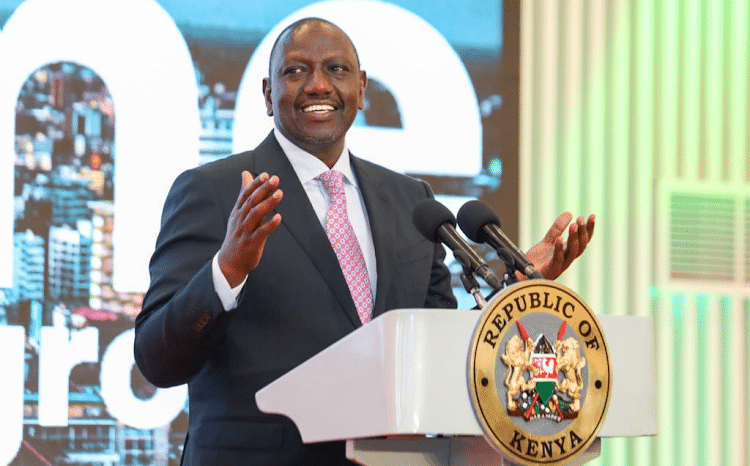

The Hustler Fund, a cornerstone initiative aimed at supporting micro, small, and medium enterprises (MSMEs), is grappling with a significant hurdle as loan defaults by Kenyan borrowers reach a critical Sh9.9 billion. Launched with optimism by President William Ruto and Prime Cabinet Secretary Musalia Mudavadi at the Green Park Terminus in Nairobi last year, the fund is now navigating a 73 percent repayment rate, raising valid concerns about its efficacy.

National Treasury Insights

Recent disclosures from the National Treasury offer a glimpse into the depth of the challenge. Despite disbursing Sh36.6 billion by October 2023, only Sh2.3 billion had been repaid, resulting in an unsettling impairment nearing Sh10 billion. This financial strain sheds light on the complexities within this State-backed initiative.

Comparative Financial Landscape

The fund’s impairment ratio surpasses that of key financial institutions, such as commercial banks, Saccos, and microfinance banks. A comparative analysis, per data from the Central Bank of Kenya, reveals that the gross non-performing loans to gross loans ratio in the banking sector stood at 15.3 percent in October 2023, indicating a broader economic uncertainty.

Addressing Underlying Economic Challenges

The declining quality of the fund’s assets aligns with prevailing economic challenges, including reduced disposable incomes and heightened borrowing costs. These factors contribute to a risk-laden environment for borrowers, posing hurdles for the fund’s efforts to recover outstanding amounts effectively.

Profiles of Key Figures

Notable individuals within the fund include the top borrower, accessing Sh4.5 million across 816 transactions, and the leading voluntary saver, amassing Sh631,491. The fund, also known as the Financial Inclusion Fund, has achieved notable milestones, boasting 50,000 active groups and disbursing Sh151 million to 20,000 beneficiaries.

Presidential Measures

In response to escalating defaults, President William Ruto recently announced measures during the fund’s first anniversary on November 30. Users can now access part of their Sh2.5 billion in savings, providing interim relief. Borrowers are set to benefit from increased loan limits to alleviate financial burdens.

Distinctive Savings and Loan Mechanism

The fund’s unique savings and loan mechanism offer savers an interest rate mirroring Treasury bill returns, estimated at an attractive 12 percent in the first year. This mechanism allocates five percent of each borrowed amount to savings, split on a 7:3 ratio for long-term and short-term savings.

Dealing with Defaulters

President Ruto underscored consequences for defaulters, making them ineligible for the new business loan facility, known as the Hustler Group loan, until arrears are cleared. Beyond these immediate challenges, the government remains committed to supporting the MSME sector. Plans include a thorough review of business licenses and the establishment of business incubation and industrial hubs.

As the Hustler Fund grapples with loan defaults, the government’s steadfast commitment to addressing challenges and providing additional support will be closely observed. This scrutiny ensures the fund’s continued role in supporting the vital MSME sector.

Image: PCS

By: Montel Kamau

Serrari Financial Analyst

21st December, 2023

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025