Executive Summary

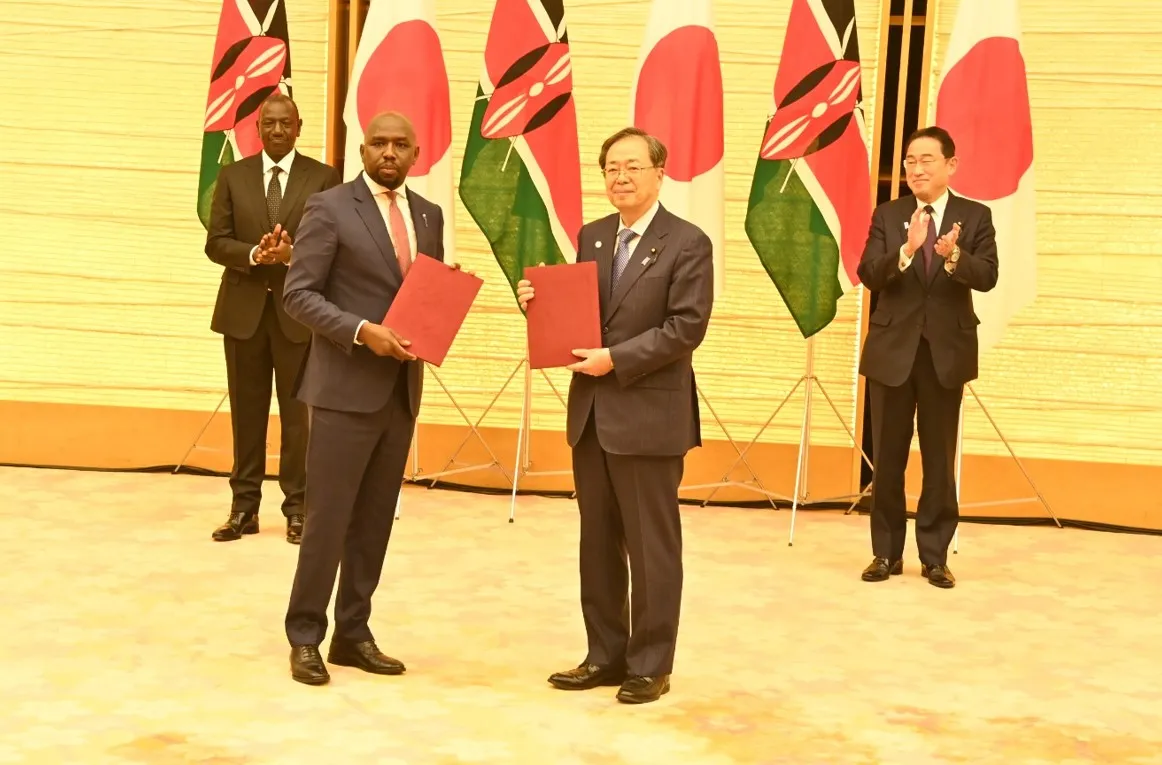

Kenya’s economic growth this year is expected to exceed official forecasts despite higher U.S. tariffs and other challenges, President William Ruto announced at the Tokyo International Conference on African Development (TICAD) in Yokohama, where Kenya and Japan also signed a strategically significant yen-denominated loan agreement. The East African nation’s economy is forecast to grow by 5.6% this year, more than the 4.7% recorded last year and surpassing both the finance ministry’s 5.3% forecast and the central bank’s 5.2% projection.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

Economic Growth Projections and Market Confidence

Outperforming Official Forecasts

“GDP (gross domestic product) is expected to grow 5.6% this year, despite global domestic headwinds arising from escalating tariffs and trade disruptions affecting many economies,” Ruto said at the Japan-Africa leaders conference. This optimistic projection reflects Kenya’s economic resilience and positions the country ahead of regional peers facing similar global challenges.

The growth forecast aligns with broader trends showing Kenya’s economic recovery momentum. According to the World Bank, Kenya’s growth is projected to recover to 4.9% on average during 2025–2027, driven mainly by easing inflation, accommodative monetary policy, and a pickup in credit growth that should support household and business incomes.

Structural Economic Indicators

The African Development Bank notes that Kenya’s economy grew 5.2% in 2023, up from 4.8% in 2022, as agriculture rebounded and services grew moderately. On the supply side, services accounted for 69% of the growth and agriculture for 23%, while household consumption accounted for 70% on the demand side.

Inflation is expected to fall to 6.2% in 2024 and 5.5% in 2025, as food and global inflation both decline. The fiscal deficit is projected to narrow to 5.9% of GDP in 2024 and 5.0% in 2025 in response to a revenue-led fiscal consolidation program.

Strategic Japan-Kenya Financial Partnership

Yen-Denominated Loan Agreement

Japan and Kenya signed a term sheet for a yen-denominated loan to be backed by Nippon Export and Investment Insurance (NEXI), Japan’s Ministry of Foreign Affairs confirmed. While details on pricing and terms of the loan were not disclosed, the agreement represents a significant shift from earlier plans for a Samurai bond issuance that were subsequently shelved.

The deal builds on an agreement signed in February 2024 between Kenya and NEXI to expand financial cooperation. NEXI’s insurance backing aims to reduce borrowing costs for sovereign borrowers by mitigating risks for investors, making yen-denominated financing more attractive for Kenya’s development needs.

Evolution from Samurai Bond Plans

According to Bloomberg, the governments of Kenya and Japan agreed on the terms of a yen loan after earlier plans for a Samurai bond were shelved. The statement came after a bilateral meeting between President William Ruto and Japanese Prime Minister Shigeru Ishiba, though ministry officials declined to explain why the financing plans were changed.

Originally, Kenya had planned to float a Samurai bond totaling USD 500 million (Ksh 80 billion) in two phases of USD 250 million each. Treasury Principal Secretary Chris Kiptoo had announced in February that “this agreement enables Kenya to issue a Samurai Bond totalling USD 500 million in two phases,” with funds expected to be channeled towards critical government projects including decarbonization and electric vehicle subsidies.

Regional Context and Financing Diversification

African Sovereign Debt Innovation

Kenya’s pursuit of diversified funding sources reflects a broader regional trend. The push is mirrored in other economies in the region, including Ivory Coast, which raised 50 billion Japanese yen in an ESG-certified samurai bond in July 2025.

Ivory Coast’s landmark transaction made it the first sub-Saharan African sovereign with an active Samurai bond issuance. The 10-year bond, issued at a 2.3% coupon and backed by the Japan Bank for International Cooperation (JBIC), demonstrated growing appetite for Africa-linked sustainable debt instruments.

Strategic Currency Diversification

The move toward yen-denominated financing represents part of Kenya’s broader strategy to diversify funding sources and reduce exposure to dollar volatility. As East Africa’s largest economy, Kenya has been seeking diversified funding sources to support infrastructure development and economic growth amid global uncertainties.

Samurai bonds, typically accessed by countries like Brazil, Malaysia, and Egypt, offer long-term, fixed-rate financing in yen, particularly appealing during periods of dollar volatility. The JBIC guarantee structure helps attract Japanese institutional investor demand while reducing borrowing costs for sovereign issuers.

Japan’s Development Cooperation in Kenya

Infrastructure and Technical Cooperation

Japan has been working to deepen economic partnerships across Africa, with Kenya representing a key strategic partner. In Kenya, Japan has funded projects in areas such as power generation, road construction and scientific research, building a comprehensive development cooperation framework.

The Japan International Cooperation Agency (JICA) has been particularly active in supporting Kenya’s infrastructure development. Key focus areas include:

Energy Infrastructure: Japan continuously supports power generation with a focus on geothermal power to meet Kenya’s demand and tackle global warming. Energy demand has been increasing by about 5% per year, with peak national consumption reaching 1,084MW against production capacity of 1,375MW.

Transportation Networks: The program aims to improve facilities and functions of Mombasa Port and regional trunk roads starting from the Port to enhance trade in the entire East African region. The Port of Mombasa recently completed Phase 1 of the Mombasa Port Development Project, funded by the Japanese Government at $217 million.

Agricultural Development: Through technical assistance to horticulture and rice smallholder farmers, improvement of irrigation infrastructure and policy support related to CARD (Coalition for African Rice Development) to achieve Kenya’s Vision 2030 economic growth targets.

Emerging Technology Cooperation

At TICAD 2025, Japan announced plans to provide support to train 30,000 artificial intelligence experts over the next three years to promote digitalization and create jobs across Africa. This initiative is particularly relevant for Kenya, which has positioned itself as a regional technology hub.

Recent UNIDO-Japan cooperation includes eight projects aimed at fostering inclusive and sustainable industrial development in Africa and the Middle East, supported through Japan’s supplementary budget and new initiatives focused on economic development within the TICAD framework.

Economic Challenges and Risk Factors

Global Trade Environment

Kenya is on a trajectory of sustained economic growth but faces risks from global trade disputes, market volatility and extreme weather conditions, according to the finance ministry. The economy continues to show considerable resilience despite more recent shocks, including a severe liquidity crunch and inflationary pressures in 2024.

According to the World Bank, GDP growth decelerated to an estimated 4.5% in 2024, following a cyclical rebound of 5.6% growth in 2023, due to climate change shocks, subdued business sentiment following mid-2024 protests, and reduced public spending amid ongoing fiscal consolidation efforts.

Infrastructure Financing Gap

According to the World Bank, Kenya faces a significant infrastructure financing deficit annually, which constrains growth and development. Sustained expenditures of almost $4 billion per year are required to meet the country’s infrastructure needs.

The African Development Bank notes that Kenya needs $12 billion annually by 2030 and $2 billion annually by 2063 to close its financing gap to fast-track structural transformation. Some funds could be raised through domestic resource mobilization, as the current tax-to-GDP ratio of 13% is below its 27% potential.

Climate and Environmental Risks

Kenya faces significant environmental challenges that impact economic growth. About 80% of national land is arid or semi-arid, with safe water available per capita expected to decrease from 1,093m³ in 2010 to 475m³ in 2030, while the United Nations recommends 1,000m³ per capita.

The country has experienced extreme weather conditions including floods and droughts that affect agricultural productivity and overall economic performance. These climate risks require substantial investment in adaptation and resilience measures.

Fuel your success with knowledge that matters. Enroll in our Online programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

Strategic Development Initiatives

Bottom-Up Economic Transformation

The Ruto Administration has prioritized affordable and social housing as part of its Bottom-Up Economic Transformation Agenda (BETA), with ambition to develop 250,000 low-income houses annually. This initiative aligns with Kenya’s Vision 2030 transformation goals.

The government’s bottom-up economic model prioritizes agriculture, healthcare, affordable housing, micro and small enterprises, and the digital and creative economy. Given Kenya’s debt burden, the government increasingly looks to the private sector to implement infrastructure projects under Design Build-Finance-Operate Maintain (DBFOM) or Public-Private Partnership models.

Regional Integration and Trade

As East Africa’s largest economy, Kenya plays a crucial role in regional economic integration. The Mombasa Port is the largest port in East Africa and second largest in Africa, serving Kenya and neighboring countries including Burundi, Democratic Republic of Congo, Rwanda, South Sudan, Tanzania, and Uganda.

However, 40% of trunk roads have lost function due to inappropriate maintenance practices, and Mombasa Port’s container handling volume has reached 800,000 TEU/year, over its maximum capacity of around 450,000 TEU/year, creating bottlenecks for regional trade.

International Financial Architecture

World Bank Group Engagement

As of March 30, 2025, the International Finance Corporation’s (IFC) investment portfolio in Kenya totaled $1.4 billion across several key sectors, including manufacturing, agribusiness, financial services, infrastructure, and technology. IFC also had an advisory portfolio of $62.1 million focused on supporting reforms to attract private investment.

The Multilateral Investment Guarantee Agency (MIGA) is actively engaged in Kenya, with a total gross exposure of $608.2 million, ranking Kenya as the ninth largest host country in MIGA’s portfolio in Africa.

IMF and Debt Sustainability

Kenya has expressed interest in securing a new funded International Monetary Fund program to support its economic stabilization efforts. The country’s public debt expanded from 66.7% of GDP in 2022 to 70.2% in 2023, driven by increased loans to finance the primary deficit and exchange rate depreciation.

The current account deficit is projected to narrow to 4.6% of GDP in 2024 and 4.5% in 2025 as a recovery in global trade reduces the trade deficit. However, the outlook remains subject to considerable risks, including tight global financing conditions and regional security challenges.

Innovation and Technology Transformation

Digital Economy Development

Kenya has positioned itself as a regional leader in financial technology and digital innovation. The country’s robust ICT infrastructure and supportive regulatory environment have enabled the growth of mobile money services and fintech innovations that serve as models for other African countries.

The emphasis on AI training and digital capacity building through the Japan partnership reflects recognition that Kenya’s economic future depends heavily on technological advancement. With Africa poised to host one-third of the world’s youth by 2050, investments in digital skills development represent crucial long-term economic assets.

Manufacturing and Industrial Development

Kenya’s manufacturing sector continues to evolve, with output growth of 5.8% per year needed to absorb the 680,000 people entering the labor market annually. With accelerated structural transformation, GDP growth of 7.3% could create 1.36 million new jobs and cut unemployment to 7%.

The government’s focus on value addition and industrial development, supported by Japanese technical cooperation and financing, aims to transform Kenya into a manufacturing hub serving regional markets through the African Continental Free Trade Area framework.

Future Outlook and Strategic Partnerships

TICAD Framework Benefits

Kenya’s participation in TICAD 2025 reinforces its strategic partnership with Japan and positions the country to benefit from expanded Japanese investment and technical cooperation. The conference platform enables Kenya to showcase investment opportunities while accessing new financing mechanisms and technology transfer programs.

The signing of the yen-denominated loan agreement during TICAD demonstrates the concrete benefits of sustained diplomatic and economic engagement through multilateral frameworks. This approach allows for comprehensive partnerships that extend beyond pure financial transactions to include capacity building and knowledge transfer.

Regional Leadership Role

As East Africa’s largest economy, Kenya’s economic performance has significant implications for regional stability and growth. The country’s success in diversifying financing sources and maintaining growth momentum despite global challenges positions it as a model for other African economies seeking to reduce aid dependence and increase economic sovereignty.

Kenya’s ability to navigate complex global economic conditions while maintaining strong partnerships with traditional allies like Japan and exploring new financing mechanisms demonstrates the country’s strategic approach to economic diplomacy and development financing.

Risk Management and Sustainability

Climate Adaptation Strategies

Given Kenya’s vulnerability to climate change and extreme weather events, the integration of climate resilience into economic planning remains crucial. Japanese cooperation in renewable energy, particularly geothermal development, provides both economic benefits and environmental sustainability.

The focus on green infrastructure and sustainable development through the Japan partnership aligns with global climate goals while supporting Kenya’s long-term economic transformation objectives.

Economic Diversification Imperatives

Kenya’s economic growth strategy emphasizes diversification across sectors and geographic markets to reduce vulnerability to external shocks. The agriculture sector, which employs the majority of the population, requires continued investment in productivity enhancement and value chain development.

The services sector, which accounts for the largest share of GDP, offers opportunities for expansion through digitalization and regional integration, while manufacturing development can provide employment for the growing urban population.

Conclusion: Partnership Model for Sustainable Growth

Kenya’s projected 5.6% economic growth in 2025, coupled with the strategic yen-denominated loan agreement with Japan, exemplifies how African countries can leverage international partnerships to achieve sustainable development goals while maintaining fiscal responsibility.

The evolution from Samurai bond plans to a structured loan facility demonstrates the flexibility and innovation possible in international development finance. By working with experienced partners like Japan through established frameworks like TICAD, Kenya can access favorable financing terms while building long-term institutional relationships.

As Kenya continues to position itself as East Africa’s economic leader, the success of this Japanese partnership model could provide valuable lessons for other African countries seeking to diversify their financing sources and strengthen international economic cooperation.

The emphasis on technology transfer, infrastructure development, and capacity building through the Japan partnership represents a comprehensive approach to economic transformation that goes beyond traditional aid relationships to create mutual benefits and sustainable growth trajectories.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

21st August, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025