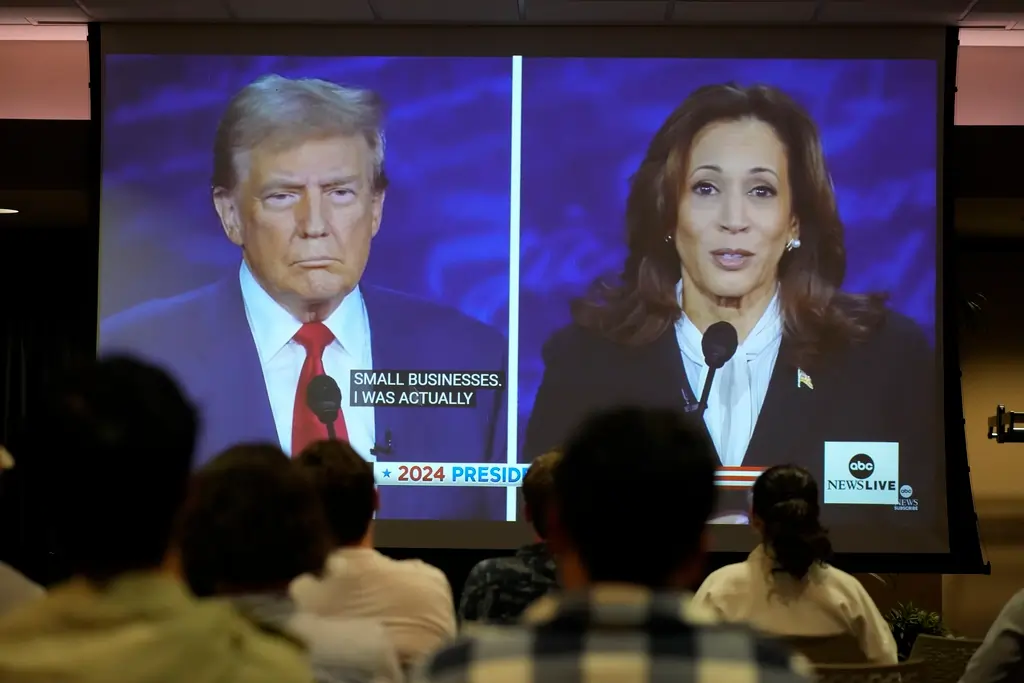

The highly anticipated first presidential debate between Republican nominee, former President Donald Trump, and Democratic nominee, Vice President Kamala Harris, took place in Philadelphia, Pennsylvania, on September 10, 2024. The debate, hosted by ABC News, was not only a crucial moment for the candidates but also a pivotal event for investors, as financial markets have historically reacted to such high-stakes political showdowns.

During the debate, both candidates presented their visions for America’s future, with Harris focusing on healthcare, economic equality, and the middle class, while Trump emphasized strong leadership, deregulation, and trade protectionism. However, market analysts and investors found the debate light on specifics, leaving questions about the future economic direction of the country unanswered.

Market Reaction: Slipping Stock Futures and a Weaker Dollar

As the debate unfolded, U.S. stock futures slipped, with the S&P 500 E-minis down 0.5%, and the Nasdaq 100 E-minis off by 0.65%. The dollar index, which tracks the performance of the greenback against a basket of six major currencies, dropped by 0.23%. This decline in stock futures and the dollar reflected growing uncertainty among investors, many of whom felt that neither candidate offered a clear plan to address the economic challenges facing the United States.

According to Quincy Krosby, Chief Global Strategist for LPL Financial, “It was light on specifics from either side… those who adhere to Trump are going to believe that he won the debate, and those who are loyal to Democrats will think that she won the debate.” Krosby highlighted that independents and undecided voters might struggle to make up their minds based on this debate alone, given the lack of detailed policy discussions. This uncertainty contributed to the subdued market reaction.

Additionally, online prediction market PredictIt reflected the shift in election dynamics following the debate. Harris’ odds of winning the 2024 presidential election improved from 52% to 56%, while Trump’s odds slipped from 51% to 48%. This shift, although modest, indicated that Harris had a slight edge following the debate.

Investor Concerns: Lack of Economic Clarity

One of the primary concerns raised by investors was the lack of clarity on economic policies from both candidates. Eric Beyrich, Portfolio Manager at Sound Income Strategies, noted that “neither one of them made strong economic points.” Beyrich expressed disappointment in the candidates’ failure to provide reassurance to investors, particularly regarding economic stability and future fiscal policies. He further commented on Harris’ healthcare policy, which she described as a fundamental right—a stance that Beyrich believes may not be well-received by markets, as it could signal increased government spending and potentially higher taxes.

Harris’ emphasis on healthcare reform, while aligned with Democratic Party ideals, raised concerns among investors about potential market implications. The concept of healthcare as a right could lead to an expansion of government programs, potentially increasing the fiscal burden. Trump’s stance, while largely focused on deregulation and tax cuts, also lacked specific details about how these policies would be implemented if he were to return to office.

Shier Lee Lim, Lead FX & Macro Strategist for APAC at Convera, shared a similar sentiment, stating that the debate “does not seem to be having a major impact on markets so far,” largely due to the low expectations for volatility heading into the event. Option markets had only priced in modest movements around the debate, with 73 basis points breakeven for USD/JPY and about 1.1% for the S&P 500. Lim further commented that the election outcome could have meaningful implications for fiscal policy, with Republicans potentially pursuing tax cuts offset by tariffs, while Democrats may lean toward wealth and corporate tax hikes.

Historical Context: Market Reactions to Presidential Debates

Historically, U.S. presidential debates have played a significant role in shaping investor sentiment, particularly when economic policies are central to the discussion. For instance, during the 2020 debates between then-President Donald Trump and former Vice President Joe Biden, markets closely monitored the candidates’ positions on taxation, regulation, and stimulus packages in the wake of the COVID-19 pandemic.

Market volatility during presidential elections is not uncommon, as investors attempt to anticipate changes in fiscal policy, trade relations, and regulatory environments based on the election outcome. In the current 2024 race, both Trump and Harris are viewed as representing starkly different economic philosophies, with Trump advocating for deregulation and Harris championing progressive reforms such as expanded healthcare and social programs. This divergence creates uncertainty in the market, which tends to react more favorably to clear, business-friendly policies.

Brian Nick, Head of Portfolio Strategy at NewEdge Wealth, echoed this view, stating, “They didn’t discuss much that was relevant to investors in any detail.” Nick emphasized that one of the most critical issues facing the next president will be taxes, yet neither candidate provided a clear vision for tax reform. Investors are particularly interested in the fate of the Tax Cuts and Jobs Act, which was signed into law by Trump in 2017 and is set to expire in 2025. The act significantly lowered corporate tax rates, and its extension or repeal could have major implications for businesses and investors alike.

Potential Economic Impact of the 2024 Election

The 2024 presidential election could have far-reaching consequences for U.S. fiscal policy and the global economy. If Trump were to win, investors might anticipate further deregulation, trade protectionism, and a continuation of the “America First” policies that characterized his first term. This could result in market volatility, particularly in sectors such as technology, healthcare, and manufacturing, as companies adjust to changes in trade tariffs and regulatory frameworks.

On the other hand, a Harris victory could lead to increased government spending on social programs, healthcare, and infrastructure, funded by tax hikes on corporations and the wealthy. While such policies might benefit the middle class and reduce income inequality, they could also raise concerns among investors about potential inflationary pressures and increased government debt. The market’s reaction to a Harris presidency may also depend on the makeup of Congress, as a divided government could limit her ability to pass progressive legislation.

Sonu Varghese, Global Macro Strategist at Carson Group, commented on the potential economic policies of both candidates, stating, “Neither candidate advocated for vastly different economic policies than currently in place.” Varghese highlighted the importance of the Senate and House makeup, as future tax reform and stimulus measures will depend heavily on congressional negotiations.

International Reactions and the Global Economy

The outcome of the 2024 U.S. presidential election will also have significant implications for the global economy. Trump’s protectionist policies, particularly his trade war with China, had a profound impact on global markets during his first term. A return to such policies could reignite tensions with key U.S. trading partners, leading to disruptions in global supply chains and increased tariffs on goods.

Ken Cheung, Director of FX Strategy at Mizuho Securities Asia, noted that the Chinese yuan is particularly sensitive to Trump’s policies on tariffs, with markets closely watching his stance on trade relations with China. In contrast, Harris’ more diplomatic approach to international relations could lead to a reduction in trade tensions, which may benefit global markets.

Meanwhile, currencies that are closely tied to U.S. trade policy, such as the Mexican peso, Canadian dollar, and Chinese renminbi, could see increased volatility depending on the election outcome. Jack Ablin, Chief Investment Officer at Cresset Capital, pointed out that “currencies that might find themselves on the front line in another trade war” have already started to react to the debate, albeit in muted volumes.

Conclusion: A Tight Election and Uncertain Market Outlook

As the 2024 presidential race heats up, investors are likely to remain cautious, with market volatility expected to persist until a clearer picture of the election outcome emerges. The debate between Trump and Harris, while significant, did little to provide clarity on the future of U.S. economic policy. Instead, it reinforced the notion that the race remains tight, with both candidates presenting contrasting visions for the country’s future.

For investors, the key takeaway from the debate is that uncertainty will continue to dominate the market in the coming weeks. As Vasu Menon, Managing Director of Investment Strategy at OCBC Singapore, remarked, “Today’s debate is not going to move the needle.” Ultimately, the direction of the economy and markets will depend on how the candidates’ policies resonate with voters and, more importantly, how the U.S. economy performs in the lead-up to Election Day.

With both candidates poised to make further appearances on the campaign trail, the coming weeks will be crucial for investors as they seek to navigate the uncertainty of the 2024 presidential election.

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

11th September, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025