East African Breweries Limited (EABL), Kenya’s leading alcoholic beverages manufacturer, has launched an ambitious fundraising initiative that opens the door for ordinary Kenyans to invest in one of the country’s most established corporate entities with as little as Ksh 10,000. The company is seeking to raise up to Ksh 11 billion through the first tranche of its Ksh 20 billion domestic bond programme, offering an attractive annual interest rate of 11.80 percent over a five-year period.

This bond issuance represents a significant opportunity for both retail and institutional investors to participate in the growth trajectory of a company that has been a cornerstone of Kenya’s manufacturing sector for decades. The offering comes at a time when Kenyans are increasingly seeking alternative investment vehicles beyond traditional savings accounts, which typically offer returns below the current inflation rate.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

In a statement released on Monday, October 27, 2025, EABL announced that the Capital Markets Authority (CMA) granted approval on October 2, 2025, for the issuance of medium-term notes under the company’s Domestic Medium-Term Note Programme. This approval enables EABL to issue debt securities periodically to finance its operations and strategic expansion initiatives.

“East African Breweries PLC hereby announces that the Capital Markets Authority, in exercise of its powers under Section 30A of the Capital Markets Act, has granted approval to EABL to offer medium-term notes in the aggregate principal amount of up to Ksh 20 billion under its Domestic Medium-Term Note Programme,” the company stated in its official notice.

Understanding the Bond Structure

The bond programme represents a sophisticated financial instrument that allows EABL to access capital markets directly rather than relying solely on traditional bank financing. Medium-term notes are debt securities that typically have maturity periods ranging from one to ten years, and they have become increasingly popular among Kenyan corporations seeking to diversify their funding sources.

By setting the minimum investment threshold at Ksh 10,000, EABL has deliberately structured this offering to be inclusive, allowing ordinary Kenyans to become creditors to one of the country’s blue-chip companies. This democratization of corporate bond investment contrasts sharply with many previous corporate bond issues that had much higher minimum investment requirements, effectively excluding retail investors.

The initial tranche will raise up to Ksh 11 billion and carries a five-year maturity period with an annual interest rate of 11.80 percent. To put this in perspective, this rate is significantly higher than what most Kenyan banks currently offer on fixed deposit accounts, which typically range between 7-9 percent annually, and substantially higher than regular savings accounts that offer returns between 1-3 percent.

Timeline and Key Dates

The offer officially opened on Monday, October 27, 2025, and investors have a two-week window to submit their applications before the offer closes on Monday, November 10, 2025. This relatively short application period means that interested investors need to act promptly to secure their allocation.

Following the close of the application period, EABL has outlined a clear timeline for subsequent steps:

- Allotment Date: November 12, 2025 – This is when EABL will determine how much each applicant will receive based on total demand and available allocation

- Payment and Issue Date: November 18, 2025 – When the bonds will be officially issued and investors’ accounts will be debited

- CDS Upload: November 20, 2025 – When the notes will appear in investors’ Central Depository System accounts

This streamlined timeline ensures that successful applicants will see their investments activated within less than a month from the opening of the offer, demonstrating efficient market infrastructure.

Investment Returns: What Investors Can Expect

With an 11.80 percent annual interest rate, investors can calculate their potential returns based on their investment amount. For example:

- An investment of Ksh 10,000 (minimum) would generate Ksh 1,180 in annual interest

- An investment of Ksh 100,000 would yield Ksh 11,800 annually

- An investment of Ksh 1,000,000 would produce Ksh 118,000 per year

Interest payments will be made semi-annually, meaning investors will receive their returns twice per year rather than waiting for an annual payout. This regular income stream can be particularly attractive for retirees, conservative investors, or anyone seeking predictable cash flows from their investments.

Over the five-year life of the bond, an investor who commits Ksh 100,000 would receive Ksh 59,000 in total interest payments, assuming they hold the bond to maturity. When combined with the return of the principal amount at maturity, the total return would represent a 59 percent gain on the initial investment over five years.

How to Apply: Digital Application Process

EABL has modernized the application process by providing an online portal, making it convenient for tech-savvy investors to apply from anywhere with internet access. The digital application can be completed through the dedicated portal at https://eablmtn.e-offer.app.

To successfully complete the online application, investors should follow these steps:

Step 1: Review Terms and Conditions Before proceeding with any investment, it is crucial to thoroughly read and understand the terms and conditions of the offer provided on the portal. These terms outline important details about the bond, including payment schedules, potential risks, and the rights and obligations of bondholders.

Step 2: Ensure CDSC Account Availability Investors must have a valid Central Depository and Settlement Corporation (CDSC) account to participate in this bond offer. The CDSC account is essentially the electronic infrastructure that holds securities on behalf of investors in Kenya. If you don’t have a CDSC account, you’ll need to contact a licensed stockbroker or agent to open one before you can proceed with the bond application.

Most Kenyan commercial banks now offer stockbroking services and can facilitate the opening of a CDSC account, though this process may take a few days. Given the limited application window, investors without existing CDSC accounts should prioritize opening one immediately.

Step 3: Submit Application Once you have confirmed your CDSC account details, click “Accept Offer” on the portal. If you have applied for previous offerings through the same system, you can log in using your existing credentials to add another application. New applicants should select “New Application” to begin the process from scratch.

The application form will require you to provide personal information, your CDSC account number, and the amount you wish to invest. Ensure all information is accurate, as errors could delay or invalidate your application.

Step 4: Payment and Proof Upload After submitting your application details, you’ll need to make payment for your desired investment amount and upload proof of payment. EABL accepts payments via Electronic Funds Transfer (EFT) or bank transfer. It’s essential to keep your payment receipt as you’ll need to upload it to the portal as verification.

Step 5: Verification and Confirmation The data processing agent will verify your payment against your application. Applicants will receive updates on the status of their application via email or SMS. This communication is important, so ensure you provide accurate contact information during the application process.

Physical Application Alternative

Recognizing that not all potential investors have reliable internet access or prefer traditional paper-based processes, EABL has maintained a physical application option. This inclusive approach ensures that the bond remains accessible to a broader demographic of Kenyan investors.

To apply physically, investors should:

Step 1: Obtain Application Form Download the application form from the EABL website or collect a physical copy from authorized accepting agents or Image Registrars’ offices located across major Kenyan cities.

Step 2: Complete Form Fill in the application form carefully, following all instructions provided. Incomplete or incorrectly filled forms may be rejected, so attention to detail is critical. Attach all required supporting documents, which typically include copies of your national ID or passport and your CDSC account statement.

Step 3: Submit to Accepting Agent Submit the completed form along with payment to any authorized accepting agent before the close of the offer period on November 10, 2025. Authorized agents include various commercial banks and financial institutions approved by EABL for this purpose.

Understanding the Use of Proceeds

Transparency about how raised capital will be deployed is crucial for investor confidence. EABL has stated that proceeds from the bond will be used for general corporate purposes, which encompasses several strategic areas:

Operations Funding: The day-to-day operations of a manufacturing company like EABL require substantial working capital. This includes purchasing raw materials such as barley and hops, maintaining inventory, managing distribution networks, and supporting sales and marketing activities across East Africa.

Debt Management: Like most large corporations, EABL maintains various debt obligations. Proceeds from this bond may be used to refinance existing debt, potentially at more favorable terms, or to better structure the company’s overall debt portfolio for optimal financial flexibility.

Growth Projects: EABL has historically invested in expanding its production capacity, developing new products, entering new markets, and modernizing its facilities. The beverage industry in East Africa is competitive and dynamic, requiring continuous investment to maintain market leadership.

This bond issuance comes shortly after EABL announced the early redemption of a previous Ksh 11 billion corporate bond, demonstrating the company’s active management of its capital structure and commitment to maintaining healthy financial ratios.

Listing on the Nairobi Securities Exchange

The notes will be listed on the Nairobi Securities Exchange (NSE), Kenya’s principal stock exchange. This listing provides several benefits to investors:

Liquidity: While bonds are typically held to maturity, listing on the NSE provides a secondary market where bondholders can potentially sell their holdings before maturity if they need to access their capital. The actual liquidity will depend on market conditions and trading volumes.

Transparency: Listed securities are subject to NSE regulations requiring regular disclosure and reporting, giving investors ongoing visibility into EABL’s financial performance and any material developments that might affect the bond’s value.

Regulatory Oversight: The NSE and CMA provide regulatory oversight that helps protect investor interests and ensures market integrity.

The notes will rank equally with EABL’s existing unsecured obligations, meaning they hold the same priority as other unsecured debt in the unlikely event of financial difficulties. This ranking is important for investors to understand as they assess the risk profile of their investment.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Tax Implications and Considerations

Understanding the tax treatment of bond investments is essential for calculating net returns. The EABL bond carries several tax implications:

Withholding Tax on Interest: Interest income from the notes will be subject to a 15 percent withholding tax. This means that from the 11.80 percent annual interest rate, investors will receive a net return of approximately 10.03 percent after tax. For an investment of Ksh 100,000, the Ksh 11,800 annual interest would be reduced by Ksh 1,770 in withholding tax, leaving Ksh 10,030 in net annual income.

However, certain categories of investors may qualify for exemptions or reduced rates under double taxation treaties. Institutional investors such as pension funds often benefit from tax exemptions on investment income. Individual investors should consult with tax advisors to understand if they qualify for any preferential tax treatment.

Capital Gains Tax Exemption: A significant benefit for investors is that capital gains tax will be exempt for these listed notes when traded on the NSE. This means if bond prices fluctuate and an investor sells their holdings at a profit in the secondary market, they won’t owe capital gains tax on that profit.

Stamp Duty Exemption: Similarly, stamp duty will be exempt for these listed notes traded on the NSE, reducing transaction costs for investors who choose to trade their holdings before maturity.

These tax exemptions make the bond more attractive compared to some other investment vehicles that face multiple layers of taxation.

Payment Infrastructure and Mechanics

Image Registrars Limited will serve as the paying agent, responsible for disbursing interest payments to bondholders. The company has established multiple payment channels to ensure convenience:

- Real Time Gross Settlement (RTGS): For larger institutional investors requiring immediate settlement of large payment amounts

- Electronic Funds Transfer (EFT): Standard bank transfers that are processed within 24 hours

- Mobile Money: Integration with platforms like M-Pesa, allowing bondholders to receive interest payments directly to their mobile money accounts

- Pesalink: An instant bank-to-bank payment system that enables real-time transfers between participating banks

This diversity of payment options reflects Kenya’s position as a leader in financial technology and mobile money adoption, ensuring that investors can receive their returns through their preferred channel.

Professional Advisors and Service Providers

EABL has assembled a team of respected financial institutions and professional service providers to facilitate this bond issuance:

Arrangers and Placing Agents: Absa Bank Kenya PLC and Absa Securities Limited are responsible for arranging the bond programme and placing the securities with investors. These institutions bring extensive experience in capital markets transactions and access to broad investor networks.

Sponsoring Stockbroker, Registrar, and Calculation Agent: Absa Securities Limited performs these multiple roles, which include sponsoring the bond’s listing on the NSE, maintaining the register of bondholders, and calculating interest payments and other financial obligations.

Note Trustee: Image Registrars Limited has been appointed as the Note Trustee, serving as the representative of bondholders’ collective interests. The trustee monitors EABL’s compliance with bond terms and takes action on behalf of bondholders if any covenant breaches occur.

Legal Counsel: MTC Trust & Corporate Services Limited provides legal expertise ensuring the bond structure complies with all relevant Kenyan laws and regulations.

Reporting Accountants: Coulson Harney LLP (Bowmans Kenya) and PricewaterhouseCoopers LLP serve as reporting accountants, providing independent verification of EABL’s financial information presented to investors.

This comprehensive team of advisors provides investors with confidence that the bond has been structured professionally and that proper safeguards are in place to protect their interests.

EABL: Company Background and Investment Profile

For investors considering this bond, understanding EABL’s business fundamentals and market position is essential. East African Breweries Limited is one of Kenya’s oldest and most established corporations, with a history spanning nearly a century. The company is a subsidiary of Diageo, the British multinational alcoholic beverages company, which provides additional financial stability and access to global best practices.

EABL’s portfolio includes some of East Africa’s most recognizable beer and spirits brands, including Tusker, the iconic Kenyan beer brand that has become synonymous with national identity and pride. Other popular brands in the company’s portfolio include Guinness, Johnnie Walker, Smirnoff, and various locally produced spirits.

The company operates multiple production facilities across Kenya and has distribution networks extending throughout East Africa. Under the leadership of Managing Director and CEO Jane Karuku, EABL has pursued strategies focused on premiumization, innovation, and sustainability while maintaining its mass-market presence.

EABL is listed on the Nairobi Securities Exchange and is a constituent of the NSE 20 Share Index, which comprises the most liquid and actively traded securities on the exchange. This listing history demonstrates the company’s commitment to transparency and good corporate governance.

Risk Considerations

While EABL’s bond offers attractive returns, prudent investors should consider potential risks:

Credit Risk: The primary risk is that EABL could face financial difficulties that impair its ability to pay interest or repay principal. However, EABL’s long operating history, strong brand portfolio, and backing by Diageo mitigate this risk significantly.

Interest Rate Risk: If market interest rates rise substantially during the bond’s five-year life, the fixed 11.80 percent rate could become less attractive relative to newer offerings, potentially affecting the bond’s value in secondary market trading.

Liquidity Risk: While the notes will be listed on the NSE, secondary market liquidity for corporate bonds in Kenya is generally lower than for equities. Investors should be prepared to hold the bond to maturity if necessary.

Regulatory and Tax Risk: Changes in tax laws or financial regulations could affect the bond’s returns or terms, though such changes are generally applied prospectively rather than retroactively.

Business Risk: EABL operates in the alcoholic beverages industry, which faces regulatory scrutiny, changing consumer preferences, and public health considerations that could affect the company’s long-term profitability.

Comparing EABL Bond to Alternative Investments

To make an informed decision, investors should compare the EABL bond to alternative investment options:

Treasury Bonds: The Central Bank of Kenya regularly issues government bonds with various maturities. Recent infrastructure bonds have offered rates around 12-13 percent, slightly higher than EABL’s offering but with the added security of government backing. However, Treasury bonds often have higher minimum investments and may be less accessible to retail investors.

Bank Fixed Deposits: Most Kenyan banks offer fixed deposit accounts with rates between 7-9 percent annually. While these typically offer greater safety through deposit insurance schemes, they provide significantly lower returns than the EABL bond.

Equity Investments: Investing in EABL shares or other NSE-listed equities could potentially offer higher returns but comes with greater volatility and risk. Equities don’t provide the predictable income stream that bonds offer.

Real Estate: Property investment can generate rental income and capital appreciation but requires much larger capital outlays, is illiquid, and involves significant transaction costs and management responsibilities.

Money Market Funds: These offer liquidity and safety but typically provide returns of 8-10 percent, lower than the EABL bond.

The Broader Context: Corporate Bonds in Kenya’s Capital Markets

EABL’s bond issuance is part of a broader trend in Kenya’s capital markets development. The corporate bond market has grown significantly over the past decade as companies increasingly tap capital markets for funding rather than relying exclusively on bank loans.

This trend benefits both companies and investors. Companies gain access to longer-term funding at potentially lower costs than bank loans, while investors gain access to fixed-income investment opportunities with varying risk-return profiles.

The Capital Markets Authority has been instrumental in developing the regulatory framework that supports corporate bond issuances, implementing guidelines that protect investors while facilitating efficient capital raising.

Conclusion: Opportunity for Retail Investors

EABL’s Ksh 11 billion bond offering represents a compelling opportunity for Kenyan retail investors to earn market-competitive returns of 11.80 percent annually with a minimum investment of just Ksh 10,000. The combination of an accessible entry point, a strong corporate issuer with a long operating history, regular semi-annual interest payments, and straightforward application processes makes this bond attractive to a wide range of investors.

With the application window open until November 10, 2025, prospective investors have a limited time to evaluate the opportunity and submit their applications. Whether applying online or through physical channels, investors should act promptly to ensure their applications are processed before the deadline.

As Kenya’s capital markets continue to mature and offer more diverse investment products, corporate bonds like this EABL offering provide an important bridge between the safety of government securities and the higher risk-return profile of equity investments. For investors seeking predictable income streams and willing to commit capital for five years, this bond represents a professionally structured, transparent investment opportunity backed by one of East Africa’s most established corporations.

The success of this offering will be measured not only by the amount raised but also by how effectively it democratizes access to corporate bond investments, allowing ordinary Kenyans to participate in financing the growth of one of their country’s industrial champions while earning attractive returns on their savings.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

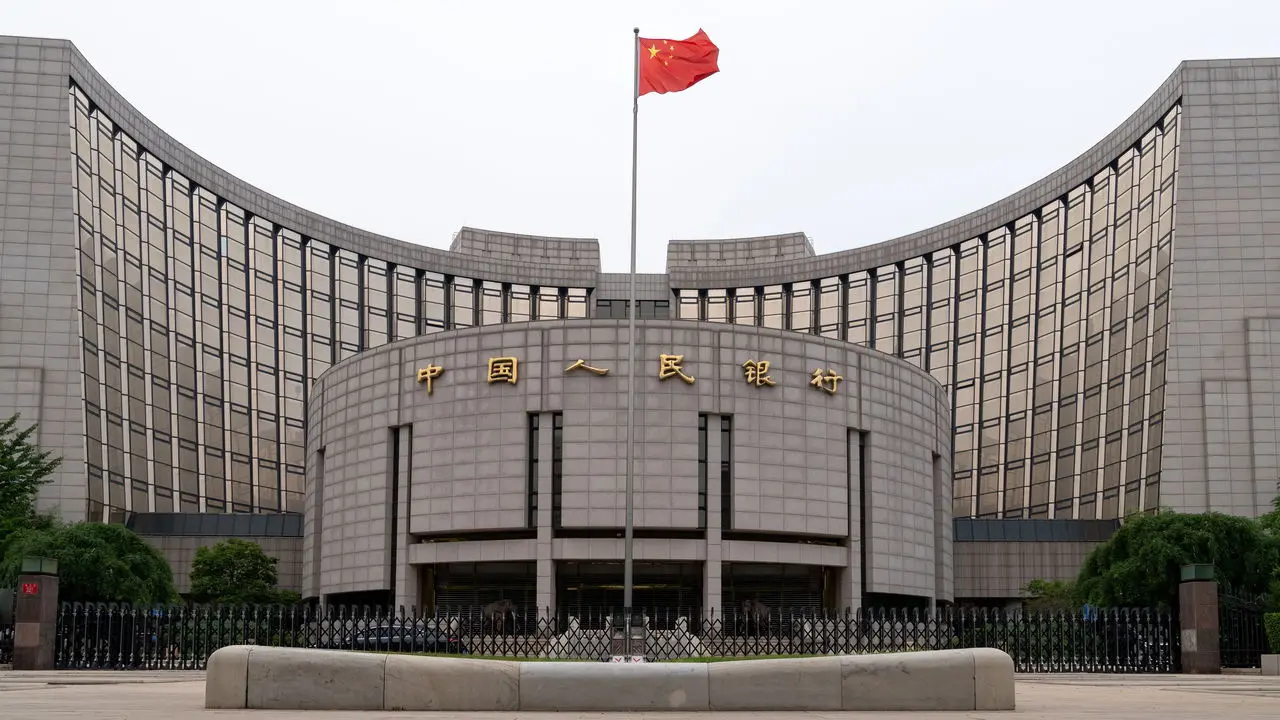

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

29th October, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025