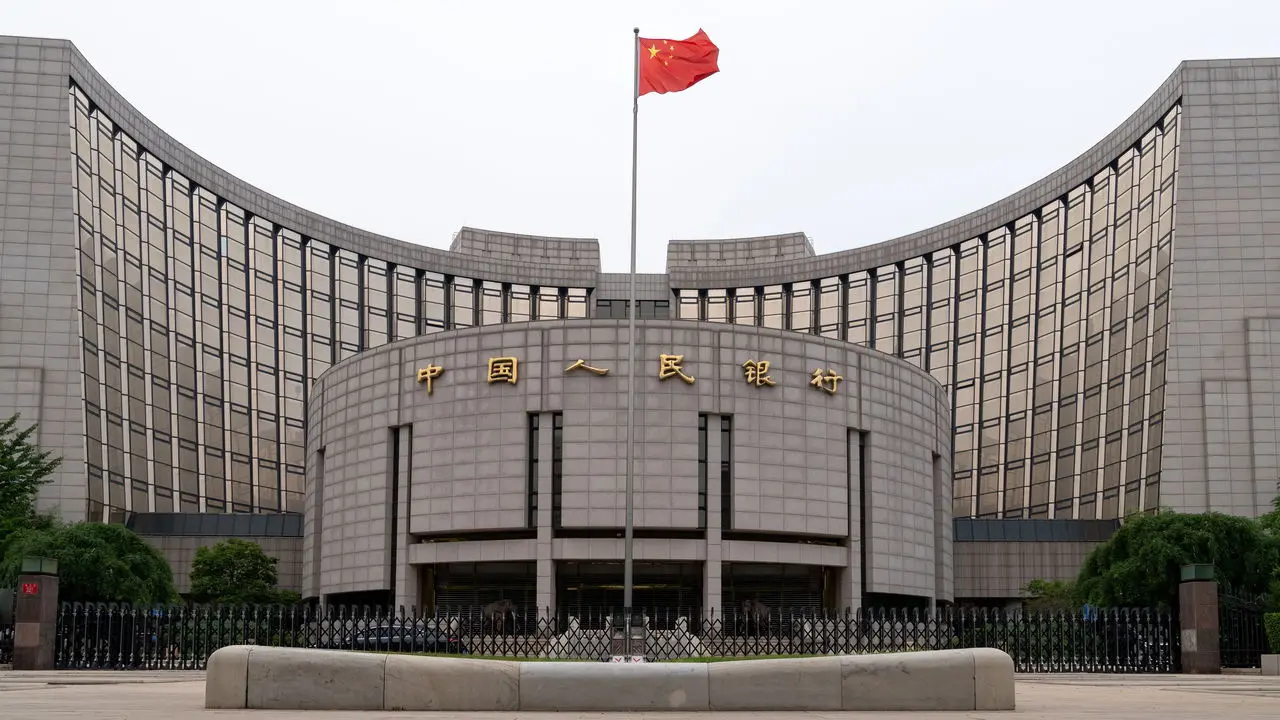

In a significant policy announcement that has captured the attention of global financial markets, the People’s Bank of China (PBOC) has revealed plans to resume its treasury bond purchase operations in the open market, marking a strategic pivot in the country’s monetary policy approach. The announcement, delivered by PBOC Governor Pan Gongsheng during the Annual Conference of Financial Street Forum 2025 in Beijing on Monday, signals China’s determination to expand its monetary policy toolkit amid evolving economic challenges.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Understanding the Context of the Resumption

The decision to restart treasury bond purchases comes after a notable pause earlier this year, a suspension that Pan Gongsheng attributed to “significant pressure” arising from supply-demand imbalances in China’s bond market and escalating market risks. This temporary halt represented a cautious approach by the central bank to address structural concerns within the financial system while reassessing the most effective deployment of its monetary policy instruments.

Treasury bonds are long-term government debt securities that play a crucial role in any nation’s financial ecosystem. For central banks, trading these instruments through open market operations represents one of the most powerful tools available for managing liquidity, influencing interest rates, and steering overall economic activity. When a central bank purchases government bonds, it injects liquidity into the banking system, potentially lowering interest rates and encouraging lending and investment. Conversely, selling bonds removes liquidity from the system, which can help contain inflationary pressures.

The Strategic Importance of Open Market Operations

Pan Gongsheng’s announcement at the Financial Street Forum, which ran from October 27-30 under the theme “Global Financial Development in an Era of Innovation, Transformation and Restructuring,” underscores the PBOC’s commitment to developing a more sophisticated and flexible monetary policy framework. The governor emphasized that the resumption would serve dual purposes: enriching China’s monetary policy toolkit and enhancing the financial functions of government bonds within the broader economic architecture.

The concept of open market operations is well-established in global central banking practice. As explained by the Federal Reserve, these operations involve the purchase or sale of securities by a central bank to influence the amount of money in the banking system. This mechanism allows monetary authorities to implement policy decisions that affect everything from inflation rates to employment levels, making it an indispensable component of modern economic management.

For China, the resumption of treasury bond purchases represents more than just a technical adjustment to monetary policy operations. It reflects the PBOC’s evolving approach to managing one of the world’s largest and most complex economies. The Chinese economy faces multiple challenges, including slower growth rates, ongoing structural reforms, and the need to maintain financial stability amid global economic uncertainty.

Market Dynamics and Supply-Demand Pressures

The pause in bond trading earlier in 2025 was necessitated by what Governor Pan described as significant supply-demand imbalances in the bond market. These imbalances can create volatility, affect pricing mechanisms, and potentially compromise market stability. When demand for government bonds significantly outpaces supply—or vice versa—it can lead to distortions in interest rates and yield curves, which in turn affect borrowing costs for businesses and consumers throughout the economy.

China’s bond market has experienced rapid growth and increasing sophistication in recent years, becoming one of the largest in the world. However, this expansion has also brought challenges related to market depth, liquidity management, and the coordination of various policy tools. The temporary suspension of bond purchases allowed the PBOC to assess these dynamics and develop a more calibrated approach to market intervention.

Liao Bo, macro co-chief analyst at Zheshang Securities, provided important context for understanding the central bank’s approach. In comments to media outlets, Liao emphasized that the “core purpose” of the central bank’s trading of government bonds is to “regulate liquidity” rather than to signal any particular stance on monetary policy. This distinction is crucial for market participants and observers to understand: the PBOC’s bond operations are primarily technical tools for managing the amount of money circulating in the banking system, not direct statements about whether policy is becoming more expansionary or contractionary.

Implications for Liquidity and Credit Lending

The resumption of treasury bond purchases carries significant implications for liquidity conditions in China’s banking system and, by extension, for credit availability throughout the economy. According to Dong Ximiao, chief researcher at Zhaolian Finance, the renewed bond-buying program will inject “long-term liquidity” into the banking system, creating conditions that prompt financial institutions to “increase credit lending.”

This mechanism works through what economists call the money multiplier effect. When the central bank purchases bonds from commercial banks, it pays for these securities by crediting the banks’ reserve accounts. These additional reserves provide banks with more capacity to extend loans to businesses and consumers. As these loans are made and deposited back into the banking system, they create additional reserves that can support even more lending, amplifying the initial injection of liquidity through multiple rounds of lending and deposit creation.

For China’s real economy, this enhanced credit availability could translate into more accessible financing for businesses seeking to invest in expansion, innovation, or operations. For consumers, it could mean more favorable conditions for mortgages, consumer loans, and other forms of household credit. These effects are particularly important as China works to sustain economic growth and support key sectors such as real estate and manufacturing.

The Broader Monetary Policy Framework

The resumption of bond purchases must be understood within the context of the PBOC’s broader monetary policy evolution. Under Governor Pan Gongsheng’s leadership, the central bank has been working to refine and modernize its policy framework, moving toward approaches that are more market-oriented and responsive to economic conditions.

In recent speeches and policy documents, Governor Pan has articulated a vision for China’s monetary policy that emphasizes flexibility, precision, and effectiveness. The PBOC has been developing multiple policy tools beyond traditional interest rate adjustments, including various lending facilities, reserve requirement ratios, and now, the refined use of open market operations through government bond trading.

This multi-tool approach reflects lessons learned from other major central banks around the world. The European Central Bank and other monetary authorities have demonstrated how diverse policy instruments can be deployed in combination to address complex economic challenges. China’s adoption of similar strategies represents a maturation of its monetary policy framework and an adaptation to the increasing sophistication of its financial markets.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Financial Market Stability and Risk Management

One of the key considerations driving the PBOC’s decisions regarding treasury bond operations is the imperative to maintain financial market stability. The pause earlier in 2025 was itself a risk management measure, reflecting the central bank’s awareness that inappropriate timing or scale of market intervention can sometimes exacerbate rather than alleviate instability.

Financial stability requires careful attention to multiple factors: asset price movements, credit growth rates, leverage levels in the financial system, and the interconnections between different market segments. When these elements fall out of balance, systemic risks can emerge that threaten the entire financial system. By temporarily stepping back from bond purchases to reassess market conditions, the PBOC demonstrated a prudent approach to risk management.

The decision to now resume these operations suggests that the central bank has determined that market conditions have stabilized sufficiently to support renewed intervention, and that the potential benefits of enhanced liquidity provision outweigh the risks of market distortion. This calibrated approach reflects what international financial institutions have identified as best practices in central bank operations.

International Context and Global Financial Governance

Governor Pan’s announcement at the Financial Street Forum also carries significance in the context of global financial governance and China’s role in the international monetary system. The forum itself, which attracted over 400 participants from more than 30 countries and regions, serves as an important platform for dialogue on global financial issues.

In his remarks at the forum, Pan touched on broader themes of international monetary cooperation and the evolution of the global financial architecture. These comments reflect China’s increasing engagement with international financial standards and practices, even as it maintains distinctive characteristics in its own policy approach.

The coordination of monetary policy across major economies has become increasingly important in an interconnected global financial system. When large central banks like the PBOC make significant policy moves, the effects can ripple through international markets, affecting exchange rates, capital flows, and financial conditions in other countries. The transparency and communication surrounding such policy decisions—exemplified by Pan’s public announcement at a major international forum—contribute to global financial stability by helping market participants anticipate and adjust to policy changes.

Structural Monetary Policy Tools and Economic Support

Beyond the immediate effects on liquidity and credit availability, the resumption of bond purchases fits into the PBOC’s broader strategy of using structural monetary policy tools to support specific economic objectives. Chinese monetary policy has increasingly incorporated what are sometimes called “targeted” or “structural” tools that aim to channel credit toward particular sectors or activities deemed priorities for economic development.

Governor Pan has indicated that these structural tools will play a vital role in the PBOC’s policy implementation going forward. Efforts are being made to promote stable development in sectors such as real estate and capital markets, both of which have experienced volatility and require supportive policy measures.

The real estate sector, in particular, has been a focus of policy attention as China works to transition from a growth model heavily dependent on property development to one more balanced across various sectors. Ensuring adequate and affordable financing for housing while preventing the emergence of property market bubbles represents a delicate balancing act that monetary policy tools must support.

Technical Implementation and Market Communication

The success of the resumed bond purchase program will depend significantly on its technical implementation and the PBOC’s communication with market participants. Modern central banking emphasizes transparency and forward guidance—the practice of clearly communicating policy intentions and the reasoning behind policy decisions to help markets form appropriate expectations.

The PBOC has been working to enhance its communication practices, recognizing that well-informed markets function more efficiently and respond more predictably to policy actions. Governor Pan’s announcement at a high-profile public forum represents part of this communication strategy, providing clear notice of the policy change and its rationale.

The operational details of bond purchases—including the timing, frequency, and scale of transactions—will be important factors determining the program’s impact. Central banks typically have considerable flexibility in adjusting these parameters in response to evolving market conditions, allowing them to fine-tune the degree of monetary accommodation they provide.

Implications for Economic Growth and Financial Stability

The resumption of treasury bond purchases comes at a time when China continues to navigate complex economic challenges. The country is pursuing high-quality economic development, transitioning toward more sustainable growth models, and addressing structural issues while maintaining stability.

Enhanced liquidity provision through bond purchases can support these objectives by ensuring that financial conditions remain conducive to productive investment and consumption. However, monetary policy alone cannot address all economic challenges. Fiscal policy, structural reforms, and regulatory measures all play complementary roles in promoting sustained economic prosperity.

The coordination between monetary policy and these other policy domains represents another important dimension of China’s economic management. The Financial Street Forum provided an opportunity for various financial regulators and policymakers to articulate their respective priorities and highlight how different policies work together toward common objectives.

Looking Ahead: The Future of China’s Monetary Policy

As China’s economy continues to evolve and its financial markets grow more sophisticated, the monetary policy framework will likely continue adapting. The resumption of treasury bond purchases represents one step in this ongoing evolution, demonstrating the PBOC’s willingness to use available tools flexibly in response to changing circumstances.

Future developments may include further refinements to the bond purchase program, the introduction of additional policy instruments, and continued improvements in policy communication and coordination with other economic authorities. The experience of other major central banks suggests that monetary policy frameworks benefit from regular review and adjustment as economic structures and financial markets change.

Governor Pan Gongsheng’s leadership of the PBOC comes at a pivotal time for China’s economy and financial system. His articulated vision for monetary policy emphasizes professionalism, market-orientation, and integration with international best practices while respecting China’s unique circumstances and development stage.

Conclusion

The People’s Bank of China’s decision to resume treasury bond purchases represents a significant development in Chinese monetary policy and carries important implications for the country’s financial markets and broader economy. By enhancing its monetary policy toolkit and providing additional liquidity to support credit expansion, the PBOC is taking concrete steps to support economic stability and growth.

The careful approach to this policy resumption—including the earlier pause to address market imbalances and the thoughtful communication of the new policy direction—demonstrates the sophistication of China’s monetary policy management. As the world’s second-largest economy continues to evolve, the effectiveness of these policy tools in supporting sustainable, balanced growth will remain a key focus for policymakers, market participants, and observers around the globe.

The broader context of China’s monetary policy evolution, its integration with international financial practices, and its coordination with other domestic policies all point to a maturing economic management system that is adapting to meet the challenges of a complex, interconnected global economy. The resumption of treasury bond purchases is not merely a technical adjustment but a reflection of this larger transformation in how China manages its monetary system and supports its economic development objectives.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

29th October, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025