Ghana, historically recognized as Africa’s leading gold producer, has also made significant strides in the oil sector. Since its first major discovery in 2007 and the start of commercial oil production in 2010, the country has aimed to establish itself as a key oil producer in West Africa. However, due to production declines in existing fields, crude oil output had been falling for the past five years, culminating in a five-year low in 2023. In a turnaround this year, Ghana has experienced its first increase in oil output in half a decade, largely attributed to new production initiatives and an improved investment climate in the sector.

The Public Interest and Accountability Committee (PIAC), a Ghanaian state body responsible for monitoring the country’s petroleum revenues, recently released data indicating a 10.7% year-on-year increase in oil production in the first half of 2024. Total production reached 24.86 million barrels by June, a sharp contrast to the 13.2% decline recorded during the same period in 2023.

Key Factors Driving Ghana’s Oil Output Increase

The primary driver of this increase has been the Jubilee South East (JSE) project. Operated by Tullow Oil, the JSE project began production in late 2023 and is located within the Jubilee Field, Ghana’s first and most prolific oil field, which was discovered in 2007. The Jubilee Field had previously reached peak production but has since experienced a decline. The JSE project, however, represents new reserves within the existing field, rejuvenating output from this critical asset.

According to Isaac Dwamena, Coordinator of the PIAC Secretariat, the rise in oil output in 2024 signals optimism for Ghana’s oil sector. “We are hopeful that the first-half output increment in 2024 will be sustained, thereby reversing the annual oil production declines,” he said, adding that the government is working on strategies to maintain this positive momentum.

Economic Impact and Revenue Surge

The increase in oil production has translated into substantial economic benefits for Ghana. PIAC reported a 56% year-on-year surge in petroleum revenues in the first half of 2024, reaching approximately $840.8 million. Oil revenue is a critical component of Ghana’s economy, providing about 7% of the government’s annual income. The increase in revenue offers a lifeline for a government contending with both internal fiscal pressures and external economic challenges, including global oil market volatility.

Additionally, gas production also saw a moderate increase of 7.5%, with output reaching 139.86 million standard cubic feet by June. The rise in both oil and gas production aligns with Ghana’s broader energy strategy, which involves leveraging its oil and gas resources to boost domestic energy security and generate foreign exchange earnings.

Challenges Facing Ghana’s Oil Sector

While recent developments are promising, Ghana’s petroleum sector faces numerous challenges. These include technical issues such as aging infrastructure and declining yields in mature fields, as well as natural constraints. The Jubilee Field, for example, has shown a natural decline in production over the years, necessitating technological enhancements and strategic reinvestments.

Another critical challenge is the legal and financial environment surrounding oil production. Under Ghanaian law, oil companies are required to allocate at least 12% of every project to the state as free and carried interest. This arrangement means that the government receives a share of revenue from projects without needing to contribute to the capital costs. However, this requirement can be costly for investors, according to Dwamena. In certain cases, the state can negotiate a carried interest share of up to 20%, which can serve as a disincentive for potential investors.

“The state can take 15%, 20% carried interest based on negotiations, and that has been a disincentive,” Dwamena explained. Such policies, while intended to ensure Ghana benefits from its natural resources, can sometimes reduce the attractiveness of the sector to international investors, who may find similar ventures more appealing in other jurisdictions with lower government participation requirements.

Strategic Initiatives and Future Outlook

To address some of these challenges, the Ghanaian government is actively exploring ways to attract more investors to its oil sector. This includes plans to offer additional exploration rights, aiming to boost production and prevent what could be termed “stranded assets”—oil reserves left untapped as the world shifts toward cleaner energy sources.

In line with its broader economic vision, Ghana’s government has prioritized energy as a key sector for driving national development. The country hopes to attract major energy firms by positioning itself as a stable and business-friendly environment in a region where political and economic risks are often a deterrent for international investment. The government has, therefore, worked to enact policies that ensure transparency, stability, and competitiveness within the oil sector, making Ghana an increasingly attractive destination for foreign investment in West Africa.

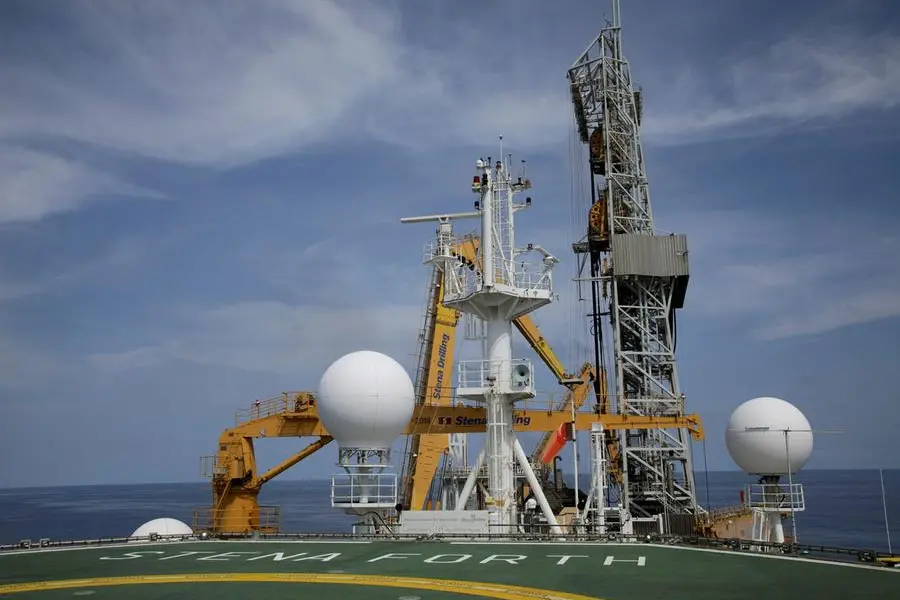

Ghana’s oil industry is currently host to several major international players, including Eni, Tullow, Kosmos Energy, and PetroSA. These companies have been integral to Ghana’s oil production efforts and are expected to play a central role in the country’s ongoing and future oil and gas projects.

Ghana’s Vision for an Energy-Driven Economy

Ghana’s growing focus on energy production goes beyond oil. The country is simultaneously developing renewable energy resources, aligning with global climate goals and seeking to reduce dependency on fossil fuels over time. However, oil remains a vital asset for the Ghanaian economy, with the government viewing it as a bridge to a more diversified, resilient economic future.

In recent years, Ghana has expressed a commitment to use oil revenues to drive investments in critical sectors, such as infrastructure, healthcare, and education, thus fostering inclusive growth. Additionally, funds from oil production are intended to support Ghana’s transition towards renewable energy sources, aiming for a gradual and balanced approach to energy diversification. The revenue from oil has thus been earmarked not just for immediate economic gains but also as a foundation for long-term investments that can sustain Ghana’s growth even as the world shifts towards greener energy.

Regional and Global Context

Ghana’s increase in oil production comes at a time of significant uncertainty in the global oil market. Prices have been volatile due to factors such as geopolitical tensions, shifts in OPEC+ production policies, and the global transition toward renewable energy. For Ghana, navigating these external factors will be crucial to maximizing the benefits of its oil sector.

In the West African region, Ghana’s stability and transparent governance have made it a model for other oil-producing nations facing political or economic difficulties. Neighboring countries like Nigeria, which has struggled with oil theft, pipeline vandalism, and governance challenges, look to Ghana as an example of how stable governance can positively impact oil revenues and economic growth.

On a global scale, Ghana’s oil strategy is shaped by broader shifts in the energy industry. The increasing demand for sustainable practices has prompted major oil companies to reconsider their portfolios, with some divesting from fossil fuels in favor of renewable energy investments. This transition poses a potential risk for oil-dependent economies but also presents opportunities for countries like Ghana, which can leverage its oil resources while gradually transitioning toward renewable energy.

Conclusion

Ghana’s first oil output increase in five years marks a significant milestone for the country’s oil sector. Driven by new production from the Jubilee South East project, Ghana’s crude oil output has shown growth, leading to a surge in revenue and helping to strengthen the national economy. However, the country faces complex challenges, including balancing investor interests, maintaining competitive regulatory policies, and addressing natural production declines in mature fields.

Looking ahead, Ghana’s government is committed to expanding the oil sector while aligning with global trends towards renewable energy. As the country diversifies its economy, oil remains a cornerstone for financing national development projects and facilitating the transition to a more sustainable energy future. The success of Ghana’s oil industry will depend on continued innovation, supportive policies, and collaboration with international partners, ensuring that oil production benefits both the economy and the broader Ghanaian society.

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 and HESI EXIT !🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today!✨

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

8th November, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025