The Coalition of Civil Society Organisations has expressed strong support for the Central Bank of Nigeria’s (CBN) proposed recapitalization of commercial banks, viewing it as essential for strengthening the banking sector and attracting foreign investment.

Alesta Wilcox Advocates for Recapitalization

At a press conference in Ikeja, Lagos, Alesta Wilcox, past chairman of the Institute of Chartered Accountants of Nigeria (ICAN), Lagos Branch, highlighted the need for recapitalization. “Nigerian banks are currently weak, which discourages investment. Recapitalization will fortify the banks and create job opportunities,” Wilcox stated.

Coalition’s Composition and Concerns

The coalition, which includes the Constitutional Rights Advocate Initiative (CRAI), Movement for Nigeria Restructuring (MfNR), Centre for Social & Economic Rights (CSER), Committee for the Protection of People’s Mandates (CPPM), and Cadrell Advocacy Centre, aims to protect public interests and ensure transparency in the banking sector.

Wilcox disclosed that there are efforts by certain groups within the banking system to undermine the CBN’s reform plans. “We have credible information about a planned campaign to halt the proposed reforms to maintain their positions in banks that need recapitalization,” he claimed.

Addressing Non-Performing Loans

One significant issue highlighted was the state of non-performing loans (NPLs) in some banks, with some dating back to the 1970s. “These NPLs have accumulated interest over decades, but recent efforts to sell this debt have been approved by both AMCON and the CBN,” Wilcox noted.

Despite these efforts, some vested interests oppose the capital injection, fearing it will lead to the replacement of current executives. “This resistance is like rejecting a certified clean blood donation for an anemic child,” Wilcox remarked.

Call for Vigilance and Support

The coalition has called on the Economic and Financial Crimes Commission (EFCC), the Department of State Services (DSS), and the Bankers Committee to support the CBN’s recapitalization efforts. They also urged the Nigerian media to expose any attempts to derail the reforms.

Conclusion

The CBN’s recapitalization initiative aims to strengthen the financial system, restore confidence in the banking sector, and promote economic growth. The coalition’s support underscores the importance of these reforms in building a robust and resilient banking sector. Transparency and vigilance will be crucial to the success of these efforts.

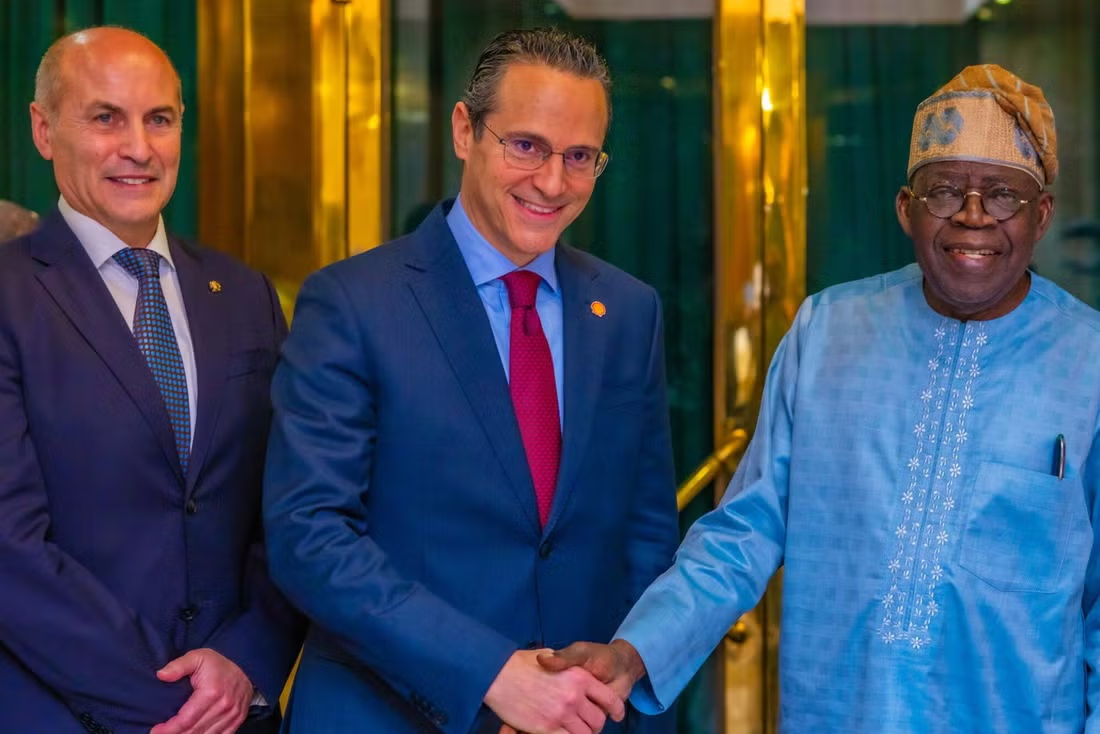

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

25th June, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025