Bangladesh is poised to unlock $1.3 billion in June from the International Monetary Fund (IMF), covering both the fourth and fifth tranches of its $4.7 billion Extended Credit Facility. The long-delayed disbursement follows a staff-level agreement on key reforms—most critically, a shift toward a more flexible exchange-rate regime via a crawling peg mechanism, alongside an overhaul of revenue management structures. In parallel, Dhaka expects an additional $2 billion in budget support from multilateral partners, including the World Bank, Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIIB), Japan, and the OPEC Fund for International Development (Reuters).

Background: From First Tranches to Reform Impasse

Bangladesh turned to the IMF in mid-2023 amid mounting pressure on its foreign-exchange reserves—eroded by surging global commodity prices in the wake of Russia’s invasion of Ukraine and a widening trade deficit. The Fund approved a 36-month, $4.7 billion Extended Credit Facility, disbursing $2.3 billion across the first three tranches between August 2023 and early 2025. However, progress stalled over Dhaka’s reluctance to abandon its tightly managed exchange-rate band, prompting the IMF to press for adoption of a crawling peg—allowing the taka to depreciate gradually against a basket of trading currencies, rather than being fixed or jumping in large steps (The Mighty 790 KFGO | KFGO).

During the fourth review mission in Dhaka in April and follow-up discussions at the Bank-Fund Spring Meetings in Washington DC, both sides hashed out a compromise on exchange-rate flexibility, tax-policy restructuring, and broader fiscal-management reforms. With these conditions met, the IMF signalled readiness to release the next $1.3 billion, providing much-needed support to government coffers ahead of the next fiscal year.

Crawling Peg: A Primer on Exchange-Rate Flexibility

Under a crawling peg, a country’s currency is permitted to adjust in small, pre-announced increments against a reference basket—balancing the need for external competitiveness with concerns over imported inflation. For Bangladesh, this represents a departure from the managed-float with narrow bands that had shielded domestic prices but gradually eroded reserves.

- Gradual Adjustment: The taka will weaken by a small percentage—likely around 2–3 percent per annum—against a weighted basket of major currencies (USD, EUR, GBP, JPY, and CNY), smoothing volatility for import-dependent sectors.

- Reserve Sustainability: By avoiding sudden devaluations, the central bank can better manage its $40 billion-plus reserves, targeting a comfortable import coverage of 4–5 months of goods and services.

- Export Competitiveness: A gradually weaker taka supports Bangladesh’s garments, textiles, and leather exports, which account for nearly 80 percent of merchandise receipts and employ over 4 million workers.

Analysts at the Bangladesh Bank have calculated that a crawling peg could boost exports by 5–7 percent over two years, while keeping annual inflation near the central bank’s 5 percent midpoint.

Revenue Management Overhaul: Dissolving the NBR

As part of the deal, Bangladesh’s government has dissolved the National Board of Revenue (NBR)—its standalone tax authority—and replaced it with two divisions under the Finance Ministry: one responsible for tax policy and the other for tax administration. This structural reform aims to:

- Enhance Efficiency: By aligning policy formulation and collection functions within a single ministry, the government expects reduced bureaucratic overlap and faster implementation of new tax measures.

- Boost Transparency: Separate divisions will publish periodic performance metrics—such as filing-to-audit ratios and average processing times—fostering greater accountability to taxpayers and international partners.

- Strengthen Compliance: A dedicated administration arm will focus on digitization of filings, e-audit capabilities, and targeted anti-evasion drives against large-scale corporate defaulters.

Moody’s noted in March that improved revenue mobilisation is vital for Bangladesh to sustain its public-investment programme—including $40 billion worth of infrastructure projects under the Delta Plan 2100—while keeping debt-to-GDP near 45 percent over the medium term.

Parallel Budget Support: Friends of Bangladesh

Beyond the IMF, Dhaka anticipates $2 billion in concessional financing and grants:

- World Bank: An $850 million package signed in April will finance the modernisation of the Chittagong Bay Terminal, boosting port capacity and reducing turnaround times for vessels—potentially saving the economy $1 million per day in freight costs (Reuters).

- ADB: A $500 million loan is earmarked for the Rupsha–Payra Transmission Line, reinforcing the grid along the southwestern coast to integrate renewable generation.

- AIIB: A $300 million sovereign loan will upgrade urban water-supply systems in Dhaka and Khulna, addressing chronic shortages and improving public health outcomes.

- OPEC Fund: A $200 million facility will support smallholder irrigation schemes in the Barind Tract, enhancing crop resilience amid erratic monsoons.

- Bilateral Support: Japan has pledged ¥20 billion (~$140 million) for digital-finance expansion, while the UK’s CDC Group is exploring a $100 million equity investment in local fintech startups.

Collectively, these resources—$3.3 billion including the IMF tranche—will help Bangladesh navigate debt repayments, bolster social spending, and maintain public-sector wage bills, even as global interest rates remain elevated.

Political Context: Interim Government and Institutional Stability

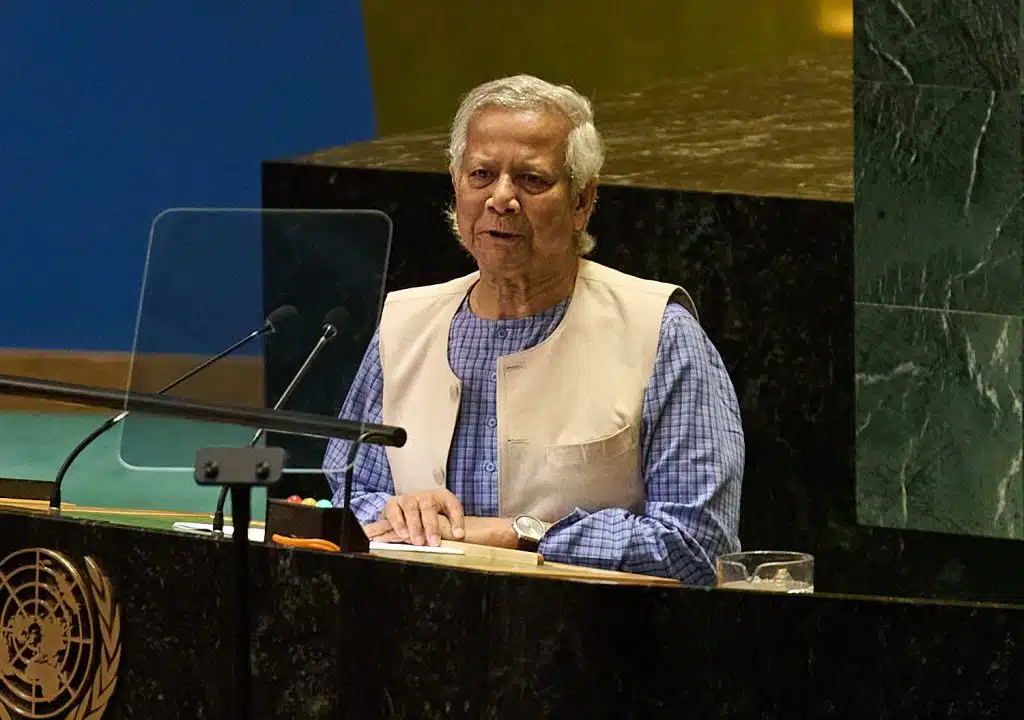

A notable development in Dhaka’s political landscape has been the appointment of Nobel Laureate Professor Muhammad Yunus as chief adviser of an interim government, following the resignation of Prime Minister Sheikh Hasina amid widespread protests in mid-2024. Yunus, famed for pioneering microcredit through Grameen Bank, has been tasked with stabilising the polity and overseeing fresh elections (Reuters).

- Caretaker Mandate: Under Bangladesh’s constitutional framework, a caretaker administration must maintain neutrality and ensure fair electoral processes—a model borrowed from past transitions in Pakistan and Sri Lanka.

- Reform Momentum: Yunus’s technocratic team has fast-tracked reforms mandated by the IMF, including the NBR overhaul and passage of a Fiscal Responsibility and Budget Management Act, setting debt-to-GDP ceilings and mandating quarterly fiscal disclosures.

- Public Sentiment: Opinion surveys by BRAC University indicate a 65 percent approval rating for the caretaker setup—reflecting hopes that political neutrality will attract investment and deliver policy continuity ahead of national polls slated for Q4 2025.

Nevertheless, critics caution that a prolonged caretaker period could stall parliamentary oversight. International observers, including the European Union Election Observation Mission, have urged Dhaka to adhere to strict timetables and ensure freedom of expression as the country readies for its first contested vote since 2018.

Business and Market Reactions

The announcement of the IMF tranche and related reforms triggered mixed responses:

- Taka Stabilisation: The USD/BDT exchange rate, which had depreciated by 8 percent since January 2025, recovered slightly—trading at 109.50 per USD on 15 May, compared to 110.75 at end-April. Local importers welcomed the stability, while exporters—already benefiting from the weaker rate—await clarity on the crawling peg’s pace.

- Bond Yields: Bangladesh’s 5-year Eurobond yield narrowed by 15 basis points to 6.20 percent, reflecting reduced rollover risk. However, spreads over U.S. Treasuries remain elevated at 450 bps, underscoring lingering external vulnerabilities amid global monetary-policy tightening.

- Banking Sector: Commercial banks are gearing up for a softer loan-to-deposit ratio—currently at 95 percent—by tapping IMF-backed budget support to bolster liquidity. Analysts at ICRA Bangladesh project non-performing loans to peak near 9 percent in mid-2025 before improving, contingent on sustained economic recovery (Reuters).

- Private-Equity Interest: Renewed confidence has drawn in regional investors. Singapore’s Temasek Holdings is reportedly evaluating investments in fintech and renewable-energy ventures, while Dubai’s Abraaj Group is exploring co-investment in agro-processing facilities.

Lessons from Comparative IMF Programs

Bangladesh’s experience mirrors that of fellow emerging markets negotiating with the IMF:

- Pakistan (March 2025): Secured a $1.3 billion climate-resilience loan and completed the first review of its $7 billion Extended Fund Facility, unlocking a combined $2 billion. Like Bangladesh, Islamabad adopted gradual exchange-rate adjustments and tax-policy reforms to stabilise reserves and attract capital (Reuters).

- Egypt (July 2024): Agreed to a $3 billion tranche under its $8 billion programme after devaluing the pound by 15 percent and broadening VAT coverage—measures credited with curbing inflation and restoring investor confidence.

- Sri Lanka (2023): Received $2.9 billion in a Staff-Level Agreement only after full currency liberalisation and the formation of an autonomous Revenue Authority, paralleling Bangladesh’s NBR split.

These cases demonstrate that, while politically sensitive, exchange-rate flexibility and revenue-authority reforms are viewed by the IMF as preconditions for medium-term macro-stability.

Risks and the Road Ahead

Despite the positive momentum, several challenges could derail Bangladesh’s trajectory:

- Global Rate Volatility: As the U.S. Federal Reserve and European Central Bank deliberate further tightening, emerging-market spreads may widen, pressuring local borrowing costs and prompting capital outflows.

- Monsoon Uncertainties: Erratic rainfall patterns threaten rice and jute harvests—key sources of rural employment and export revenue—potentially requiring ad hoc fiscal relief during lean seasons.

- Political Transitions: The caretaker administration must balance neutrality with reform delivery; any delays to scheduled elections risk investor jitters and credit-rating downgrades.

- Debt Composition: With 30 percent of public debt denominated in foreign currencies, taka depreciation—even gradual—raises the domestic-currency cost of servicing external obligations.

To mitigate these risks, Bangladesh’s authorities plan to:

- Establish an Exchange-Rate Advisory Council, comprising central-bank, finance-ministry, and private-sector representatives, to fine-tune crawling-peg parameters.

- Launch a Sovereign Green Bond—modeled on Kenya’s successful 2024 issuance—to finance climate-resilient infrastructure, tapping the growing global appetite for ESG assets.

- Strengthen the Credit Guarantee Scheme for SMEs, leveraging AIIB and ADB lines to underwrite 50 percent of new loans to women-owned and rural enterprises.

Conclusion: A Pivotal Juncture for Bangladesh

The release of $1.3 billion by the IMF—and the prospect of $2 billion from development partners—represents more than a liquidity lifeline. It signifies international endorsement of Bangladesh’s reform course: toward greater exchange-rate realism, streamlined revenue collection, and judicious fiscal management. As the country navigates complex global headwinds, the success of the crawling peg, the performance of restructured tax divisions, and the caretaker government’s stewardship will shape whether Bangladesh can sustain robust growth—projected by the IMF at 5.1 percent in FY2026—and achieve its ambition of upper-middle-income status by 2031.

With millions of Bangladeshis relying on stable food and fuel prices, affordable credit, and reliable infrastructure, the stakes could not be higher. Yet, buoyed by decisive policy action and broad based support from multilateral institutions, Dhaka stands at a critical inflection point—one that could define its economic and social trajectory for years to come.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT , NCLEX – RN and NCLEX – PN, Financial Literacy!🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

15th May, 2025

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025