1. How do I calculate compound interest manually or online?

To calculate compound interest manually, use this compound interest formula:

A=P×(1+nr)(n×t)

Where:

- = future value (final amount)

- P = principal (initial investment or loan)

- r = annual interest rate (in decimal form)

- n = number of times interest is compounded per year

- t = time in years

Example:

If you invest $1,000 at an annual rate of 5% compounded monthly for 3 years:

P=1000

r=0.05

n=12

t=3

A=1000×(1+120.05)(12×3)≈1000×(1.004167)36≈$1,161.62

Online compound interest calculator tools automate this process—you just plug in the values and get the result instantly. You can find reliable tools to compute compound interest on sites like Investopedia or NerdWallet. For a comprehensive suite of financial tools, including a compound interest calculator, visit Serrari Group.

Push boundaries, reach goals, achieve more. Whether it’s ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, or Financial Literacy, we’ve got the course to match your ambition. Start with Serrari Ed now.

2. What is the formula used in a compound interest calculator?

Most compound interest calculator tools use the standard compound interest formula:

A=P×(1+nr)(n×t)

Where:

- A = amount after interest

- P = starting amount

- r = interest rate (annual, in decimal)

- n = number of compounding periods per year

- t = number of years

This formula accounts for interest on both the initial principal and the accumulated interest over each compounding period. Some advanced calculators also include recurring contributions, using an extended formula, helping you with figuring compound interest more comprehensively.

3. What’s the difference between simple and compound interest in a calculator?

Simple Interest only grows on the original amount (principal), using the formula:

I=P×r×t

Total = P+I

Compound Interest, on the other hand, grows on both the principal and accumulated interest. That’s why the growth accelerates over time.

Example:

$1,000 at 5% for 3 years

- Simple Interest: 1000×0.05×3=$150→Total=$1,150

- Compound Interest (annual): 1000×(1+0.05)3=$1,157.63

Compound interest always yields a higher return than simple interest over time, and calculators show this difference. This distinction is crucial when you figure compound interest for long-term financial planning.

4. Can I calculate compound interest with monthly or yearly compounding?

Yes, you can calculate compound interest for different compounding frequencies. The only change in the compound interest formula is the value of “n”, which represents how many times interest is applied each year.

Use:

A=P×(1+nr)(n×t)

- Monthly compounding: n=12

- Quarterly compounding: n=4

- Yearly compounding: n=1

- Daily compounding: n=365

Example:

$1,000 at 6% annual interest for 2 years:

- Monthly: A=1000×(1+120.06)(12×2)≈$1,127.49

- Yearly: A=1000×(1+0.06)2≈$1,123.60

Online compound interest calculator tools usually allow you to select this compounding option, making it easy to estimate compound interest for various scenarios.

5. How do I use a compound interest calculator for daily compounding?

To calculate compound interest with daily compounding, set n=365 in the compound interest formula:

A=P×(1+365r)(365×t)

This accounts for interest being added every single day of the year.

Example:

$1,000 at 5% annual interest compounded daily for 1 year:

A=1000×(1+3650.05)(365×1)≈$1,051.27

In a compound interest calculator:

- Enter Principal = 1000

- Rate = 5%

- Compounding frequency = Daily

- Time = 1 year

Most online calculators have a dropdown menu for compounding frequency—just select “Daily” to compute compound interest with this granularity.

Fuel your success with knowledge that matters. Enroll in career-defining programs: ACCA, HESI A2, ATI TEAS 7, HESI EXIT, NCLEX-RN, NCLEX-PN, and Financial Literacy. Join Serrari Ed now and take control of your future.

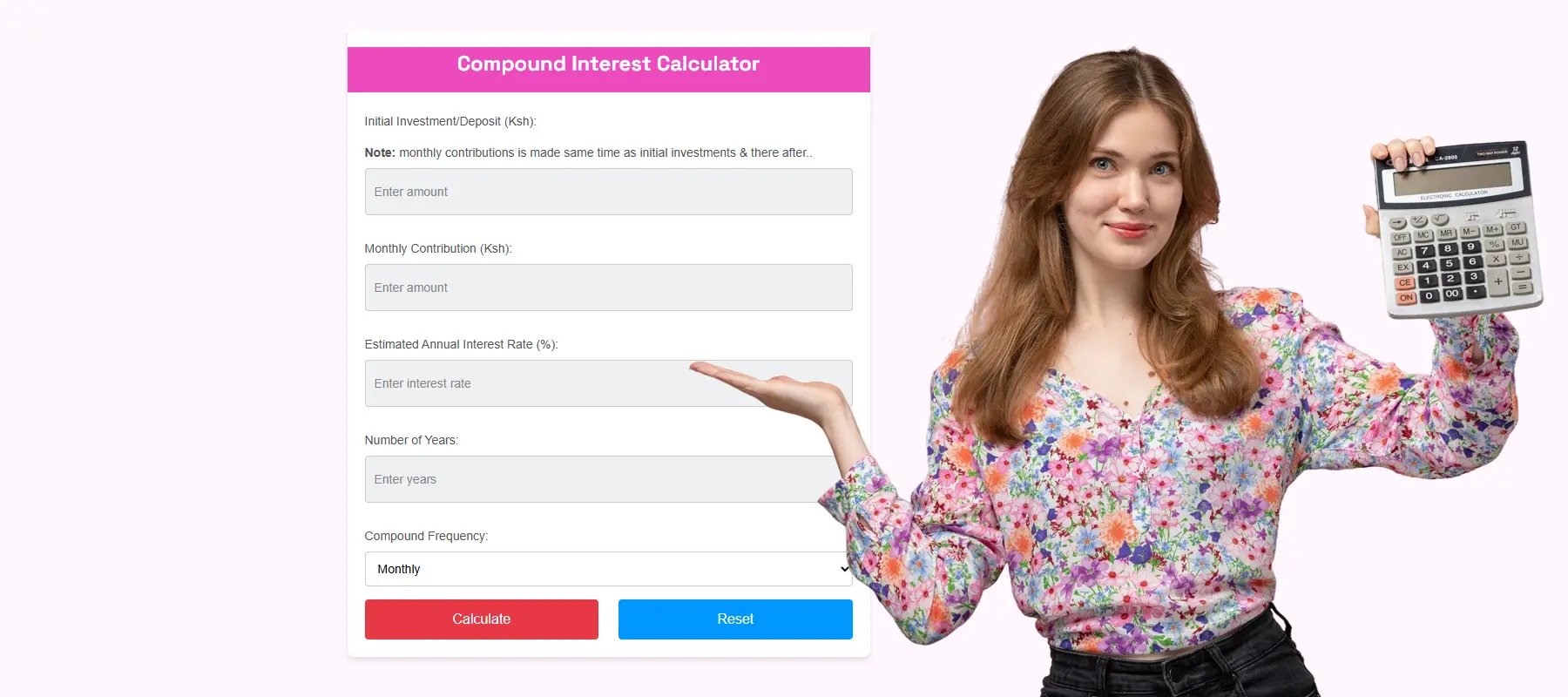

6. What inputs do I need to calculate compound interest correctly?

To calculate compound interest accurately, you need the following key inputs:

- Principal (P): The initial amount of money invested or loaned.

- Annual interest rate (r): The rate at which the investment or loan grows, usually expressed as a percentage.

- Number of times interest compounds per year (n): Common frequencies include annually (1), semiannually (2), quarterly (4), monthly (12), or daily (365).

- Time (t): The duration the money is invested or borrowed, in years.

- Additional contributions (optional): If regular deposits are made, their amount and frequency need to be included.

Basic Compound Interest Formula:

Future Value (FV) = P×(1+nr)(nt)

If there are regular contributions (PMT) added at each compounding period, the formula expands to:

FV=P×(1+nr)(nt)+PMT×[(nr)((1+nr)(nt)−1)]

These inputs are essential for any compound interest calculator to provide a precise calculation.

7. How accurate are online compound interest calculators?

Online compound interest calculator tools are highly accurate if they are coded correctly and users input the right values. These tools use standard mathematical formulas to compute compound interest and its effects, including:

- Compound growth over specific periods

- The impact of different compounding frequencies

- Optional contributions and how they affect the outcome

The accuracy depends on:

- Correct input of rate and time

- Selection of compounding frequency

- Precision of the calculator’s algorithm

Most calculators do not account for taxes, inflation, or changing interest rates, so while accurate in raw computation, real-world applicability may vary. However, they are excellent for figuring compound interest under ideal conditions.

8. Where can I find a free compound interest calculator for investments?

You can find free compound interest calculator tools for investments:

- On financial planning websites and blogs, such as Bankrate or Calculator.net.

- Through online banking or personal finance platforms.

- On educational websites focusing on economics or finance, like Investor.gov.

Key features to look for when you want to estimate compound interest for your investments:

- Support for different compounding frequencies

- Ability to add regular contributions

- Option to view growth over time (such as in a graph or table)

- Mobile-friendly and free to use without sign-ups

A good calculator helps simulate real investment growth over months or years, making it a powerful tool for planning savings, retirement, or debt payoff strategies.

9. Can a compound interest calculator show future value of savings?

Yes. One of the primary functions of a compound interest calculator is to project the future value (FV) of your savings. This includes:

- Growth from the initial principal

- Compound interest earned over time

- Additional regular contributions (if any)

Compound Interest Formula with recurring contributions:

FV=P×(1+nr)(nt)+PMT×[(nr)((1+nr)(nt)−1)]

Example:

If you invest $5,000 at an annual rate of 5%, compounded monthly, for 10 years with monthly contributions of $100:

P=5,000

r=0.05

n=12

t=10

PMT=100

Plug these values into the formula to get your projected future value. This helps you figure compound interest for your long-term savings goals.

10. How do compound interest calculators handle recurring contributions or deposits?

When you make regular deposits (e.g., monthly), compound interest calculator tools treat these as ordinary annuity payments, and add them using this component of the compound interest formula:

PMT×[(nr)((1+nr)(nt)−1)]

Where:

- PMT = payment amount per period

- r = annual interest rate (as a decimal)

- n = number of compounding periods per year

- t = time in years

These contributions are assumed to be made at the end of each period unless otherwise stated. The result is a much higher future value compared to compound interest without contributions, showing the power of disciplined investing over time.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨