In a significant development, the U.S. Securities and Exchange Commission (SEC) has approved eight applications for spot Ethereum exchange-traded funds (ETFs).

The approvals follow the submission of 19b-4 forms detailing proposed rule changes and regulatory compliance, paving the way for ETF listing and trading. Among the approved firms are financial giants BlackRock Inc. and Fidelity, along with industry leaders such as Grayscale Investments Inc., Bitwise Asset Management Inc., VanEck Associates Corp., Ark Investment Management LLC, Invesco Capital Management LLC, and Franklin Templeton.

Despite the SEC’s nod to the 19b-4 submissions, ETF providers must still file S-1 forms, standard procedure for companies preparing to go public. These filings provide essential financial and operational details for potential investors.

The timeline for ETF listing remains uncertain, contingent upon the completion of S-1 filings. Analyst James Seyffart from Bloomberg suggests that while the process could conclude within a few weeks with dedicated effort, historical precedents indicate potential delays extending beyond three months.

Ethereum ETFs offer investors an alternative avenue to track Ethereum’s price movements without directly holding the cryptocurrency. Traded on traditional stock exchanges, these funds mirror Ethereum’s performance, providing exposure to its market fluctuations.

The SEC’s decision mirrors its earlier approval of bitcoin ETFs in January, overcoming similar regulatory hurdles. Concerns surrounding market manipulation within cryptocurrency markets have historically impeded ETF approvals. However, recent regulatory advancements and enhanced correlation analysis between spot and futures markets have influenced the SEC’s favorable stance.

Acknowledging the imperative of investor protection, the SEC underscores the significance of Ethereum ETFs in addressing concerns such as premium/discount volatility and high management fees associated with alternative investment vehicles. By offering a stable and cost-effective investment option, these ETFs aim to cater to investor needs amidst the evolving digital asset landscape.

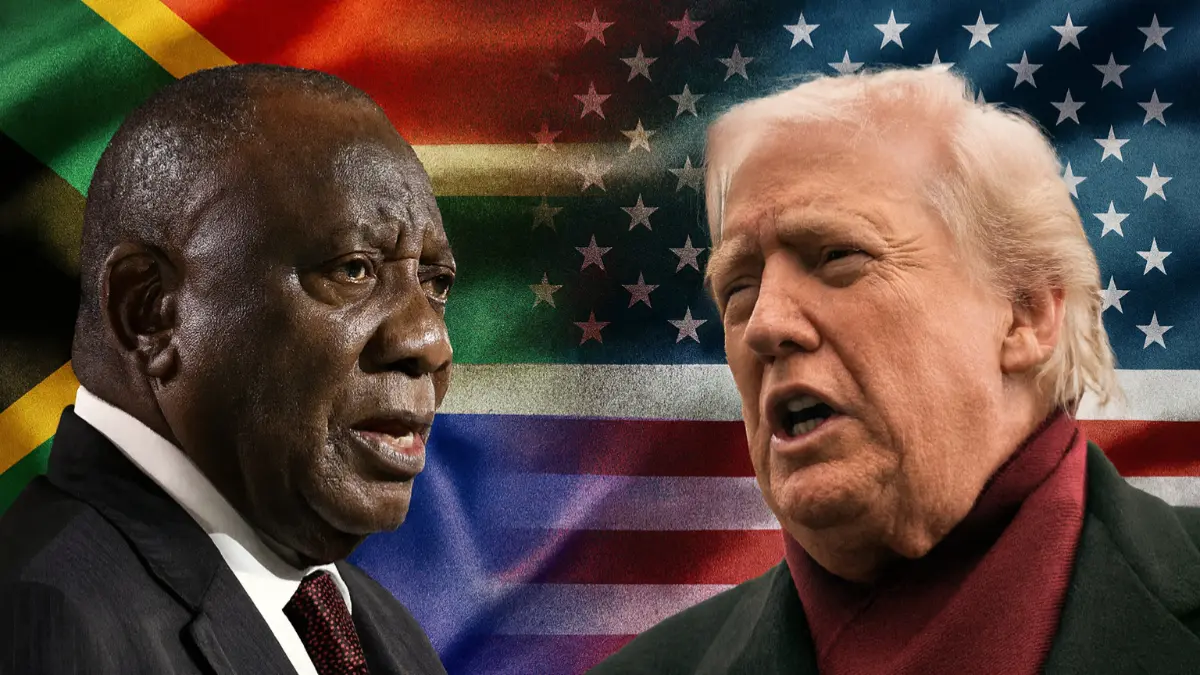

Photo source: Google

By: Montel Kamau

Serrari Financial Analyst

24th May, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025