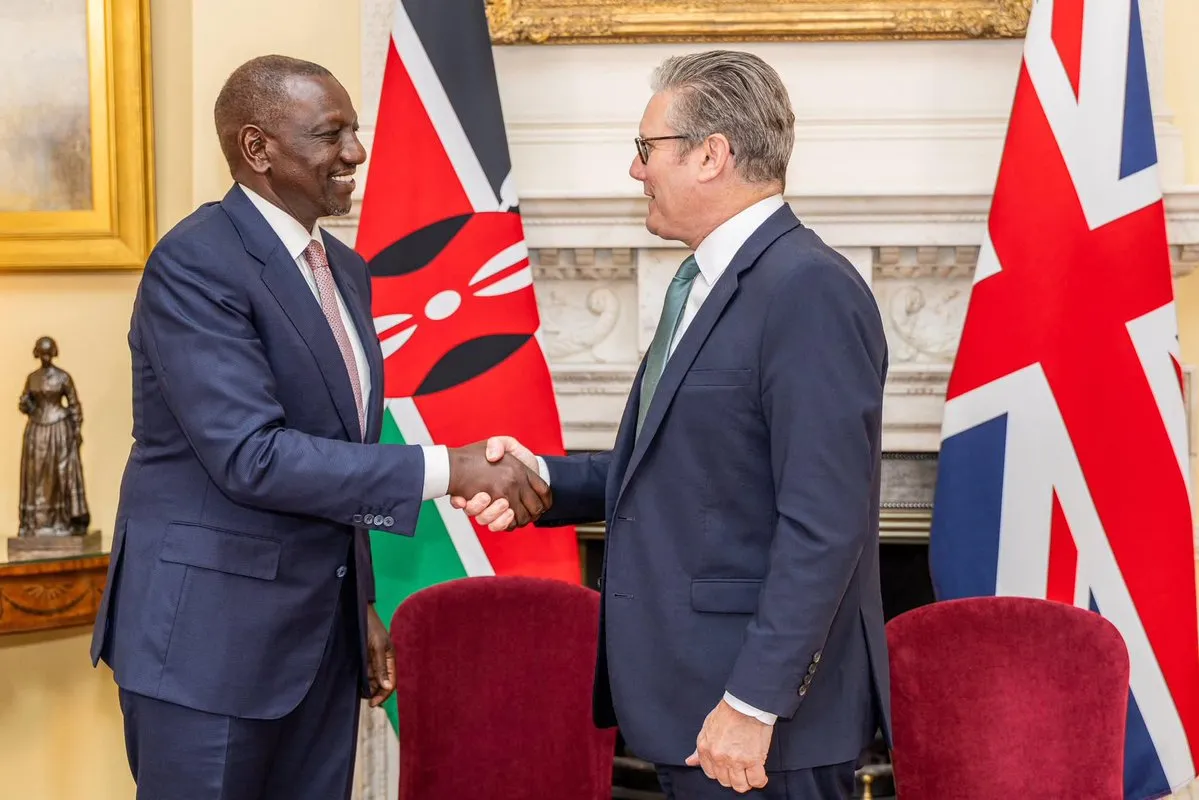

In a landmark development set to significantly accelerate Kenya’s economic trajectory, the United Kingdom has pledged a substantial KSh 17.7 billion (approximately £100 million) fund specifically targeting Kenya’s vibrant innovation landscape. This commitment is a cornerstone of the renewed Strategic Partnership 2025–2030, solidified during a recent high-profile meeting between Kenyan President William Ruto and UK Prime Minister Keir Starmer. The ambitious investment aims to catalyze growth across Kenya’s burgeoning startup ecosystem and its extensive network of Small and Medium Enterprises (SMEs), with far-reaching implications for job creation and digital transformation.

This strategic injection of capital is poised to directly benefit over 500 startups, provide crucial support to 5,000 digitally driven SMEs, and generate an impressive 30,000 new digital jobs across the nation. Beyond this dedicated innovation fund, the UK has also committed to mobilizing an additional £1.5 billion (KSh 266.1 billion) in new investments across various strategic sectors in Kenya, alongside facilitating $250 million (KSh 32.3 billion) in capital markets funding by 2030. These multifaceted commitments underscore a deepening bilateral relationship, pivoting towards technology, green energy, and financial services as key pillars of future cooperation.

Catalyzing the “Silicon Savannah”: The KSh 17.7 Billion Innovation Fund

The KSh 17.7 billion innovation fund is a direct investment into the heart of Kenya’s entrepreneurial spirit, often dubbed “Silicon Savannah.” This significant financial backing recognizes Kenya’s established reputation as a regional leader in technological innovation, particularly in mobile payment solutions, exemplified by the global success of M-Pesa.

The Power of Startups and SMEs

Kenya’s startup ecosystem has demonstrated remarkable resilience and growth. In 2024, Kenyan startups collectively secured $638 million in funding, representing nearly 29% of the total capital raised across the African continent. This positions Kenya as a top destination for venture funding in Africa, alongside Nigeria, Egypt, and South Africa. Nairobi, as the undisputed hub, continues to surge in global rankings, recently climbing six spots to rank 107th globally and maintaining its top spot in Eastern Africa for the fifth consecutive year in the Startup Blink report.

The fund’s focus on 500 startups will provide much-needed early-stage and growth capital, enabling these innovative ventures to scale their operations, develop new products, and expand their market reach. Key sectors where Kenyan startups excel and are likely to benefit include:

- Fintech: Building on the legacy of M-Pesa, Kenya’s fintech sector remains robust, with Nairobi hosting the African Economic Research Consortium’s 61st plenary in December 2024, which highlighted Africa’s $65 billion fintech potential by 2030.

- Climate-tech: With Kenya’s nearly 90% renewable electricity grid (from geothermal, hydro, wind, and solar), climate-tech startups focusing on clean energy and e-mobility solutions have attracted significant funding.

- Agritech: Leveraging technology to improve agricultural productivity, supply chains, and market access for farmers.

- Edutech: Innovating in digital learning and educational access.

- Healthtech: Developing solutions to improve healthcare delivery and access.

Beyond startups, the fund’s support for 5,000 digitally driven SMEs is equally critical. SMEs are the backbone of the Kenyan economy, driving innovation, employment, and resilience. Kenyan SMEs are increasingly embracing digital payments and other technologies to enhance efficiency and reach new customers. A recent Mastercard SME Confidence Index report revealed that 91% of SMEs in Kenya have adopted digital payments, reflecting a significant shift towards digitalization. This fund will further accelerate this trend, providing resources for digital transformation, upskilling teams, and accessing broader financial services.

Fueling Digital Job Creation

The projection of 30,000 new digital jobs is a direct response to Kenya’s burgeoning digital economy. Kenya is recognized as one of the ten fastest-growing digital economies in the world. The country’s ICT sector has averaged 10.8% annual growth since 2016, and its digital economy is expected to contribute 9.24% of the country’s GDP by 2025. By 2028, the digital economy is projected to contribute KSh 662 billion to GDP and create 300,000 new jobs.

The UK’s investment will support initiatives that bridge the digital skills gap, ensuring a pipeline of talent for these new roles. Efforts like Microsoft’s program to train 1 million individuals in AI and Cybersecurity by 2027 in collaboration with local platforms, and Safaricom’s Hook Circle Bootcamps, are already building a robust foundation of digital professionals. The new digital jobs will span various areas, from software development and data analytics to cybersecurity and digital marketing, further cementing Kenya’s position as a regional tech hub.

Broader UK Investment and Capital Markets Mobilization

Beyond the innovation fund, the UK’s commitment to mobilize up to £1.5 billion (KSh 266.1 billion) in new investments across Kenya signifies a comprehensive approach to economic partnership. This broader investment is expected to flow into strategic sectors critical for Kenya’s long-term development, including:

- Infrastructure: Enhancing connectivity and logistics, vital for trade and economic integration.

- Manufacturing: Boosting local production, creating jobs, and reducing reliance on imports.

- Green Energy: Further supporting Kenya’s transition to a fully renewable energy economy.

- Digital Transformation: Beyond startups, this includes broader digitalization efforts across industries.

In 2024, trade between Kenya and the UK totaled £1.8 billion ($2.4 billion), reflecting a 10.1% increase over 2023. A key objective of this new agreement is to double the value of bilateral trade between the two countries by 2030, indicating a strong focus on mutual economic benefit.

The facilitation of $250 million (KSh 32.3 billion) in capital markets funding is equally significant. This aims to deepen Kenya’s financial markets, providing local companies with alternative avenues for raising capital beyond traditional bank loans. A robust capital market can attract more foreign portfolio investment, enhance liquidity, and support the growth of both established companies and emerging enterprises. This move aligns with Kenya’s aspiration to strengthen Nairobi’s position as a leading financial center.

Nairobi: A Rising Regional Financial Hub

President Ruto’s visit to the UK also highlighted the growing international recognition of Nairobi as a premier financial center in the region. This momentum is significantly reinforced by Lloyd’s of London’s decision to establish a regional underwriting hub under the Nairobi International Financial Centre (NIFC). This hub is projected to manage up to KSh 75.5 billion, a testament to Nairobi’s increasing appeal as a gateway for financial services into East and Central Africa.

The NIFC, established to attract international financial services and investment, offers a favorable regulatory environment, tax incentives, and a skilled workforce. Lloyd’s of London’s presence is a major vote of confidence, signaling to other global financial institutions that Nairobi is a viable and attractive location for regional operations.

Nairobi’s standing is further solidified by the expanding presence of other reputable global institutions. Major technology firms such as Microsoft, AWS (Amazon Web Services), and Apple have established their regional operations in Kenya, leveraging the country’s strategic location, growing digital penetration, and skilled talent pool. These tech giants contribute to the local ecosystem through job creation, technology transfer, and fostering a culture of innovation.

Alongside these tech behemoths, global Business Process Outsourcing (BPO) companies are increasingly choosing Kenya for their operations, drawn by its English-speaking workforce, competitive labor costs, and improving infrastructure. Financial services firms like BUPA Global, Africa Speciality Risk, and the European Bank for Reconstruction and Development (EBRD) further underscore Nairobi’s appeal as a diverse financial services hub. The presence of such a wide array of international players creates a dynamic and interconnected business environment, fostering knowledge transfer and enhancing Kenya’s integration into the global economy.

Green Financing: Advancing Kenya’s Climate Agenda

On the critical front of climate action, the UK and Kenya have committed to unlocking at least £200 million (KSh 35.5 billion) in green financing. This funding, drawn from a mix of public, private, and blended sources, is earmarked for advancing Kenya’s clean energy agenda and climate resilience goals.

Kenya has been a global leader in renewable energy, with a significant portion of its electricity generated from clean sources. The country boasts vast geothermal potential, substantial wind resources (such as the Lake Turkana Wind Power project), and increasing solar energy adoption. This green financing will support:

- Clean Energy Expansion: Investing in new renewable energy projects, upgrading existing infrastructure, and expanding access to clean energy, particularly in rural areas. This aligns with Kenya’s ambitious target of achieving 100% clean energy by 2030.

- Climate Resilience: Funding initiatives that help Kenya adapt to and mitigate the impacts of climate change. This includes investments in sustainable agriculture, water management, early warning systems for extreme weather events, and nature-based solutions to protect ecosystems. Kenya is highly vulnerable to climate change impacts, including droughts and floods, making resilience efforts crucial for sustainable development.

- Green Bonds and Sustainable Finance: The commitment to green financing also encourages the development of Kenya’s sustainable finance market, promoting the issuance of green bonds and other financial instruments that channel capital towards environmentally friendly projects.

This partnership positions Kenya as a key player in the global climate change discourse, attracting investment that not only addresses environmental challenges but also creates green jobs and fosters sustainable economic growth.

Enhanced Connectivity: Boosting Trade and Tourism

The agreement to add an additional six weekly Kenya Airways flights between Nairobi and London is a practical step with significant economic implications. This increased air connectivity aims to alleviate persistent cargo and passenger challenges, fostering greater trade and tourism between the two nations.

- Cargo Logistics: More flights mean increased capacity for air cargo, facilitating the export of Kenyan fresh produce (flowers, fruits, vegetables) to the UK market and the import of essential goods. This directly benefits Kenyan farmers and exporters, boosting their competitiveness and market access.

- Passenger Travel: Enhanced passenger capacity will support growing tourism flows, business travel, and diaspora connections. The UK is a significant source market for Kenyan tourism, and improved accessibility will further boost this vital sector. For business travelers, more direct flights mean greater convenience and efficiency, encouraging more bilateral investment and collaboration.

- Economic Impact: Improved air links generally lead to increased trade volumes, foreign direct investment, and job creation in related sectors like logistics, hospitality, and aviation. It strengthens Nairobi’s position as a regional aviation hub.

Deepening Security and Defence Cooperation

Beyond economic ties, President Ruto and UK Prime Minister Starmer also agreed to expand cooperation between their security and defence agencies. This includes enhanced intelligence sharing, capacity building, and joint operations. Such collaboration is crucial for addressing shared security threats and promoting regional stability.

- Counter-Terrorism Efforts: Both Kenya and the UK have a vested interest in combating terrorism, particularly in East Africa, where groups like Al-Shabaab pose a significant threat. Intelligence sharing and joint operations are vital for disrupting terrorist networks and enhancing national security.

- Capacity Building: The UK’s support in capacity building will strengthen Kenya’s security forces through training, equipment, and expertise, enabling them to more effectively respond to various security challenges, including border security, maritime security, and internal stability.

- Regional Stability: The leaders welcomed the United States’ continued engagement in the Democratic Republic of Congo (DRC) and emphasized the importance of harmonizing regional responses through the East African Community (EAC) and Southern African Development Community (SADC). Kenya has played an active role in regional peace efforts, including deploying troops to the DRC as part of regional stabilization forces. Enhanced cooperation with the UK will support these efforts, contributing to broader peace and security in the Great Lakes region and the Horn of Africa.

This security partnership underscores the comprehensive nature of the UK-Kenya relationship, recognizing that economic prosperity and development are inextricably linked to peace and stability.

Conclusion: A Strategic Partnership for a Prosperous Future

The renewed Strategic Partnership between the United Kingdom and Kenya represents a significant leap forward in their bilateral relations. The multi-billion shilling commitments, spanning innovation, broader economic investment, capital markets development, green financing, and enhanced connectivity, lay a robust foundation for Kenya’s continued growth and digital transformation.

This partnership is not merely about financial aid; it is about fostering a collaborative ecosystem that leverages Kenya’s youthful population, entrepreneurial spirit, and strategic location. By supporting startups and SMEs, strengthening financial markets, investing in clean energy, and enhancing security cooperation, the UK is positioning itself as a key partner in Kenya’s journey towards achieving its Vision 2030 goals.

For Kenya, this partnership offers a powerful boost to its economic agenda, creating jobs, attracting further investment, and solidifying its role as a regional leader. For the UK, it represents a strategic engagement with a dynamic African economy, opening new avenues for trade, investment, and diplomatic influence in a continent of immense global importance. The coming years will undoubtedly witness the tangible impacts of this ambitious and forward-looking alliance, shaping a more prosperous and secure future for both nations.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

3rd July, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025