Overview of the Proposed Law

The Kenyan banking sector faces significant upheaval following a proposed law to increase the minimum core capital requirement for banks from Ksh. 1 billion to Ksh. 10 billion. The proposal, tabled during discussions before the National Assembly’s Finance Committee, could result in the closure of 24 banks and put the jobs of nearly 7,000 employees at risk. This move is aimed at strengthening the financial sector but has sparked concerns about its potential adverse effects on smaller financial institutions, the broader economy, and job creation.

The Kenya Bankers Association (KBA) voiced strong opposition during the discussions, warning that this abrupt increase in core capital could have cascading consequences on financial inclusion, access to credit, and economic stability.

Impact on Smaller Banks

The proposed law, if passed, would disproportionately affect smaller banks that currently struggle to meet the existing core capital threshold. A KBA analysis revealed that these banks collectively require an additional Ksh. 150 billion to meet the new requirements. Without this capital, they face possible mergers, acquisitions, or outright closures, disrupting their role in providing financial services to underserved segments of the population.

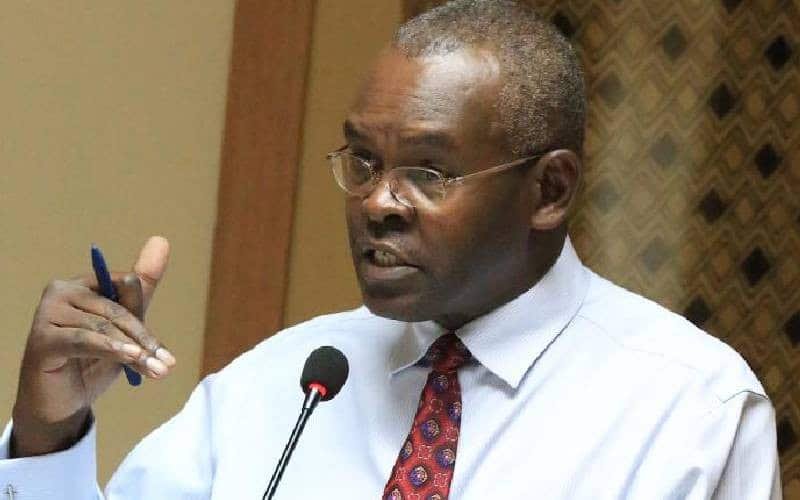

Raymond Molenje, Acting CEO of KBA, emphasized the role of these banks in economic growth, saying, “We should not ignore the 24 banks’ contribution to real economic growth, employment creation, and enhanced government revenue.”

Wider Economic Ramifications

In addition to job losses, the proposed law could have broader implications:

- Credit Access: Smaller banks often serve micro, small, and medium-sized enterprises (MSMEs), which rely heavily on accessible loans. Increasing core capital could limit these banks’ ability to offer credit, thereby stifling business growth and innovation.

- Economic Concentration: Kenya is already perceived as overbanked, with 39 banks, nine of which control over 75% of the market share. Analysts fear that increasing the core capital requirement could lead to a concentration of financial power among a few large banks, reducing competition and potentially raising borrowing costs for consumers.

- Reduced Financial Inclusion: Small banks play a critical role in mobilizing deposits and offering loans to rural and lower-income communities. Their closure would limit financial inclusion, pushing more Kenyans to unregulated financial services.

Historical Context and Global Comparisons

The push to increase core capital is not new. In 2015, a similar proposal to raise the minimum requirement to Ksh. 5 billion was rejected by Parliament over concerns of market concentration. Kenya’s current core capital requirement of Ksh. 1 billion, set in 2012, is among the lowest in Sub-Saharan Africa. In comparison, countries like Nigeria and South Africa have higher thresholds, but their banking sectors are far more consolidated.

The Treasury Cabinet Secretary, Njuguna Ndung’u, defended the move, stating, “Increasing core capital will strengthen banks’ resilience to economic shocks and their capacity to finance large-scale projects.” However, critics argue that this approach overlooks the challenges faced by smaller financial institutions and the communities they serve.

Concerns Over Rising Non-Performing Loans (NPLs)

Kenya’s banking sector has also been grappling with rising non-performing loan (NPL) ratios, which reached 16.1% in April 2024. This is significantly higher than the average for Sub-Saharan Africa, raising questions about the timing of the proposed reforms. Analysts fear that increasing core capital could exacerbate liquidity challenges, forcing smaller banks to offload risky loans or tighten lending criteria.

Options for Smaller Banks

To survive the proposed changes, smaller banks may consider the following:

- Mergers and Acquisitions: Consolidation could help smaller banks pool resources and meet the new capital requirements. However, this comes with challenges, including integration issues and potential loss of identity.

- External Investments: Seeking foreign or local investors could inject the necessary capital, but finding willing partners in a turbulent economic climate may be difficult.

- Niche Focus: Smaller banks could specialize in serving specific customer segments or geographic areas to maintain relevance and profitability.

Stakeholder Reactions

While the KBA and affected banks have been vocal in their opposition, some stakeholders support the reforms. Proponents argue that a higher capital base would reduce the risk of bank failures, improve customer confidence, and align Kenya’s banking sector with international standards. Critics, however, believe the government should adopt a phased approach to minimize disruptions.

In addition to banks, other entities such as Westminster and LexLinks Consultancy participated in the public hearings, emphasizing the need for a balanced approach that safeguards both the banking sector and the economy.

Global Lessons

Countries that have implemented similar reforms have often adopted a gradual approach. For instance, Nigeria increased its core capital requirements over a five-year period, allowing banks to adjust and explore strategic partnerships. Kenya could benefit from such a phased strategy to avoid abrupt market shocks.

Conclusion

The proposed increase in core capital requirements has sparked a heated debate about the future of Kenya’s banking sector. While the reforms aim to strengthen financial stability and resilience, their potential impact on small banks, job creation, and financial inclusion cannot be ignored. Stakeholders must work together to find a solution that balances regulatory goals with the needs of the economy and its most vulnerable participants

Ready to take your career to the next level? Join our dynamic courses: ACCA, HESI A2, ATI TEAS 7 , HESI EXIT and NCLEX – RN !🌟 Dive into a world of opportunities and empower yourself for success. Explore more at Serrari Ed and start your exciting journey today! ✨

photo source: Google

By: Montel Kamau

Serrari Financial Analyst

28th November, 2024

Article, Financial and News Disclaimer

The Value of a Financial Advisor

While this article offers valuable insights, it is essential to recognize that personal finance can be highly complex and unique to each individual. A financial advisor provides professional expertise and personalized guidance to help you make well-informed decisions tailored to your specific circumstances and goals.

Beyond offering knowledge, a financial advisor serves as a trusted partner to help you stay disciplined, avoid common pitfalls, and remain focused on your long-term objectives. Their perspective and experience can complement your own efforts, enhancing your financial well-being and ensuring a more confident approach to managing your finances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Readers are encouraged to consult a licensed financial advisor to obtain guidance specific to their financial situation.

Article and News Disclaimer

The information provided on www.serrarigroup.com is for general informational purposes only. While we strive to keep the information up to date and accurate, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

www.serrarigroup.com is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information on the website is provided on an as-is basis, with no guarantee of completeness, accuracy, timeliness, or of the results obtained from the use of this information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.

In no event will www.serrarigroup.com be liable to you or anyone else for any decision made or action taken in reliance on the information provided on the website or for any consequential, special, or similar damages, even if advised of the possibility of such damages.

The articles, news, and information presented on www.serrarigroup.com reflect the opinions of the respective authors and contributors and do not necessarily represent the views of the website or its management. Any views or opinions expressed are solely those of the individual authors and do not represent the website's views or opinions as a whole.

The content on www.serrarigroup.com may include links to external websites, which are provided for convenience and informational purposes only. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorsement of the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, www.serrarigroup.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Please note that laws, regulations, and information can change rapidly, and we advise you to conduct further research and seek professional advice when necessary.

By using www.serrarigroup.com, you agree to this disclaimer and its terms. If you do not agree with this disclaimer, please do not use the website.

www.serrarigroup.com, reserves the right to update, modify, or remove any part of this disclaimer without prior notice. It is your responsibility to review this disclaimer periodically for changes.

Serrari Group 2025