Intel Corporation received a significant boost on Monday as Japanese technology investment giant SoftBank announced a $2 billion investment in the embattled American chipmaker, paying $23 per share for common stock. The announcement came amid swirling reports that the Trump administration is simultaneously exploring a government stake in the company, marking an unprecedented convergence of private and public sector support for the struggling semiconductor icon.

Intel shares, which closed Monday at $23.66, rose approximately 6% in extended trading to $25 following the SoftBank announcement, providing much-needed momentum for a company that has endured one of the most challenging periods in its storied history.

One decision can change your entire career. Take that step with our Online courses in ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed and start building your brighter future today.

Trump Administration’s Strategic Interest

The SoftBank investment announcement came just hours after renewed reports that the Trump administration is actively discussing converting government grants into an approximately 10% equity stake in Intel. This potential deal, first reported last week, represents what political scientist Sarah Bauerle Danzman from Indiana University describes as a “major escalation” in the Trump administration’s approach to reshaping the government’s role in the private sector.

The discussions center around Intel’s ambitious plans to build a flagship manufacturing hub in Ohio, a project seen as critical to America’s semiconductor independence. However, a White House spokesman previously told the BBC that such reports “should be regarded as speculation” unless officially announced, and the BBC has reached out to both the White House and Intel for updated comments.

Last week’s meeting between President Trump and Intel CEO Lip-Bu Tan added another layer of complexity to the relationship. The encounter occurred just days after Trump publicly called for Tan’s resignation, accusing him of being “highly conflicted” due to his previous business ties to China. This dramatic shift from public criticism to potential partnership underscores the strategic importance Intel holds in America’s technology landscape.

Intel’s Mounting Challenges

Intel’s 2024 performance has been nothing short of disastrous, with the company losing more than 60% of its market value following a 90% gain in 2023. The chipmaker has struggled with what analysts describe as a dual business model challenge – simultaneously designing and manufacturing chips in an increasingly complex and capital-intensive market that has led to significant market share losses.

The market punishment has been severe, with Intel’s stock dropping by over 50% in 2024 alone. In a symbolic blow to the company’s prestige, Intel was removed from the Dow Jones Industrial Average in November 2024 and replaced with Nvidia, reflecting the broader shift in semiconductor market leadership.

The company has responded with aggressive cost-cutting measures, implementing a comprehensive spending reduction plan that includes more than 15% headcount reduction – affecting around 15,000 employees – as part of a broader $10 billion cost reduction initiative targeting completion by mid-2025.

The Foundry Business Struggles

Intel’s ambitious foundry business, designed to compete with industry leaders Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung, has faced significant headwinds. According to industry reports, Intel faces difficulties with its upcoming 18A process technology, slated for high-volume production in 2025, with major potential client Broadcom concluding after tests that Intel’s process was not yet ready for large-scale deployment.

The foundry challenges have contributed to Intel’s broader struggles in the artificial intelligence market, which continues to be dominated by Nvidia, while skepticism surrounds Intel’s manufacturing bet. The company has been forced to make difficult decisions, including axing certain chip facility projects as it struggles to attract customers to its manufacturing services.

Build the future you deserve. Get started with our top-tier Online courses: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Let Serrari Ed guide your path to success. Enroll today.

SoftBank’s Strategic Vision

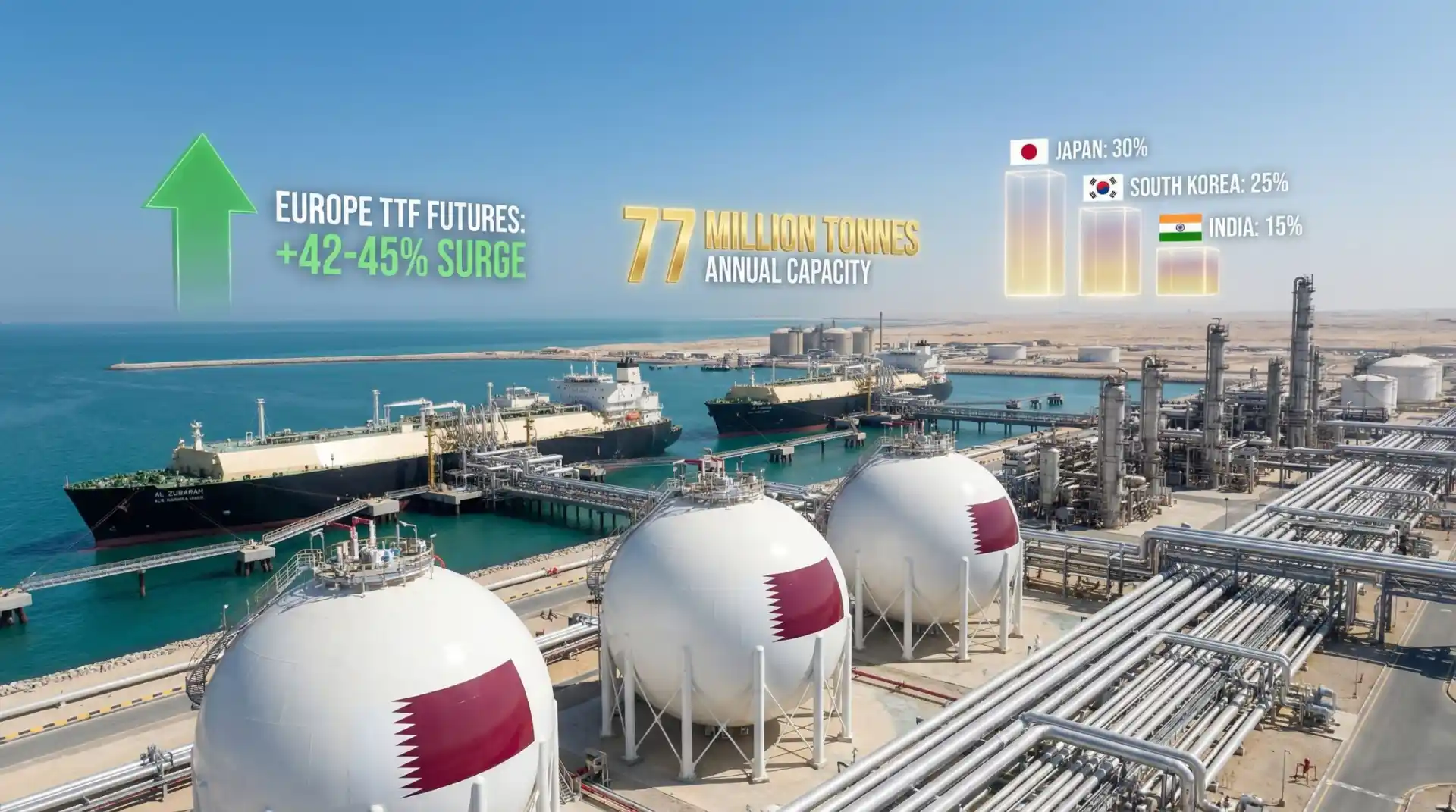

SoftBank’s $2 billion investment represents more than just financial support – it signals confidence in Intel’s potential recovery and aligns with the Japanese conglomerate’s broader artificial intelligence strategy. The investment was described by both companies as a commitment to advanced technology and semiconductors in the United States, positioning it within the context of America’s broader technology competitiveness goals.

SoftBank, led by Masayoshi Son, has been making significant AI-focused investments across multiple sectors. The Intel investment comes on the heels of SoftBank’s participation in other major American technology initiatives, including its involvement in Trump’s announced AI infrastructure project alongside Oracle and OpenAI, which committed to invest up to $500 billion over four years.

The $2 billion investment is expected to represent approximately a 2% stake in Intel, providing SoftBank with meaningful influence while allowing Intel to maintain its independence and operational control.

National Security Implications

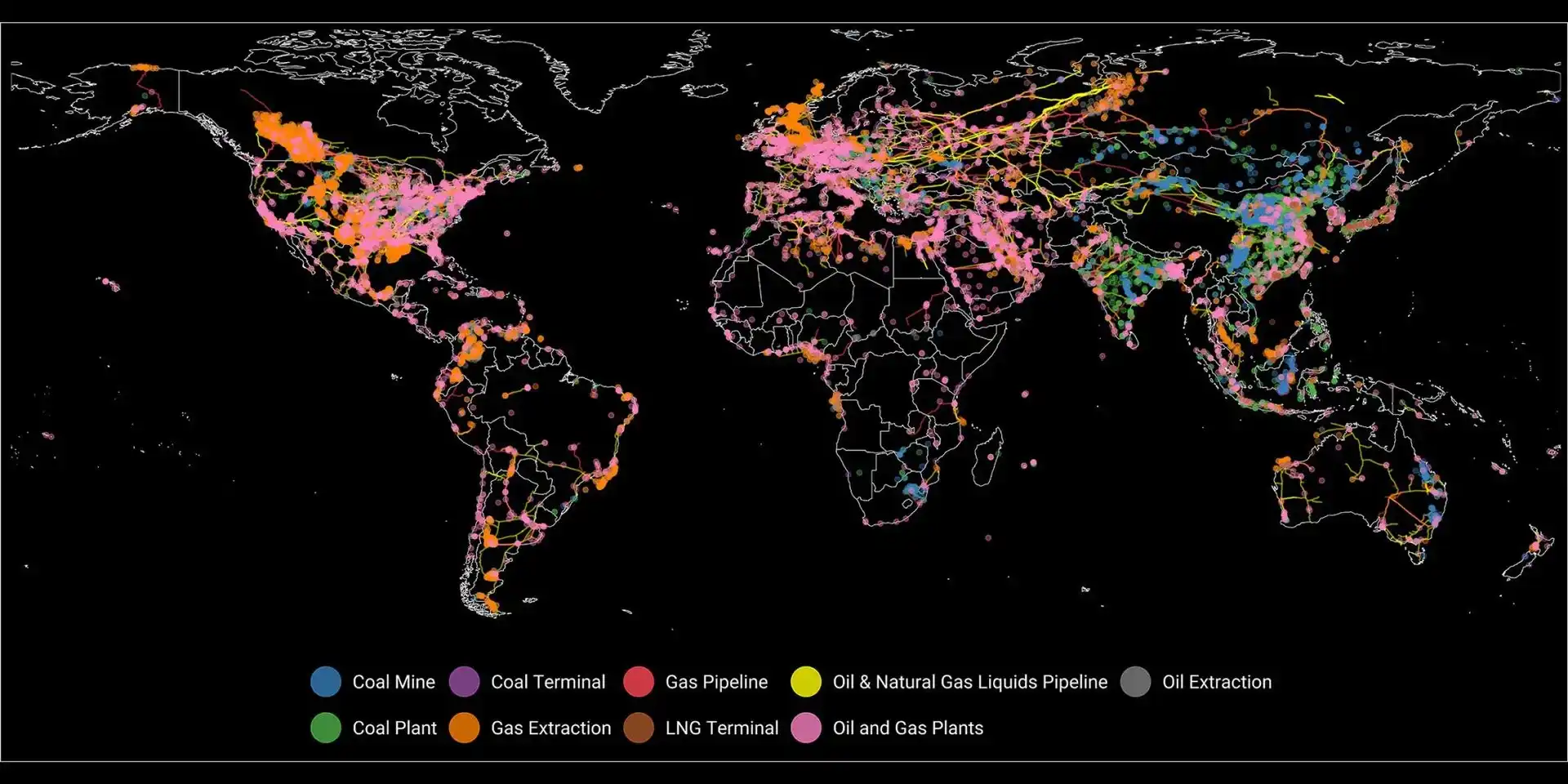

Intel’s struggles carry implications far beyond corporate boardrooms. As one of the few American companies capable of manufacturing high-end semiconductors at scale, Intel’s health directly impacts national security and technological sovereignty. Dan Sheehan from Telos Wealth Advisors emphasizes that the government’s interest reflects a clear agenda: “Accelerate domestic production, reduce dependence on Asia, and position Intel at the centre of the AI and national security landscape.”

The potential government investment would mark an extraordinary intervention in private industry, raising questions about the precedent it sets for future government involvement in struggling but strategically important companies. Danzman warns that such moves create a “concerning precedent” as they raise questions about whether companies may be pushed to follow political agendas rather than purely market-driven strategies.

Competitive Landscape Shifts

Intel’s challenges come at a time when the global semiconductor industry is experiencing rapid transformation. While Intel has historically dominated personal computer processors, it has struggled to capitalize on the artificial intelligence boom that has propelled competitors like Nvidia to unprecedented heights.

Despite its challenges, Intel maintains leadership positions in certain segments, continuing to lead the AI PC category and tracking toward shipping more than 100 million AI PCs by the end of 2025. However, this progress pales in comparison to the broader AI infrastructure market where Nvidia maintains overwhelming dominance.

The competitive dynamics have been further complicated by recent regulatory developments affecting Intel’s rivals. Last week, Nvidia and AMD agreed to pay the US government 15% of their Chinese revenues as part of an unprecedented deal to secure export licenses to China, highlighting the increasingly politicized nature of the semiconductor industry.

Manufacturing Renaissance

Intel’s Ohio manufacturing hub represents more than just a single facility – it symbolizes America’s broader effort to rebuild domestic semiconductor manufacturing capabilities. The project aligns with the Biden administration’s CHIPS Act initiatives, which allocated billions in subsidies and incentives to bring advanced chip manufacturing back to American soil.

The Ohio facility is designed to produce Intel’s most advanced processors and serve as a foundry for other companies’ chip designs. Success in this venture could help Intel reclaim its position as a global semiconductor leader while providing America with greater technological independence from Asian suppliers.

Market Analyst Perspectives

Industry analysts view the SoftBank investment through multiple lenses. While some see it as validation of Intel’s turnaround potential, others question whether financial injections alone can address the company’s fundamental technological and competitive challenges.

Intel’s financial metrics paint a challenging picture, with negative earnings per share of -$3.74 and a negative P/E ratio of -5.44 highlighting the company’s recent struggles. However, progressive developments in product enhancements, particularly with upcoming Lunar Lake processors and other technological advances, offer potential paths to recovery.

The investment timing is particularly significant given Intel’s position in the artificial intelligence revolution. While the company has struggled to compete directly with Nvidia’s specialized AI chips, Intel’s broader semiconductor capabilities and manufacturing infrastructure could prove valuable as AI applications become more diverse and distributed.

Global Technology Competition

The Intel-SoftBank partnership occurs against the backdrop of intensifying global technology competition, particularly between the United States and China. America’s determination to maintain semiconductor leadership has led to increasingly aggressive industrial policies, including direct government investment in private companies.

Intel’s role in this competition extends beyond its commercial success to its function as a national strategic asset. The company’s advanced manufacturing capabilities, research and development infrastructure, and technological expertise make it indispensable to America’s long-term competitiveness in emerging technologies.

Future Outlook

The SoftBank investment provides Intel with a crucial capital injection during a critical turnaround period, offering the company additional financial flexibility as it implements its restructuring plans and pursues technological advancement.

The convergence of private investment from SoftBank and potential government backing creates an unusual but potentially powerful support structure for Intel’s recovery efforts. This dual approach reflects both market confidence in Intel’s long-term potential and government recognition of the company’s strategic importance.

However, significant challenges remain. Intel must demonstrate that it can execute on its technological roadmap, particularly the troubled 18A process technology, while competing effectively in rapidly evolving markets like artificial intelligence and autonomous vehicles.

The coming months will be crucial for Intel as it navigates this complex landscape of private investment, potential government partnership, and intense global competition. Success could restore Intel to its former position as America’s undisputed semiconductor champion, while failure could further erode the country’s technological independence.

Ready to take your career to the next level? Join our Online courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Track GDP, Inflation and Central Bank rates for top African markets with Serrari’s comparator tool.

See today’s Treasury bonds and Money market funds movement across financial service providers in Kenya, using Serrari’s comparator tools.

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

19th August, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025