Guaranty Trust Holding Company Plc (GTCO), one of Africa’s leading financial institutions, is embarking on a transformative journey set to redefine its global footprint and strengthen its foundational capital. In a landmark move that has sent ripples across the financial markets, GTCO has unveiled ambitious plans to directly list its ordinary shares on the London Stock Exchange (LSE), simultaneously initiating a fully marketed equity offering aimed at raising approximately $100 million for strategic recapitalization. This pivotal development not only underscores GTCO’s forward-thinking approach but also highlights the evolving dynamics of African finance on the international stage.

The decision to transition from its current Global Depositary Receipts (GDRs) structure to a direct LSE listing marks a significant leap for the Nigerian financial giant. It signals a clear intent to enhance global visibility, tap into deeper pools of international capital, and reinforce its position as a robust and resilient player in the global financial services landscape. This article delves into the intricacies of GTCO’s strategic maneuvers, exploring the rationale behind its LSE listing, the imperative of its recapitalization efforts in line with the Central Bank of Nigeria’s (CBN) new directives, and the broader implications for the Nigerian and African banking sectors.

GTCO’s Bold Leap: From GDRs to Direct LSE Listing

Guaranty Trust Holding Company Plc (GTCO) is not merely seeking additional capital; it is fundamentally restructuring its international market presence. The company’s announcement to list its ordinary shares directly on the London Stock Exchange represents a strategic evolution from its existing Global Depositary Receipts (GDRs) program.

Understanding the Shift: GDRs vs. Direct Listing

To appreciate the significance of this transition, it’s crucial to understand the difference between GDRs and a direct listing.

- Global Depositary Receipts (GDRs): These are certificates issued by a depositary bank, typically in a major financial hub like London, that represent shares in a foreign company. They allow investors in international markets to buy shares in a company without having to deal with the complexities of foreign stock exchanges, currencies, and regulations. While GDRs provide access to international capital, they are an indirect form of ownership. The underlying shares are held by a custodian bank in the company’s home country.

- Direct Listing (Ordinary Shares): This involves listing the company’s actual ordinary shares directly on a foreign stock exchange. This means investors directly own shares in the company, rather than a certificate representing them. It typically signifies a deeper commitment to the foreign market and can offer greater liquidity and potentially a higher valuation due to increased transparency and direct investor engagement.

GTCO’s GDRs have been trading on the London Stock Exchange since 2007. The move to cancel this listing and instead list its ordinary shares directly under the ticker symbol “GTHC” (which will later change to “GTCO” by July 31, 2025) is a deliberate strategic choice. As stated in a disclosure to the Nigerian Exchange Limited (NGX) on Thursday, the equity offering commenced on July 2 and is expected to close on July 3, 2025. The highly anticipated admission of GTCO’s ordinary shares to the London Stock Exchange is scheduled for 8:00 a.m. on July 9, 2025.

The Strategic Rationale: Why London?

The London Stock Exchange has long been a preferred destination for companies seeking international capital, particularly those from emerging markets. For GTCO, a direct listing on the LSE offers a multitude of strategic advantages:

- Enhanced Global Visibility and Brand Recognition: A direct listing on one of the world’s most prestigious stock exchanges significantly elevates GTCO’s international profile. This increased visibility can attract a broader and more diverse base of institutional and retail investors from across the globe, enhancing liquidity and potentially leading to a higher valuation for the company. It also strengthens the GTCO brand as a truly international financial services institution.

- Access to Deeper Capital Pools: The London market boasts a vast and sophisticated investor base, including large institutional funds, pension funds, and asset managers with significant capital to deploy. Accessing this deeper pool of capital can facilitate larger fundraising rounds, enabling GTCO to finance its ambitious growth strategies more effectively.

- Improved Liquidity: Direct listing of ordinary shares generally leads to greater liquidity compared to GDRs, as it removes an intermediary layer. Higher liquidity makes it easier for investors to buy and sell shares, which can attract more trading activity and contribute to more efficient price discovery.

- Enhanced Investor Confidence and Governance: Listing on the LSE subjects GTCO to stringent regulatory and governance standards, which are highly regarded globally. This commitment to transparency and robust corporate governance can significantly boost investor confidence, signaling a well-managed and accountable organization.

- Strategic Positioning for Future Growth: As Segun Agbaje, Group Chief Executive Officer of GTCO, aptly put it, this move “represents a pivotal moment in GTCO’s growth story, reinforcing our position as a forward-thinking African financial services institution.” By enhancing its global visibility and access to capital, GTCO is not just advancing its own ambitions but also “unlocking transformative opportunities across the markets and customer segments we serve.” This includes potential for further expansion within Africa and beyond, as well as investment in new technologies and services.

This transition places GTCO among a select group of African companies, like Standard Bank of South Africa, Seplat Energy, and Airtel Africa, that have successfully navigated the complexities of dual listings or direct listings on major international exchanges. GTCO is set to become the first Nigerian bank to achieve a direct listing of its ordinary shares on the LSE, a testament to its pioneering spirit and commitment to global best practices.

Fortifying the Core: Recapitalization and CBN’s Mandate

The London Stock Exchange listing is inextricably linked to GTCO’s ongoing efforts to meet the Central Bank of Nigeria’s (CBN) new minimum capital requirement. This recapitalization drive is a critical component of the CBN’s broader strategy to strengthen the Nigerian banking sector and ensure its resilience in a dynamic global economy.

The CBN’s Mandate: Strengthening the Banking Sector

In a significant policy shift announced on March 28, 2024, the Central Bank of Nigeria (CBN) issued a circular mandating substantial increases in the minimum capital base for commercial, merchant, and non-interest banks, depending on their scope of operations. For commercial banks with international authorization, such as GTBank Nigeria (GTCO’s banking subsidiary), the new minimum capital requirement is a staggering ₦500 billion (approximately $330 million, assuming an exchange rate of ₦1500 to $1). Banks have been given until March 2026 to comply with these new requirements.

The rationale behind the CBN’s directive is multifaceted and crucial for Nigeria’s economic stability and growth:

- Enhancing Financial System Stability: Higher capital buffers enable banks to better absorb economic shocks, unexpected crises, and potential losses from non-performing loans. This reduces systemic risk within the financial sector, making it more robust and less vulnerable to adverse macroeconomic conditions.

- Supporting Economic Growth and the $1 Trillion Economy Target: A well-capitalized banking sector is better positioned to provide larger and longer-term loans to critical sectors of the economy, including manufacturing, agriculture, infrastructure, and small and medium-sized enterprises (SMEs). This increased lending capacity is vital for stimulating business expansion, job creation, and ultimately, achieving the Federal Government’s ambitious target of a $1 trillion economy by 2030.

- Boosting Investor Confidence: A strong and adequately capitalized banking system builds trust among both domestic and international investors. This confidence is essential for attracting foreign direct investment (FDI) into Nigeria, which is crucial for economic development.

- Aligning with International Standards: The recapitalization exercise also aims to align Nigerian banks with international best practices and regulatory standards, such as those recommended by Basel III, which emphasize capital adequacy and risk management. This enhances the competitiveness of Nigerian banks on the global stage.

- Addressing Macroeconomic Headwinds: Nigeria has faced significant macroeconomic challenges, including high inflation, currency devaluation, and foreign exchange (FX) scarcity. These factors have eroded the capital base of banks in dollar terms. The recapitalization is a proactive measure to address these vulnerabilities and ensure banks remain sound.

GTCO’s Recapitalization Journey

GTCO has been proactive in responding to the CBN’s mandate. The current $100 million equity offering represents the second tranche of its capital raise. In July 2024, GTCO successfully completed the first tranche, securing ₦209 billion (approximately $139 million at the assumed ₦1500/$1 rate). This phased approach demonstrates a well-thought-out strategy to meet the CBN’s March 2026 deadline.

The net proceeds from this latest offering are explicitly earmarked for the “further recapitalisation of GTBank Nigeria,” indicating a direct injection of capital into its core banking operations. This capital infusion is intended to be deployed in accordance with GTCO’s overarching growth strategy, which includes expanding its loan book, investing in digital infrastructure, and exploring new market opportunities.

Other major Nigerian banks are also actively working to meet the new capital requirements. For instance, United Bank for Africa (UBA) has assured stakeholders that it will meet the ₦500 billion requirement by Q3 2025, ahead of the deadline, through various capital-raising initiatives. Similarly, banks like Zenith Bank and Access Holdings have reportedly already met or exceeded this threshold, highlighting the industry-wide effort to comply with the CBN’s directive. The options available to banks include injecting fresh equity through private placements, rights issues, and/or offers for subscription; pursuing mergers and acquisitions (M&As); or even downgrading their license authorization if they cannot meet the capital base for their current category.

A Glimpse into GTCO’s Robust Performance

Beyond the strategic capital raise, GTCO’s recent financial performance underscores its underlying strength and efficient operations, providing a compelling narrative for potential investors on the London Stock Exchange.

The group delivered an impressive profit after tax of ₦258 billion in the first quarter of 2025. This represents a remarkable 61% year-on-year growth (excluding fair value gains), primarily driven by strong core earnings. “Core earnings” refer to the profits generated from a bank’s primary business activities, such as lending, deposit-taking, and fee-based services, rather than one-off gains or volatile market fluctuations. This indicates that GTCO’s fundamental operations are highly profitable and sustainable.

Improving Asset Quality: The Non-Performing Loan Ratio

A key indicator of a bank’s financial health is its Non-Performing Loan (NPL) ratio. An NPL is a loan on which the borrower has not made scheduled payments for a specified period, typically 90 days or more. A high NPL ratio signals potential credit risk and can reduce a bank’s earnings, impacting its soundness and ability to lend.

GTCO reported a significant improvement in its NPL ratio, which declined to 4.5% in Q1 2025, down from 5.2% at the end of 2024. This reduction is a highly positive development for several reasons:

- Strong Credit Risk Management: A falling NPL ratio indicates that the bank is effectively managing its credit risks, either through more stringent lending practices, successful loan recoveries, or proactive restructuring of distressed assets.

- Improved Asset Quality: It suggests that a larger proportion of the bank’s loan portfolio is performing as expected, reducing the likelihood of future losses.

- Enhanced Profitability: Lower NPLs mean fewer provisions for loan losses are needed, which directly boosts profitability.

- Investor Confidence: A healthy NPL ratio reassures investors about the bank’s stability and the quality of its assets, making it a more attractive investment.

Furthermore, GTCO’s Q1 2025 results also showed robust growth in its loan book (net), which increased by 15.6% from ₦2.79 trillion in December 2024 to ₦3.22 trillion in March 2025. Deposit liabilities also grew by 7.7% from ₦10.40 trillion to ₦11.20 trillion during the same period. These figures demonstrate the bank’s continued ability to attract deposits and expand its lending activities, crucial for revenue generation and market share growth.

In 2024, GTCO had already reported a record-breaking financial performance, doubling its profit before tax from the previous year. The Group Chief Executive Officer, Segun Agbaje, attributed this stellar performance to the strength of the company’s diversified revenue streams across its banking and non-banking subsidiaries, emphasizing a commitment to sustainable growth, operational efficiency, and disciplined capital management. These consistent strong performances provide a solid foundation for its current capital-raising and international listing ambitions.

Broader Economic and Financial Landscape in Nigeria

GTCO’s strategic moves occur within a complex and evolving Nigerian economic landscape. Understanding this broader context is essential to fully grasp the significance of the bank’s decisions.

Macroeconomic Headwinds and Resilience

Nigeria, Africa’s largest economy, has been navigating significant macroeconomic headwinds. The Nigerian economy in 2025 is projected to grow by approximately 2.9% year-on-year, driven primarily by the non-oil sector and a slight increase in hydrocarbon production. However, the country continues to grapple with persistent challenges:

- High Inflation: Inflation has been a major concern, with consumer price inflation forecast to moderate to around 22.1% in 2025 from over 33% in 2024. This persistent inflation erodes purchasing power and increases operating costs for businesses.

- Currency Volatility and FX Scarcity: The Nigerian Naira has experienced significant depreciation following exchange rate liberalization in June 2023. While forecasts suggest some stability, foreign currency supply constraints remain a challenge, impacting businesses reliant on imports and those seeking to repatriate profits.

- High Interest Rates: In response to inflationary pressures, the CBN has aggressively hiked its Monetary Policy Rate (MPR), which directly impacts lending rates. While this aims to curb inflation, it also increases borrowing costs for businesses and individuals.

Despite these challenges, the Nigerian banking sector has demonstrated remarkable resilience. Banks play a pivotal role as engines of economic growth by:

- Mobilizing Savings: Collecting deposits from individuals and businesses.

- Providing Credit: Channeling funds to productive sectors for investment, business expansion, and job creation.

- Facilitating Trade: Supporting both domestic and international trade through various financial instruments.

- Implementing Monetary Policy: Acting as a conduit for the CBN’s monetary policy directives.

The CBN’s recapitalization policy, therefore, is not just about strengthening individual banks but about ensuring the entire financial system is robust enough to support Nigeria’s ambitious economic agenda. It aims to create a banking sector that can fund large-scale infrastructure projects, industrial development, and crucial SME growth, all of which are vital for achieving the $1 trillion economy goal.

Opportunities Amidst Challenges

While the macroeconomic environment presents hurdles, it also offers opportunities for well-positioned banks like GTCO:

- Digitalization: The rapid adoption of digital payment solutions and mobile banking in Nigeria presents immense opportunities for financial inclusion and cost efficiencies.

- Remittances: Significant remittance inflows from the Nigerian diaspora continue to support household incomes and consumption, providing a stable source of funds for the banking sector.

- Population Growth: Nigeria’s large and growing population represents a vast untapped market for financial services.

- Diversification: Banks are increasingly diversifying their revenue streams beyond traditional lending, venturing into payments, asset management, and pension administration.

GTCO’s strategy to raise capital and list on the LSE is a direct response to these dynamics, positioning it to capitalize on the opportunities while mitigating the risks inherent in the Nigerian market.

African Financial Institutions on the Global Stage

GTCO’s move is part of a broader, accelerating trend of African companies seeking greater integration with global capital markets. For too long, African businesses have been perceived as high-risk, limiting their access to the vast pools of capital available internationally. However, this narrative is shifting.

A Growing Trend of International Listings

African companies, particularly those in the financial services, telecommunications, and energy sectors, are increasingly looking beyond their domestic exchanges to tap into international investor bases. The London Stock Exchange, with its deep liquidity, diverse investor base, and robust regulatory framework, remains a popular choice.

Examples include:

- Airtel Africa: A prominent telecommunications and mobile money services provider with operations across 14 African countries, listed on the LSE in 2019. Its listing provided it with access to significant capital for expansion and diversification.

- Seplat Energy: A leading Nigerian independent energy company, dual-listed on the NGX and LSE, demonstrating the benefits of accessing both local and international capital markets.

- Standard Bank Group: Africa’s largest bank by assets, headquartered in South Africa, has various debt instruments listed on the LSE, showcasing its international financial presence.

GTCO’s direct listing of ordinary shares on the LSE is a significant step, as it will be the first Nigerian bank to achieve this. This move is expected to encourage other Nigerian and African financial institutions to consider similar strategies, further deepening the integration of African capital markets with global finance.

Impact on Foreign Direct Investment (FDI)

Increased international listings by African companies can have a profound impact on Foreign Direct Investment (FDI) into the continent. When companies list on major global exchanges, it:

- Increases Transparency: Adherence to international reporting and governance standards makes these companies more transparent and attractive to foreign investors.

- Reduces Perceived Risk: The rigorous due diligence and regulatory oversight associated with LSE listings can reduce the perceived risk of investing in African markets.

- Diversifies Investor Base: It allows foreign investors to diversify their portfolios by gaining exposure to high-growth African economies and sectors.

- Signals Market Maturity: A growing number of international listings indicates the increasing maturity and sophistication of African financial markets.

This influx of FDI is crucial for Africa’s development, providing the capital needed for infrastructure, industrialization, and job creation. GTCO’s pioneering step is therefore not just a win for the company but a positive signal for the entire African investment landscape.

Conclusion: A New Chapter for African Finance

Guaranty Trust Holding Company Plc’s strategic decision to directly list on the London Stock Exchange and undertake a significant recapitalization is a landmark event in the evolution of African finance. It represents a bold and forward-thinking approach to navigating the complexities of both domestic regulatory demands and the global capital markets.

By moving from GDRs to a direct listing, GTCO is embracing a higher level of international integration, aiming for enhanced visibility, deeper capital access, and stronger investor confidence. This move, coupled with its proactive recapitalization to meet the Central Bank of Nigeria’s stringent requirements, positions GTCO for sustained growth and resilience in a challenging yet opportunity-rich environment.

The success of GTCO’s offering and listing will not only solidify its standing as a leading African financial institution but also serve as a powerful testament to the growing maturity and potential of Nigeria’s banking sector. It reinforces the narrative that African companies are increasingly capable of competing on the global stage, attracting international capital, and playing a pivotal role in driving economic development across the continent. As the financial world watches, GTCO is indeed unlocking transformative opportunities, not just for itself, but for the broader African financial landscape.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

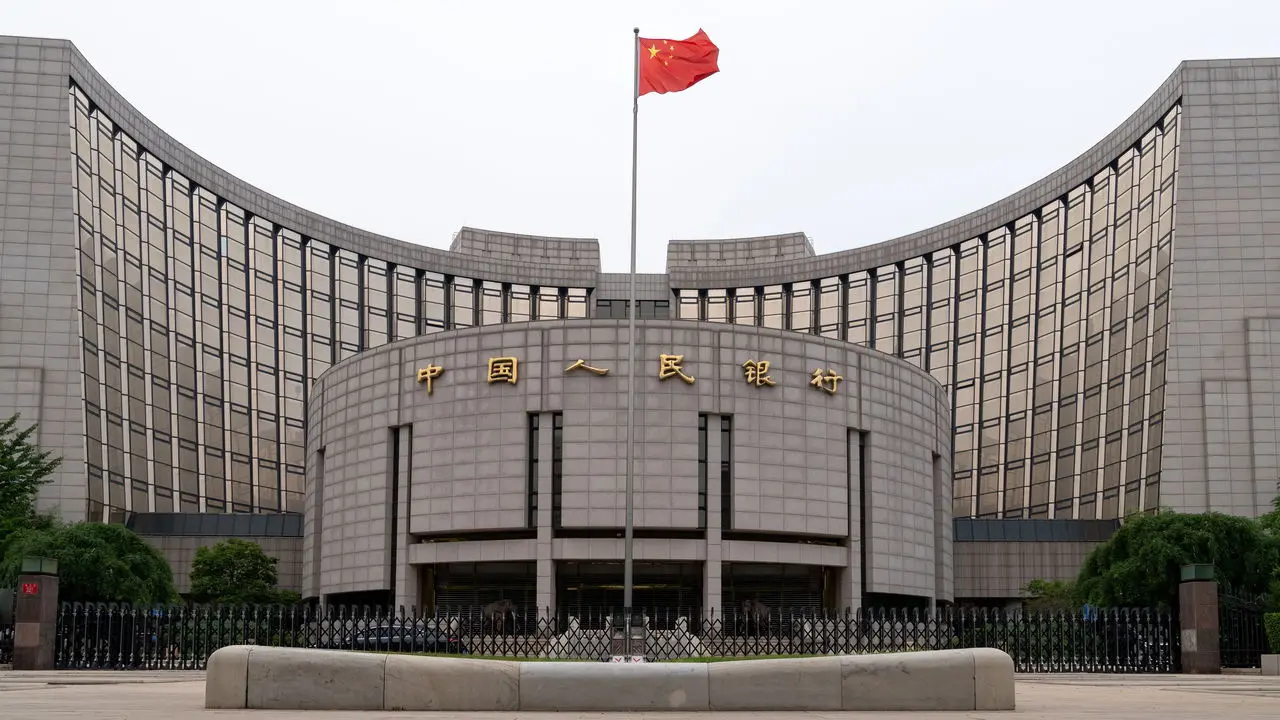

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

7th July, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025