Kenya is intensifying efforts to finalize a groundbreaking bilateral trade agreement with the United States by December 2025, as the African Growth and Opportunity Act (AGOA) approaches its critical September 30 expiration date. This landmark deal would mark the first comprehensive trade agreement between the US and a sub-Saharan African nation, representing a pivotal moment in the evolution of Africa-US economic relations.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

AGOA’s Critical Role in Kenya’s Economy

The African Growth and Opportunity Act has been instrumental in Kenya’s transformation from a culturally rooted textile tradition into a modern apparel manufacturing hub over the past two decades. Under AGOA’s duty-free access provisions, Kenya’s apparel exports to the United States have grown explosively from approximately $55 million in 2001 to $603 million in 2022, accounting for nearly 68% of Kenya’s total exports to the US.

Recent data from the Kenya National Bureau of Statistics (KNBS) Economic Survey 2025 reveals that employment in AGOA-accredited firms rose sharply by 15.18% in 2024, reaching 66,804 workers, up from 58,002 the previous year. Capital investment in the sector also expanded by 21.1% to KSh 38.3 billion in 2024, demonstrating the program’s continued vitality.

Kenya’s apparel exports to the US under AGOA earned $470 million in 2024, marking a significant 19.2% increase from the previous year. The volume of apparel exported increased from 97.3 million pieces in 2023 to 116.0 million pieces in 2024, highlighting the sector’s robust growth trajectory.

The Employment Crisis at Stake

The potential expiration of AGOA represents an existential threat to Kenya’s textile industry and the hundreds of thousands of workers it supports. Industry leaders warn that over 150,000 Kenyan livelihoods are at risk, with the textile sector supporting an estimated 300,000 direct and indirect jobs. Major factories like United Aryan in Nairobi, which produces 8 million pairs of jeans annually for US retailers including Walmart and JCPenney, employ thousands of workers directly while supporting countless more through indirect economic activity.

Workers at these facilities earn an average of $200 per month, providing crucial economic stability in communities where the textile industry has helped reduce crime rates and improve living standards. As worker representative Norah Nasimiyu, 48, explains: “Our families are happy, our children go to school, crime has gone down.”

Factory owners warn that without clarity on AGOA’s renewal, US clients may cut spring 2025 orders, creating a damaging prospect for an industry that plans production cycles months in advance. The Export Processing Zone Authority projects that most of the 50,000+ direct apparel jobs would be at risk, given that over 90% of their output is destined for the US market.

Trump Administration’s Trade Policy Impact

The return of Donald Trump to the White House has added complexity to Kenya’s trade situation. In April 2025, Trump imposed a 10% blanket tariff on Kenyan goods as part of his global tariff regime, effectively overriding AGOA’s preferential treatment. This tariff, while relatively moderate compared to levies imposed on countries like Vietnam or South Africa, represents a significant shift in trade dynamics.

Trade Minister Lee Kinyanjui acknowledged the tariff’s impact but expressed optimism about Kenya’s competitive position: “We believe we still can be competitive. You may see those big companies actually wanting to come to Kenya.” The minister emphasized that the 10% tariff would primarily affect US consumers, who would bear the additional costs.

Strategic Trade and Investment Partnership Evolution

The current negotiations represent an evolution from earlier trade discussions that began in 2020 under Trump’s first administration. Under President Biden, these talks were reframed as a Strategic Trade and Investment Partnership (STIP) rather than a traditional free trade agreement, focusing on lifting non-tariff barriers rather than addressing tariff issues comprehensively.

However, the STIP approach faced criticism for not addressing the fundamental tariff barriers that concern Kenyan exporters. According to US Congress documents, businesses and the agriculture industry preferred a comprehensive FTA that would include tariff provisions, arguing that Kenyan tariffs on agricultural products would continue to hinder US market access even if non-tariff barriers were addressed.

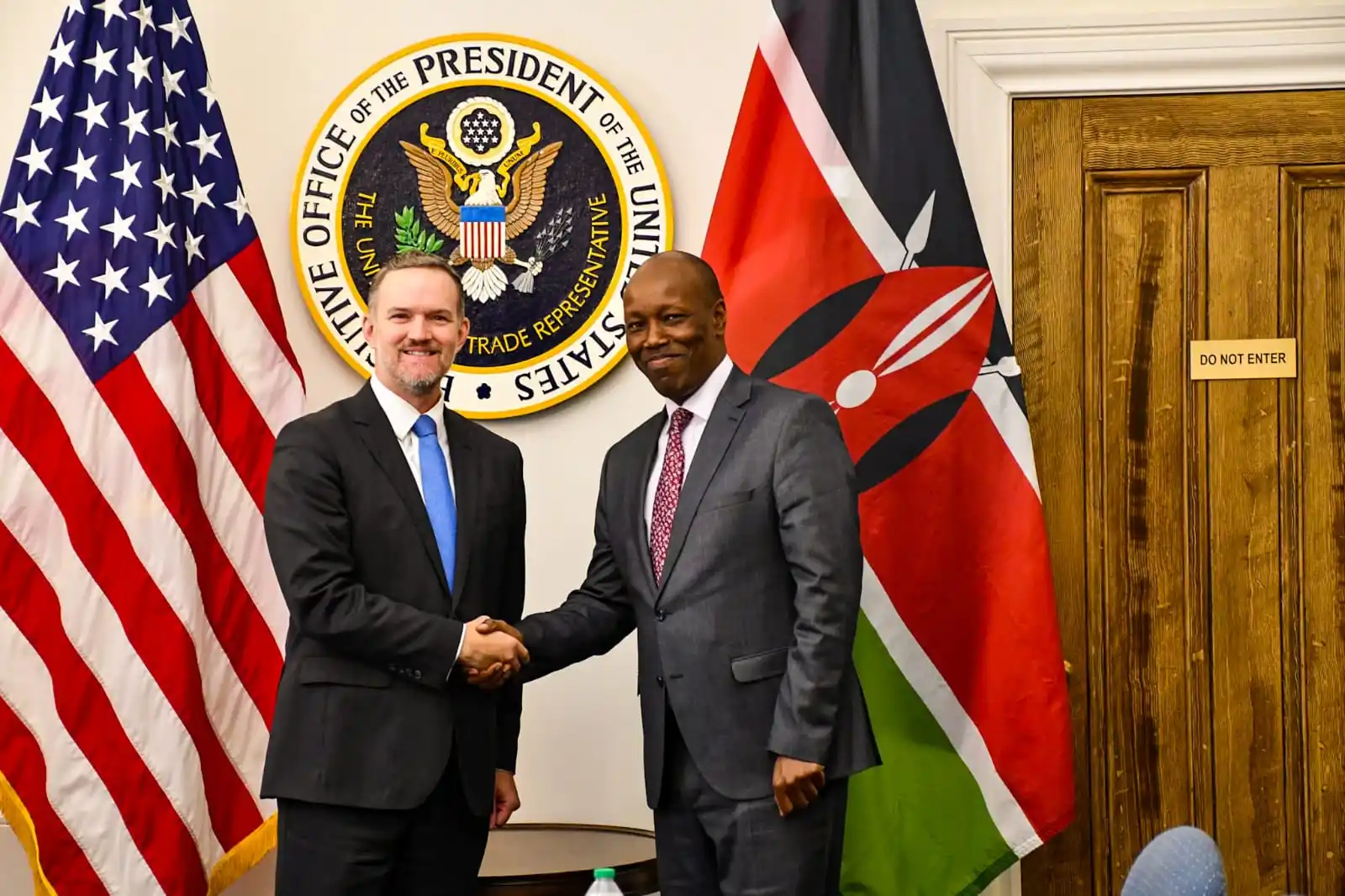

Presidential Diplomacy and International Engagement

President William Ruto departed Kenya on September 20, 2025, for New York to attend the High-Level Week of the 80th United Nations General Assembly, marking his first trip to the US under the Trump administration. This diplomatic mission carries significant weight as Kenya seeks to advance its trade interests while navigating complex international relationships.

At the UN General Assembly, President Ruto is advocating for comprehensive reforms of multilateral institutions, including the UN Security Council, while calling for reforms of the international financial architecture to ensure fair access to development finance for developing countries. As Chair of the African Union’s Committee of Heads of State and Government on Climate Change (CAHOSCC), he is also consolidating Africa’s position ahead of COP30 in Brazil.

Beyond multilateral engagements, President Ruto will hold bilateral talks with global leaders, development partners, and industry executives to advance Kenya’s interests and secure partnerships in key sectors such as agriculture, technology, infrastructure, and energy under the Bottom-Up Economic Transformation Agenda.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

The China Factor and Geopolitical Considerations

Kenya’s relationship with China has emerged as a source of tension in US-Kenya trade discussions. Despite Kenya’s designation as a major non-NATO ally in 2024, US officials have criticized Nairobi’s deeper engagement with Beijing. President Ruto has defended this rapprochement, arguing that Kenya needs to export more goods to China to close a trade gap that heavily favors Beijing.

This balancing act reflects broader challenges facing African nations as they navigate between competing global powers. As the US returns to a more protectionist trade agenda under Trump, many African countries are accelerating economic diplomacy with China, the European Union, and Gulf states, while the African Continental Free Trade Area (AfCFTA) gains traction as an alternative to Western trade preferences.

Industry Resilience and Historical Context

Kenya’s textile industry has demonstrated remarkable resilience through multiple global shocks, including the 2005 removal of global textile quotas that flooded markets with cheaper Asian imports, the 2008 global financial crisis that reduced consumer demand, and the 2020 COVID-19 pandemic that nearly halted production. Through each crisis, AGOA has served as a stabilizing force.

Industry leader Pankaj Bedi, CEO of United Aryan, reflects on these challenges: “There were many times when we thought we should give up. But when you have 150,000 people dependent on you, you have a responsibility.” This sentiment captures the broader social responsibility that Kenya’s textile manufacturers feel toward their communities.

Economic Diversification and Export Strategy

Kenya’s dependence on US markets extends beyond textiles. Last year, Kenya exported goods worth $737 million to the US, representing 10% of its total exports. This significant trade volume underscores the urgency of securing continued market access as AGOA approaches expiration.

The textile and garment sector alone accounted for 7% of Kenya’s total exports in 2024, with monthly exports reaching Sh4.5 billion (approximately $150 million per day) according to London-based Institute of Economic Affairs studies. Kenya ranks as the second-largest exporter of textile and apparel products to the United States among AGOA beneficiaries.

Congressional Support and Political Dynamics

While both Republican and Democratic lawmakers in Congress have backed a 12-year extension for AGOA to provide stability for African manufacturers, Trump’s free-trade skepticism has left the decision in limbo. The American Apparel & Footwear Association (AAFA) has actively lobbied for AGOA’s renewal, emphasizing its importance for American companies, workers, and the broader US economy.

AAFA President and CEO Steve Lamar argued: “The programs are not only good for American companies, American workers, and the US economy, they ensure America remains influential in key regions of the world. Allowing these programs to lapse means ceding power and influence to others.”

Alternative Scenarios and Risk Assessment

As AGOA renewal remains uncertain, Kenya and other African nations are exploring alternative frameworks. The African Continental Free Trade Area (AfCFTA) represents a potential pivot away from external preferences toward building a robust, integrated African market. By unifying 54 countries with a combined population of 1.4 billion and GDP of $3.4 trillion, AfCFTA aims to increase intra-African trade from its current level below 17%.

However, economists warn that the loss of AGOA preferences would represent a significant setback for Africa’s industrialization efforts. The duty-free access has stimulated significant value addition in the region, traditionally known for exporting unprocessed commodities, helping countries like Kenya, Lesotho, and Mauritius integrate into global supply chains.

Timeline Pressures and Market Reactions

With AGOA set to expire at the end of September and the 10% tariff already in place since April, Minister Kinyanjui’s year-end timeline represents the clearest marker yet for how quickly both sides need to move. Nairobi is pursuing a dual-track approach, pressing for a bilateral deal while hoping for an extension that would prevent a cliff-edge end to AGOA.

Industry observers note that buyers are growing increasingly anxious about production planning for 2025. Without clarity by March 2025, when production planning deadlines arrive, orders could dry up and factories may be forced to shut down. As Bedi explained: “Buyers have started to panic. We’ve been assuring them it will be okay.”

Future Prospects and Strategic Implications

If successfully concluded, the Kenya-US bilateral trade agreement would establish a precedent for similar deals across sub-Saharan Africa. Minister Kinyanjui’s vision is to “largely replicate the terms of AGOA” in a more permanent framework, providing the certainty that investors require for long-term planning.

Despite the challenges, industry leaders remain cautiously optimistic. Bedi believes Trump will prioritize American retail interests: “America cannot produce what we are making. He has to find an alternative, and Africa is the best option.” This perspective reflects broader hopes that economic pragmatism will prevail over protectionist rhetoric.

The outcome of Kenya’s trade negotiations with the United States will have far-reaching implications not only for the hundreds of thousands of workers in Kenya’s textile industry but also for the future of US-Africa economic relations. As the September AGOA deadline approaches and negotiations continue, the stakes could not be higher for a country that has built much of its export-oriented manufacturing strategy around preferential access to the world’s largest consumer market.

The success or failure of these negotiations will serve as a bellwether for other African nations watching closely as they prepare for their own post-AGOA future. For Kenya, securing a bilateral agreement before year-end represents not just economic necessity but a crucial test of its diplomatic capabilities in an increasingly complex global trade environment.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

22nd September, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025