Kenya has reported a notable drop in its import expenditure for the first time since the COVID-19 pandemic, reflecting reduced spending on critical supplies such as factory materials, machinery, and fuel, according to official data.

Between January and July this year, traders spent Ksh 1.43 trillion on foreign goods, down from Ksh 1.46 trillion during the same period last year—a decline of 2.09 percent, equivalent to about Ksh 30.57 billion. This dip coincided with a global moderation in major import prices as supply chains disruptions eased, leading to lower shipping costs.

Global supply chain challenges, particularly exacerbated by the Ukraine-Russia conflict last year, had disrupted trade when nations were grappling with pandemic-induced shocks.

The decline in the import bill was chiefly influenced by a substantial 15.83 percent reduction in spending on intermediate goods used by manufacturers, which amounted to Ksh 212.43 billion compared to Ksh 252.37 billion during the same period in the previous year. Kenyan industries heavily depend on foreign markets for raw materials.

Moreover, Kenya witnessed a year-on-year decrease of 9.68 percent in the value of machinery and transportation equipment, totaling Ksh 237.78 billion, as per provisional data.

The Central Bank of Kenya attributed the machinery spending decline to a slowdown in public investment in infrastructure projects, particularly roads. For instance, the Ruto administration spent Ksh 52.48 billion on road projects in the fiscal year ending in June, compared to the budgeted Ksh 62.88 billion by the previous government.

Public spending on energy projects also contracted significantly, dropping by 62.33 percent to Ksh 24.03 billion, significantly below the original budget, according to separate Treasury data.

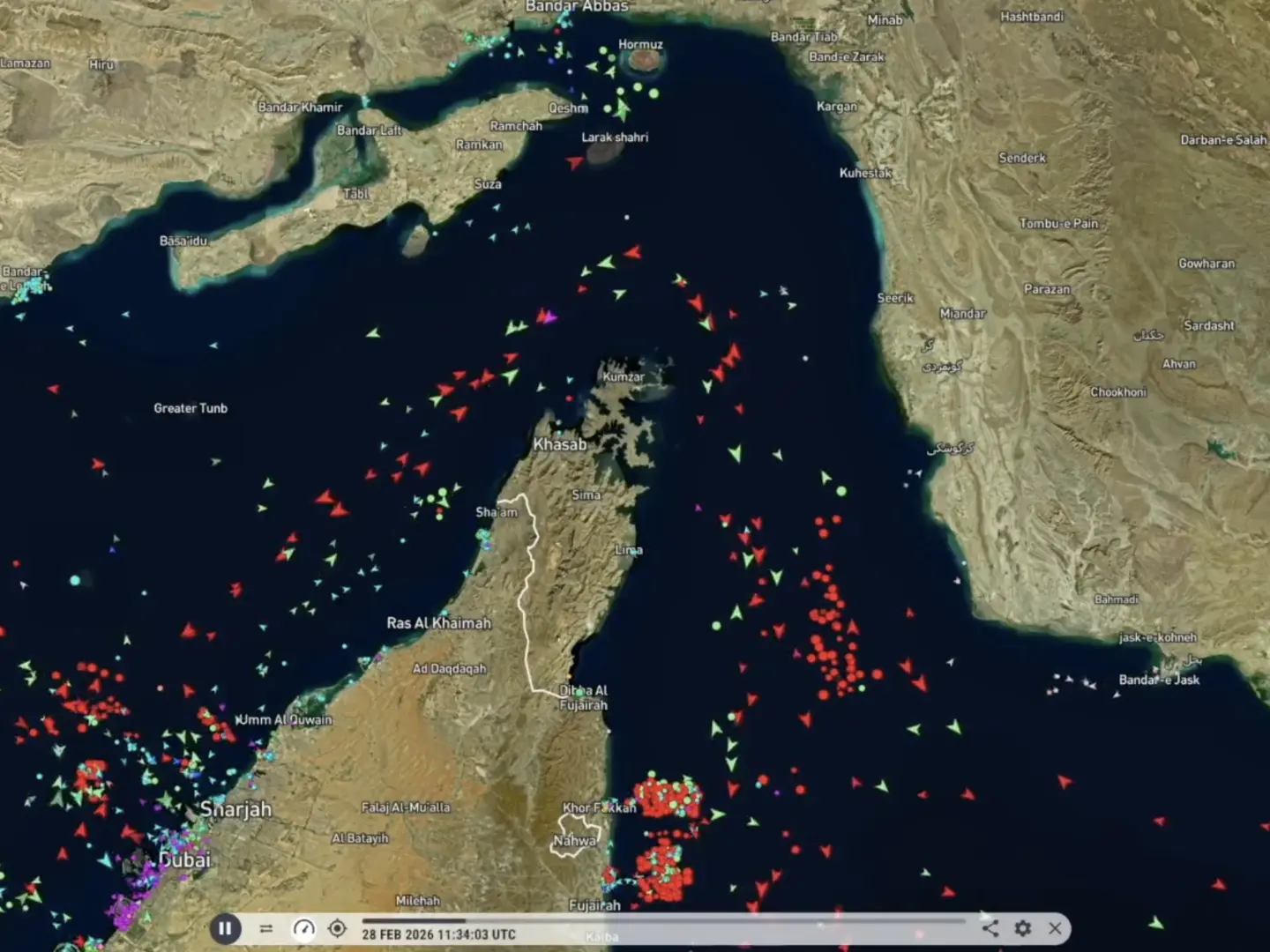

Notably, fuel expenditure, a significant driver of the import bill, fell by 5.93 percent to Ksh 356.66 billion over the seven-month period compared to the previous year. This can be attributed to the decrease in Murban crude oil prices, which dropped from around $130 per barrel in March 2022 to about $96 per barrel currently. Kenya imports refined fuel from Murban crude oil, mainly from the United Arab Emirates.

In contrast, food imports surged by 46.97 percent to Ksh 193.01 billion due to a decline in staple crops like maize, rice, wheat, and sugar, caused by reduced production amid drought conditions and increased input costs, including fertilizers.

Despite a slower export growth rate since the onset of the pandemic, the overall reduction in imports helped narrow Kenya’s goods trade deficit—the difference between merchandise exports and imports—by 8.81 percent to Ksh 867.53 billion. This reduction occurred despite export earnings growing at their slowest pace in the post-pandemic era.

Exporters earned Ksh 561.87 billion in the first seven months of the year, marking a 10.47 percent increase from the previous year. However, this growth in export value was slower compared to the corresponding periods in 2022 and 2021, with earnings at Ksh 508.63 billion and Ksh 429.24 billion, respectively.

Notably, Kenya’s largest agricultural export, tea, saw a 7.18 percent increase in revenue to Ksh 99.93 billion during January to July, while horticultural exports witnessed an 8.78 percent rise to Ksh 81.99 billion. However, revenue from coffee exports remained stagnant, decreasing by 1.91 percent to Ksh 26.64 billion, according to data sourced from the Kenya Revenue Authority.

Central Bank of Kenya governor Kamau Thugge commented in August, “We expect exports to increase by about 6.7 percent, mainly driven by tea and horticultural exports. At the same time, we expect imports to remain broadly unchanged.”

Economists emphasize that a persistent trade deficit can hinder job creation for Kenya’s growing skilled youth, as most of the revenue earned within the country is spent on imports, ultimately boosting production and job opportunities in source markets. Additionally, a widening import-export gap puts pressure on the Kenyan shilling, as the demand for dollars outpaces supply.

Kenya has long grappled with narrowing its goods trade deficit, primarily due to its reliance on traditional farm produce exports like tea, horticulture, and coffee, which are primarily sold in their raw form, fetching comparatively lower earnings. This strategy persists due to higher taxes imposed on semi-processed or processed products in destination markets, particularly in Europe, where fears of reduced competitiveness in the global market deter value addition.

Photo Source: Google

By: Montel Kamau

Serrari Financial Analyst

19th September, 2023

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025